M&A Outlook: High Prices Impede Dealmaking in the U.S.

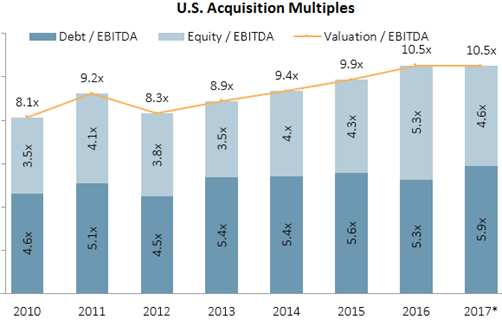

Acquisition multiples in the U.S. are at record levels, while pricing for European deals has stabilized.

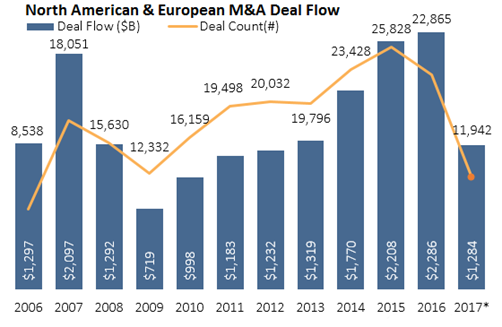

- North American and European investors completed 11,942 transactions totaling $1.3 trillion in deal value through the first eight months. Although 2016 was a record year for M&A activity, 2017 deal count is on pace to be down 34% year over year as corporations begin to focus more on integration of recent acquisitions.

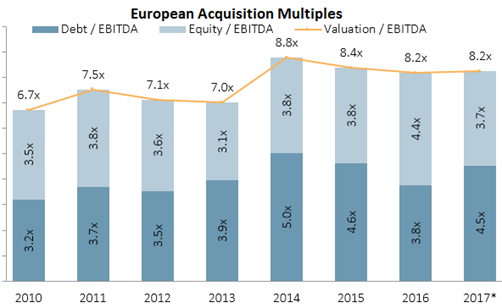

- There is a wide variance in EV-to-EBITDA multiples, with U.S. acquisition multiples reaching a record high 10.5x while Europe has fallen to 8.2x. European multiples are generally lower than their U.S. counterparts due to a landscape dominated by smaller regional businesses, but the trends rarely divert in opposite directions.

- We expect U.S. M&A activity to remain strong on a historical basis due to ease of credit and strong balance sheets, but activity will remain well below the booming years of 2015 and 2016 without significant tax reform.

M&A deal flow has been strong on a historical basis this year, but remains on a downward trend following the two-year corporate spending spree in 2015 and 2016. Through Sept. 15, North American- and European-based investors completed 11,942 M&A transactions totaling $1.3 trillion in deal value. At the current pace, 2017 M&A deal count will be down 34% from 2016.

Source: PitchBook Data | * As of 9/1/2017

Several factors are driving the downward trend in M&A activity, including the fact that many corporate acquisition teams have already acquired key targets after two years of record spending. Although boosting growth through acquisitions remains a key strategy in a low-growth environment, acquisition fever is beginning to abate as companies shift focus to integrating recent acquisitions into their operations. Economic uncertainty is also a concern as large-scale shifts in both U.S. and global policy may occur of the next few years, but the outcomes of recent political headwinds remain entirely speculative.

While global EV-to-EBITDA multiples reached a record 9.2x, this is largely driven by the U.S., which sits at a median multiple of 10.5x. Europe, on the other hand, has trended downward since 2014, with a median acquisition multiple of 8.2x through the first nine months of 2017, compared to 8.8x three years ago. We believe pricing pressures eased last year due to the political uncertainty surrounding the EU, which led to heightened caution around executing deals in the region. As such, we expected a strong uptick in European M&A activity following several significant political campaigns during the first half of the year, but there has been no such bounce-back in the third quarter. This suggests that the fundamental factors driving down M&A activity remain as political uncertainty continues and corporate focus shifts from acquisition to integration.

Source: PitchBook Data | * As of 9/1/2017

The U.S. has seen a similar decline in M&A activity, as post-election gains in the public markets have not coincided with greater dealmaking. However, much attention has been placed on the current administration’s tax reform plan and the ability to get such legislation passed. If Congress and the administration is successful in lowering the corporate and repatriation tax rates, we would expect a significant uptick in corporate acquisition activity as companies put extra cash to work. Due to the prevalence of cheap debt and strong balance sheets, we expect M&A to remain strong on a historical basis even without tax reform but well below the boom years of 2015 and 2016.

Source: PitchBook Data | * As of 9/1/2017

More Market Outlooks

Stock Market Outlook: China Rebalancing Presents Winners and Losers

Credit Market Insights: A Solid Quarter for the Bond Markets

Basic Materials: Valuations Propped Up by Shaky China Fundamentals

Communication Services: Smaller Rivals Call the Shots in U.S. Wireless

Consumer Cyclical: Tepid Mall Traffic Could Constrain the All-Important Holiday Season

Consumer Defensive: Valuations More Reasonable After Third-Quarter Retreat

Energy: All Roads Point to Oversupply in 2018

Financial Services: Banks Can't Rest Easy

Healthcare: Stock Selection Key as Valuations Rise

Industrials: Worldwide Growth Is Resilient, But Valuations Look Full

Real Estate: Enter With Caution

Technology: Valuations Painting Overly Rosy Scenarios

Utilities: Valuations Still Running Out of Control

Private Equity Outlook: Larger Funds, Larger Deals

Venture Capital Outlook: Exits Come Into Focus as Valuations Continue to Climb

U.S. Stock Funds: Steady as She Goes

International-Stock Funds: The Beat Goes on

Bond Funds: A Period of Relative Calm

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)