Private Equity Outlook: Larger Funds, Larger Deals

As investors deploy large reserves of capital into a market with elevated prices, deal sizes have climbed to decade-highs.

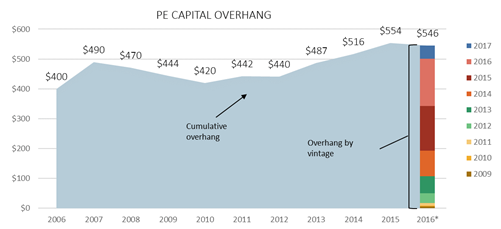

- U.S. private equity capital overhang has declined for the first time since 2012, signaling that private equity funds deployed more than they raised in 2016; however, the decrease can be almost entirely attributed to energy funds. If this trend were to continue, it could alleviate some of the competitive pressures that have pushed up buyout multiples.

- Deal count has been trending down, but capital invested has held relatively consistent; both the median and average deal size in 2017 are at their highest level in the last decade. Larger deal sizes are likely to persist in the coming years, as the average fund size has more than doubled from 2010 to 2017, and bigger funds will inevitably need to execute larger deals.

- Deal activity has undergone significant shifts at the sector level, with IT growing from 16% to 19% of deals, while business-to-consumer (B2C) has fallen to just 16%, down from its average level of 20% over the last decade. This shift away from B2C is unsurprising given the much-reported challenges facing the retail sector. Heightened activity in the software industry has been the main driver of IT's expansion, as PE firms gravitate to software-as-a-service (SaaS) platforms and other IT business models that offer a reliable source of recurring revenue and predictable cash flows.

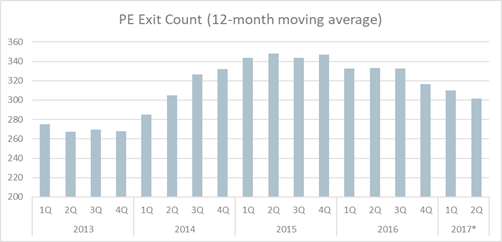

- Exit activity continued its trend downward. Although some contraction in exit activity was to be expected after 2014–2016 registered as the best three-year stretch on record, exits should still be a focus for general partners (GPs) as 40% of currently PE-backed companies have been held for at least five years. As such, we expect exit activity to rebound through the end of 2017 and into 2018.

For the last several years, one of the most persistent stories in private equity has been the unrelenting buildup of dry powder. Many industry professionals have expressed concerns about GPs’ ability to prudently deploy these record levels of uncalled capital commitments—worries that have only been exacerbated as fundraising has continued unabated. It seems as if the industry may have reached a turning point, however, as U.S. capital overhang dipped in 2016 for the first time in years.

Source: PitchBook | * Data as of 9/15/2017

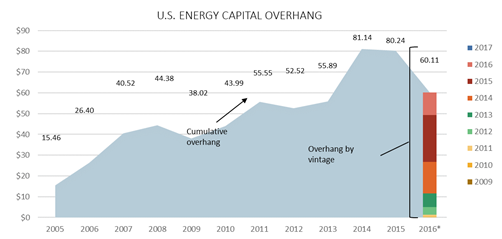

The first thing to note is that while dry powder fell, it only declined by $8.4 billion (1.5%). Furthermore, a single strategy—energy—accounted for the entirety (and even more) of the decrease. Since peaking in 2014, dry powder in energy funds has fallen by more than $20 billion, with funds engaging in a buying spree of heavily discounted assets whose prices fell in response to the prolonged downturn in oil prices. With lenders being hesitant to expose themselves to the energy sector, dealmakers have had to write relatively larger equity checks, which further contributed to the strong drawdown in dry powder.

In 2017, however, deal activity in the energy space has slowed considerably, with the deal count in the first half of the year coming in at just 57% of what it was during 2016. As such, it’s possible that the decline in dry powder may simply be an aberration that is attributable to anomalous activity in a single sector.

Source: PitchBook | * Data as of 9/15/2017

Outside of energy, GPs have been shifting their focus to the IT sector, which has seen its share of total deal count swell to 19% in 2017. Software deals now account for nearly two-thirds of IT deals, up from 50% in 2010, as PE firms have been attracted to SaaS platforms and other IT business models that offer a reliable source of recurring revenue and predictable cash flows.

Conversely, the B2C sector has slipped to just 16% of dealmaking, down from its average level of 20% over the last decade. This development coincides with widespread concerns about the viability of many B2C business models in an era of e-commerce.

In aggregate, private equity deal count has showed some signs of slowing in 2017, but it’s important to keep in mind that deal activity in recent years has been elevated by historical standards. Moreover, capital invested has proven more resilient than the deal count, with both the average and median deal size in 2017 rising to decade-highs, as GPs look to put large pools of capital to work.

To that point, the average fund size has more than doubled from 2010 to 2017. All else being equal, larger funds will need to execute larger deals to deploy capital at a similar rate and in similar proportions as they have historically. This may be easier said than done, however, because M&A activity has been elevated for several years, and many of the larger potential targets have already been taken.

We are unlikely to see a resurgence in club deals, which proliferated prior to the financial crisis in response to a similar escalation in fund sizes, due to the high-profile struggles of these transactions (including the recent bankruptcy of Toys-R-Us). Instead, we expect PE managers to get more creative in how they source deals, including actively seeking opportunities to capitalize on corporate divestitures and teaming up with experienced operating partners to build larger platform companies via add-on deals.

Another factor contributing to the trend toward larger deal sizes is the elevated pricing environment, with purchase-price multiples continuing to hover around 10.5x. Multiples are being driven higher in part by the seemingly incessant runup in public markets, with valuations for publicly traded companies being used to value private companies, as well as easy access to financing that has allowed PE firms to increase the leverage used in deals.

Despite the high acquisition multiples, exit activity has been decelerating for nearly two years. This slowdown can be somewhat attributed to mean reversion, given that the 2014–2016 period is the best three-year stretch ever for exits.

Source: PitchBook | * Data as of 9/15/2017

But with relatively high valuations, open debt markets, and both strategic and financial acquirers flush with cash, this seems like an ideal environment for GPs to be addressing their aging backlog of portfolio companies. Furthermore, 40% of private equity-backed companies have now been held for at least five years, so many GPs are likely feeling pressure to realize investments. As such, we expect exit activity to rebound through the end of 2017 and into 2018.

More Market Outlooks

Stock Market Outlook: China Rebalancing Presents Winners and Losers

Credit Market Insights: A Solid Quarter for the Bond Markets

Basic Materials: Valuations Propped Up by Shaky China Fundamentals

Communication Services: Smaller Rivals Call the Shots in U.S. Wireless

Consumer Cyclical: Tepid Mall Traffic Could Constrain the All-Important Holiday Season

Consumer Defensive: Valuations More Reasonable After Third-Quarter Retreat

Energy: All Roads Point to Oversupply in 2018

Financial Services: Banks Can't Rest Easy

Healthcare: Stock Selection Key as Valuations Rise

Industrials: Worldwide Growth Is Resilient, But Valuations Look Full

Real Estate: Enter With Caution

Technology: Valuations Painting Overly Rosy Scenarios

Utilities: Valuations Still Running Out of Control

M&A Outlook: High Prices Impede Dealmaking in the U.S.

Venture Capital Outlook: Exits Come Into Focus as Valuations Continue to Climb

U.S. Stock Funds: Steady as She Goes

International-Stock Funds: The Beat Goes on

Bond Funds: A Period of Relative Calm

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JUWC2VJUKBCG5P3KVQJCHL5QSQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JD5KSEJFLNFLJA5XRS6YK2O24Q.jpg)