5 Misconceptions About College Aid

The FAFSA for the 2022-23 school year is now available. Don't disregard it when planning how to pay for college.

A version of this article originally ran in October 2016.

If you are the parent or grandparent of a college student, you should know more about the Free Application for Federal Student Aid (known as FAFSA).

Many people assume that the FAFSA doesn't apply to them. Perhaps they assume their family's income is too high to qualify for need-based aid, so filling out the FAFSA would be a waste of time. Or maybe they think it's too big a hassle.

But filling out this one (free) form can determine your child's eligibility for myriad types of student aid for students of all income levels--some of which don't require repayment, like grants and scholarships. In addition, the information you report on the FAFSA determines eligibility for federal subsidized and unsubsidized loans, which can be very affordable alternatives to other types of loans.

We attempt to demystify some areas of the FAFSA, and explain some changes aimed at facilitating the process.

Mistake Number 1: Assuming you won't qualify for grants. According to government estimates, an estimated 2 million students who are enrolled in college and would be eligible for a Pell Grant never applied for aid. The maximum Pell Grant award for the 2021-22 school year is $6,495--an amount that goes a long way toward paying a tuition bill, and, unlike a loan, a grant doesn't need to be paid back.

Let that sink in for a moment--2 million students passed up thousands of dollars of free money from the government, and that's only students who were enrolled in college! Undoubtedly there were many, many more eligible people who didn't even apply to college, perhaps because they weren't aware this type of funding was available or didn't know how to take advantage of it.

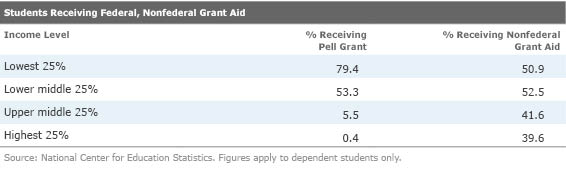

But it's true that the higher your family's income is, the lower your chances of receiving this type of federal grant. According to the Department of Education, in 2019-20, approximately 66% of all Pell Grant recipients had incomes less than or equal to $30,000.

But the Pell Grant isn't the only reason to fill out the FAFSA. Information submitted on the FAFSA can qualify students for other types of nonfederal grants--from state governments, private entities, and colleges themselves--that are available to students from higher-income households as well. Even some merit-based scholarships offered by colleges and universities require applicants to file the FAFSA or the CSS/Financial Aid PROFILE form.

Mistake Number 2: Ruling out federal student loans. Filling out the FAFSA will also determine a student's eligibility for subsidized and unsubsidized federal Direct student loans. Although some private student loans may advertise lower rates, further investigation is warranted. For instance, if that low advertised rate is a variable rate, that means there is a possibility that the base rate (and therefore the monthly payment) will increase over the life of your loan, sometimes by a large percentage. Also, the lowest advertised rates may not be available to borrowers with low credit scores or a lack of credit history.

In contrast, federal student loans offer low fixed rates for the life of the loan, and rates are not based on a borrower's credit. For undergraduates, the interest rates on subsidized and unsubsidized Direct loans is currently 3.73% (for loans disbursed between July 2021 and July 2022).

There is a big benefit to subsidized loans: The U.S. Department of Education pays the interest if you're in school at least half time and for a limited grace period after you leave school. This makes subsidized loans a better deal for the borrower than other types of loans, where interest begins to accrue immediately. Subsidized loans are available to students with a financial need, and there are limits to how much a student is eligible to borrow each academic year.

Another option is unsubsidized Direct loans, which are available to all students regardless of financial need and have a low fixed interest rate (currently 3.73% for an undergrad) that is not based on the borrower's credit. Though the limits are higher than with subsidized Direct loans, there are also limits to how much a student is eligible to borrow each year with unsubsidized loans. (This is also cheaper than the Parent PLUS loan, which has a 6.28% interest rate.)

Mistake Number 3: Assuming that filling out the FAFSA is too much trouble. The FAFSA takes the average student less than an hour to fill out, according to the U.S. Department of Education's federal student aid website. Even if that's an optimistic estimate, the form costs nothing to fill out, and it could be well worth the time spent if it saves your family money.

Also, some new federal rules have been implemented during the past couple of years with the aim of making it easier to fill out the form. For one, the window for filing the FAFSA is now three months longer than it used to be--Oct. 1 to June 30.

Also, many users will be able to pull in their family's tax information directly from the IRS using the IRS Data Retrieval Tool, which is again available to applicants after being offline since March. The benefit of using this tool is that data are transferred directly from the IRS and automatically populate the form, which saves time and ensures greater reporting accuracy. In addition, according to the IRS, using the tool reduces the likelihood that the school's financial aid office will select your form for verification (wherein the student's family would be required to supply additional documentation for the information reported on the FAFSA).

Mistake Number 4: Waiting too long to fill it out. Don't procrastinate. Though it's tempting to focus on the FAFSA's June 30 deadline and think there's no rush to complete it, the FAFSA website says because many states and colleges have earlier deadlines for applying for state and institutional financial aid, it is highly recommended that you fill out the form as soon as you can to ensure that you don't miss out on any aid.

Mistake Number 5: Forgetting to fill it out every year. Filling out the FAFSA is not a one-and-done affair, because eligibility for student aid does not carry over from one academic year to the next. Further, variables such as your family's income level in a given year and the number of family members enrolled in college at the same time will affect the amount of aid a student is eligible to receive. Therefore, you need to file the FAFSA for every academic year. (To save time, check the FAFSA Renewal button, which will populate the form using information reported on previously submitted forms.)

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)