Look What These Liquid Alts Made Investors Do

Poor timing has investor returns lagging in liquid alternatives.

The past several years have not been great for liquid alternatives, but their Morningstar Investor Returns have been even worse thanks to poor timing decisions.

Investor returns are dollar-weighted returns, as opposed to time-weighted returns, which are the standard way of displaying an investment's total returns. We calculate investor returns for a single fund by adjusting returns to reflect monthly flows and their compounding effect over time. Generally, investor returns fall short of a fund's stated time-weighted returns because, in the aggregate, people tend to buy after a fund has gained value and sell after it has lost value. Thus, they miss out on a key part of the return stream.

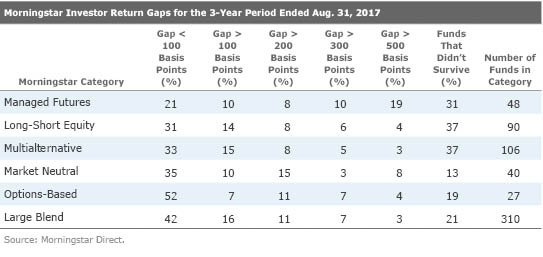

In liquid alternatives, investor returns have badly lagged fund returns, in some cases by more than 500 basis points annually, over the last three years. The exhibit below shows the percentage of funds in each liquid alternatives Morningstar Category that had investor return gaps of less than 100 basis points, more than 100 basis points, more than 200 basis points, more than 300 basis points, and more than 500 basis points, as well as the percentage of funds that didn't survive the three-year period. For comparison, we've included the same figures for large-blend funds.

Investors in managed futures have fared the worst, with nearly one in five funds having investor return gaps of more than 500 basis points and half with at least a 100-basis-point gap. A 100-basis-point gap may not seem like a lot, but the average managed-futures return was 1.46% over that time period, so many investors in managed-futures funds likely suffered losses over the period even though the funds had positive returns.

Managed futures, like other liquid alternatives strategies, became popular after performing well during the 2008 financial crisis. These funds, which follow trends across asset classes, also performed well during the tech bubble. In both cases, the strategies were short equities as they fell and long interest rates, which rallied as investors sought less risky assets. The strategy's prior positive performance in bear markets may have given investors the false impression that the funds wouldn't face bear markets of their own. However, from August 2015 through June 2017, the SG Trend Index, a popular managed-futures hedge fund index, fell 17.8%, its worst drawdown since the index was created in 1999. (My colleague Tayfun Icten covered some of the challenges faced by managed futures during that period.)

The complexity behind managed-futures strategies likely also adds to the difficulty in using and understanding the funds.

Investors' poor use of alternative funds extends beyond managed futures, though. A fourth of market-neutral fund investors experienced investor return gaps of more than 200 basis points annually; the average fund return over that period was negative 10 basis points annually. Market-neutral strategies are similar to managed futures in that they are expected to have a low correlation to broad equity markets over long periods. That means returns aren't likely to be driven by whether or not stocks are going up. Although that is a characteristic investors should be looking for in an alternative strategy, it also makes it harder to predict when the strategy will perform poorly, which could make it harder to own.

One additional factor that makes choosing a liquid alternatives fund and sticking with it harder is the high death rate of the strategies. Over the three-year period we looked at, around one third of distinct funds that existed at the start of the period are no longer around. Long-short equity and multialternative funds saw the highest death rates over the period, with 37% of the funds in each category failing to survive.

Do Liquid Alternatives Belong in the Too-Hard Bucket? The investor return gaps and high death rates paint a gloomy picture for liquid alternatives, but we still believe there is a role for liquid alternatives in a diversified portfolio, provided investors do their homework and understand why they own the fund. We don't advocate trying to time alternative strategies over short periods. Factors like low costs, experienced management teams, and firms with strong track records running nontraditional strategies are other things investors should seek from their liquid alternatives fund.

Associate analyst Jesse Dashefsky contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)