Closing Your Medicare Gaps

Contributor Mark Miller explains how Medigap works, what it covers and costs, and when you should buy it.

Rail systems around the world warn you to "mind the gap" when boarding a train. It's good advice for your Medicare coverage, too.

Medicare is comprehensive, but it doesn't cover everything. There are copays, deductibles, and limits on hospitalization benefits. If you enroll in Medicare Advantage--the all-in-one managed care alternative to traditional Medicare--your out-of-pocket costs are capped. But if you elect traditional Medicare, you'll probably want to buy a Medigap supplemental policy to close some or all of your gaps. Nearly 1 in 4 Medicare enrollees have a Medigap policy, according to the Kaiser Family Foundation.

What does Medigap cover, when should you buy it, and how much coverage do you need? Read on.

What Is Medigap? Medigap is commercial insurance that closes gaps in traditional fee-for-service Medicare Parts A (hospitalization) and B (outpatient services).

The coverage level varies by the policy type you purchase. Policies come in an alphabet soup of lettered plan choices, currently including A, B, C D, F, G, K, L, M, and N. The most popular--accounting for more than half of all policies sold--are plans C and F, which are the most comprehensive.

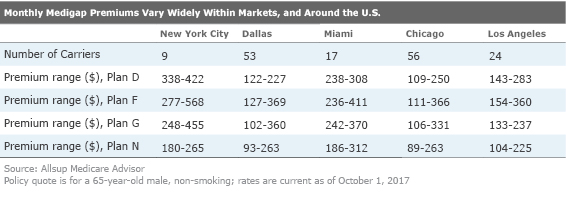

By law, the benefits offered by Medigap plans must be uniform across the country. That is, a C plan in Ohio must offer the same benefit features as a C plan in California. Premium prices for the same plan, however, can vary quite a bit from state to state, and even from carrier to carrier within a local market.

Medigap offers the peace of mind that comes with making your healthcare expenditures more predictable. This year, for example, the Part A deductible is $1,316 and the daily coinsurance charge for longer hospital stays (61 to 90 days) is $329. In the unlikely event of a very long hospital stay, Medicare stops paying after 90 days, and after you exhaust a lifetime reserve of 60 days. The Part B deductible this year is $183.

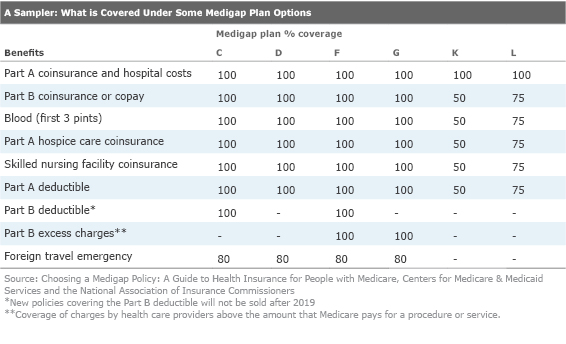

What Does Medigap Cover? The most comprehensive Medigap policies--C and F--cover 100% of Part A coinsurance charges and hospital costs up to an additional 365 days after Medicare benefits are exhausted. These plans also cover 100% of Part B co-insurance or copayment amounts, hospice care co-insurance, skilled nursing facility co-insurance, and deductibles for Part A and Part B. Other plans provide less generous coverage. For example, plan K covers only 50% of Part B copays and various other deductibles. The chart below shows how some of the plan coverage differs. For the complete list of all Medigap plans and their coverage levels, download Medicare's free guide to policies.

Two plans--F and G--cover what Medicare refers to as Part B excess charges. Medicare sets standard rates for all procedures that participating physicians must accept, but they also can be classified as "nonaccepting," which means they can add surcharges to the patient beyond Medicare rates. Medigap coverage for excess charges meets these costs; starting in 2020, G plans will be your only option for buying this coverage.

Federal legislation passed in 2015 phases out Medigap C and F plans--also known as "first dollar" coverage--for new buyers beginning in 2020, although current policyholders can keep their plans. The idea here is intended to save money for Medicare by reducing unnecessary utilization of healthcare by giving enrollees more "skin in the game."

The phase-out of new C and F sales could also lead to hefty premium increases for current policyholders, since there would be fewer younger enrollees to keep the risk pool in balance.

Starting in 2020, D and G plans will be the new most comprehensive plans.

"C becomes D, and F becomes G minus the Part B deductible coverage," says Aaron Tidball, manager of Medicare operations for Allsup, a firm that offers a fee-based service that helps people find good-fit plans.

Tidball notes that some insurers already are steering new customers to D and G plans, and may try to entice existing C and F policyholders to move over with one-time incentive offers.

When To Buy The best time to buy a Medigap policy is during your six-month Medigap Open Enrollment Period. This period begins on the first day of the month in which you're both 65 or older and enrolled in Medicare Part B. (Don't confuse this with the open enrollment period for Medicare prescription drug and Advantage plans, which occurs annually from Oct. 15 to Dec. 7.)

During Medigap Open Enrollment--also referred to as the guaranteed issue period--insurers cannot use medical underwriting to refuse to sell you a policy. Insurers also can't charge you more for a policy due to any pre-existing conditions.

"Once that six-month period is over, insurers don't have to sell to you at all, and if they do, they can charge you whatever they want--hundreds, even thousands more dollars annually,' says Tidball.

The open enrollment feature makes the initial choice between traditional Medicare and Medicare Advantage especially important.

Let's say you choose an Advantage plan when you are first eligible for Medicare at age 65, but later want to switch into traditional Medicare with a Medigap policy. If you switch during your first year of Advantage enrollment, you get the benefits of guaranteed issue.

'But it needs to be during the first year, and only with your first Advantage plan," notes Tidball. "If you've switched into a second Advantage plan and then decide you want to switch to traditional Medicare, there's no guaranteed issue benefit."

Also, if you dropped a Medigap policy to join a Medicare Advantage plan for the first time and you want to switch back, then you have a full year trial right to decide.

How Policies Are Priced The cost of Medigap is not insignificant, generally ranging annually from a few thousand dollars to $7,000 for the most comprehensive plans. And policy prices vary quite a bit even for the same policy type, as you can see in the chart below. The gaps underscore the need to shop carefully among providers even after you have selected a plan type, and to not simply buy from a carrier whose name you know or have done business with in the past.

Membership organizations often offer discounts on policies--check your professional and social organizations, as well as groups like AARP. Insurers sometimes will make special offers to a community or to households for joint spousal purchases.

Additionally, while "first dollar" coverage is the most popular option, you can save on premiums by selecting a less comprehensive option.

"A lot of people like plan N--the coverage is similar to C and F but it is less expensive because it includes co-pays for doctor visits and emergency rooms," says Tidball.

Be on the lookout for low come-on rates that could jump substantially in later years. Tidball advises buyers to consider an insurer's history on premium hikes, but also the rating system used by the insurer to determine prices.

Insurers can use one of three rating systems:

- Attained age-rated is based on your current age; premiums may be the least expensive at first, but will rise due to age as you get older.

- Issue age-rated (sometimes called "entry age rating") is based on your age when you buy your policy. Premiums are lower for people who buy at younger ages, and won't change due to age as you get older. (Other factors may affect your premium, however).

- Community-rated (also called "no-age rated") requires insurers to charge everyone the same rate no matter their age. This rating system is more rare but it is very beneficial for buyers. It may require that you pay a somewhat higher price upfront in exchange for more rate stability down the road.

If you live in New York, Massachusetts, or Connecticut, congratulations, you have hit the Medigap jackpot. These three states have continuous guaranteed issue and all plans use community rating.

One final note: Medigap plans are sold and regulated by states. If you move to a different state after buying a policy, there is no guaranteed issue right, but carriers often will transition you to a local version of the same letter policy, possibly with a price increase.

Mark Miller is a retirement columnist and author of The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work, and Living. The views expressed in this article do not necessarily reflect the views of Morningstar.com.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)