The Case for International Diversification

It pays to diversify a stock portfolio globally, even though most large companies are global.

A version of this article previously appeared in the May issue of the Morningstar ETFInvestor.

How strong is the case for investing in stocks outside the United States? Vanguard founder Jack Bogle has argued that U.S. investors don’t need to venture into foreign markets because 1) most large U.S. stocks generate a large portion of their revenue outside the U.S., 2) foreign stocks have greater currency and--in many cases--greater macroeconomic risk, and 3) returns across different markets should be similar over the long term. With similar expected returns and greater risk, non-U.S. stocks aren’t appealing--in Bogle’s view (which Vanguard doesn't share). But investors who limit themselves to the U.S. market miss nearly half of the world’s available equity market capitalization. A closer look reveals that while the benefits of international diversification will likely be modest for U.S. investors, non-U.S. stocks should have a place in most investors’ portfolios.

Business has become increasingly global in the past few decades. Where a company is incorporated and traded is not necessarily indicative of the economic exposure it provides. Most large-cap firms are global organizations, which means that investors don’t necessarily need to venture out of their home market to get international exposure and that foreign-listed stocks may offer less diversification than their places of incorporation would suggest.

It also means that confining a portfolio to a single market artificially limits the opportunity set, placing many strong companies out of reach. For example, when Inbev (the European maker of Stella Artois) bought Anheuser Busch, it took the company out of U.S. indexes--even though the combined company continues to have significant exposure to the U.S. market. If Inbev takes market share away from Molson Coors TAP (a U.S. brewer), U.S. investors will lose out. The market does not compensate this type of diversifiable risk. Other examples include

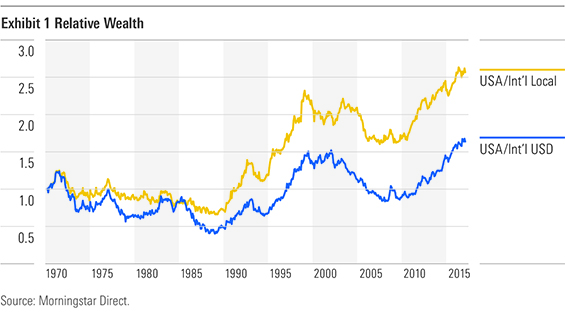

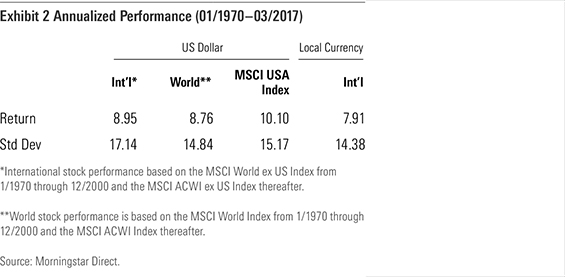

Performance From January 1970 through March 2017, foreign stocks lagged their U.S. counterparts, with greater volatility. But this divergence in performance illustrates the benefits of investing globally. Sometimes U.S. stocks will lead foreign stocks, other times they will lag, but they should offer similar returns over the long run. As long as these returns are less than perfectly correlated, foreign stocks can help diversify risk. Exhibits 1 and 2 show the relative performance of U.S. stocks against foreign stocks, denominated in both local currencies and U.S. dollars.

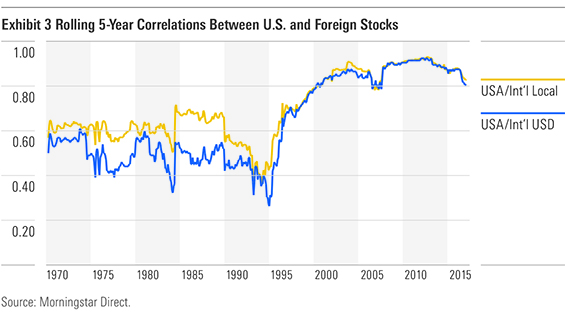

Currency risk has made foreign stocks more volatile than their U.S. counterparts, as shown in Exhibit 2. Yet the global, market-cap-weighted stock portfolio exhibited volatility comparable with the MSCI USA Index, owing to the less-than-perfect correlation between U.S. and foreign stocks, which averaged 0.65 during the sample period. That said, correlations between U.S. and foreign stocks spiked in the late 1990s and early 2000s and have remained elevated since, as shown in Exhibit 3. If this trend continues (and it probably will, in light of greater global integration), foreign stocks will likely offer smaller diversification benefits going forward.

Investors can bring foreign stocks’ risk back on par with U.S. stocks’ by hedging their currency risk. Currency fluctuations add to volatility, but they shouldn’t have a big impact on returns over the very long term. During the sample period from January 1970 through March 2017, the local-currency version of the composite international stock index, which strips out the impact of currency fluctuations on returns, generated a slightly lower return than the U.S. dollar version of the index, as shown in Exhibit 1. This indicates that unhedged investors benefited from a weakening U.S. dollar. But it also exhibited lower volatility than the U.S. dollar version of the index and was more highly correlated with the MSCI USA Index. Despite this higher correlation, the local-currency version of the composite world index exhibited lower volatility than its U.S.-dollar-denominated counterpart and the MSCI USA Index.

Local-currency returns are not available to a U.S. investor, though currency hedging should provide a similar volatility profile. However, currency-hedged funds are more expensive than their unhedged counterparts and are more likely to make taxable capital gains distributions.

Foreign Stock Allocation The foreign stock allocation embedded in the global market-cap-weighted portfolio is a good starting point because it reflects the collective views of all investors about the relative value of each market and represents the theoretical optimal portfolio. But money doesn't float as freely in practice as it does in theory. In most markets, local investors tend to have overweightings in domestic stocks, a phenomenon called home-country bias. This may stem from greater familiarity with local stocks and an aversion to currency risk. However, it means that the regional composition of the global stock market does not necessarily reflect the optimal allocation.

At the end of March 2017, non-U.S. stocks represented about 47% of the world’s available market capitalization. Parking such a large sum in foreign stocks may be hard to stomach and is not necessary to realize most of the diversification benefits. The market-cap-weighted portfolio’s exposure to foreign stocks changes over time with prices, which can change the portfolio’s risk profile. For many, it may be more sensible to maintain a fixed allocation to foreign stocks.

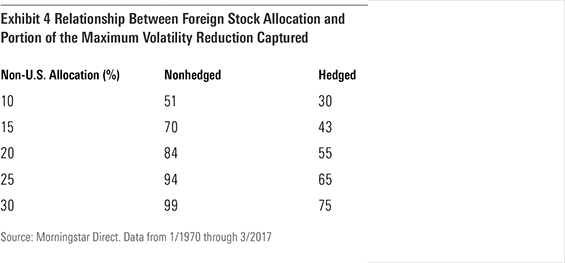

During the sample period, a 33% allocation to non-U.S. stocks would have generated the maximum reduction in volatility relative to an equity allocation consisting only of the MSCI USA Index, if currency risk is unhedged. But this volatility reduction amounted to only a modest 5%. A 10% allocation to non-U.S. stocks would have reduced volatility about half as much. A 20% allocation would have resulted in 84% of the volatility reduction that would result from allocating a third of one’s equity portfolio to non U.S. stocks, as shown in Exhibit 4.

Removing currency risk increases the potential volatility reduction and allocation to non-U.S. stocks that would be necessary to achieve that maximum risk reduction. This is because it reduces the volatility of the foreign stock allocation and increases its correlation with U.S. stocks. With currency risk out of the equation, it would have taken a whopping 59% allocation to non-U.S. stocks to achieve the maximum volatility reduction. That said, a 30% allocation would have captured 75% of the benefit.

But this full sample period probably isn’t representative of what investors can expect going forward, as markets are more interconnected now than in the past. During the most recent decade, when correlations were high, any unhedged allocation to non-U.S. stocks would have increased portfolio volatility. And any hedged allocation would have resulted in only a tiny volatility reduction. Even if correlations do come down a bit, the potential volatility reduction from an allocation to international stocks will likely be modest at best.

An Outside Perspective While there is a reasonable case for global diversification from the perspective of U.S. investors, the argument is even stronger from the point of view of investors in other markets. The U.S. market is a closer approximation of the global market than any other country, as it represents about half the global market. The Japanese market is the world's second largest, but it accounts for only about 8% of the world's investable market capitalization. This creates greater opportunities for Japanese investors to diversify risk by investing abroad.

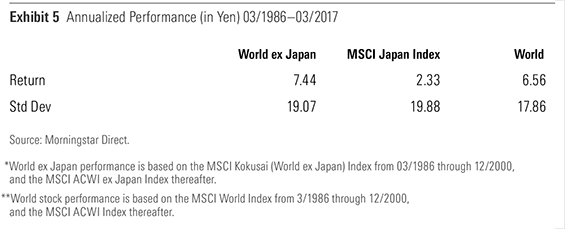

Japanese investors would have clearly benefited from global diversification from March 1986 through March 2017. During that time, the MSCI Japan Index returned a meager 2.32% in Japanese yen, well behind the composite index of non-Japanese stocks, as shown in Exhibit 5. The global market-cap-weighted portfolio generated substantially higher returns (in yen) than the Japanese index, with lower volatility, despite the added currency risk. This example illustrates how global diversification can help when the domestic market goes through a rough stretch. So even if global diversification doesn’t significantly reduce U.S. investors’ portfolio volatility, it can make periods of poor U.S. market performance more bearable.

Regardless of where investors live, it is prudent to reach beyond the local market, even if with only a small allocation. Global diversification may help reduce volatility and, in some cases, even help returns. But it will always allow investors to participate in the best-performing markets and invest in the leading firms in each industry.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)