Big (Passive) Voices on Gender Diversity and Climate Risk

The stewardship efforts of BlackRock, State Street, and Vanguard are having widespread impact.

The rise of passive investing would seem to pose a problem for stewardship--the actions that asset managers take as shareholders to improve the companies they own through direct engagement and proxy voting on management and shareholder proposals.

If you are a permanent owner of every company, what incentive do you have to engage with the companies you own as a shareholder? You are not going to sell the stock, in any event, so why bear the costs of researching thousands of companies and engaging with enough of them for it to make a difference in the performance of your portfolio, especially when any performance benefit you receive would be shared with your passive competitors, who own the same companies?

As their passive assets under management have grown and they have become the largest shareholders of most large companies, however, the Big Three of passive investing--

That was the consensus when I spoke with the heads of stewardship from the Big Three at the Morningstar ETF Conference last week. As State Street's head of ESG investments and asset stewardship Rakhi Kumar, put it, "Index investing is like being married, with divorce not an option; you have to work out your differences." Glenn Booraem, Vanguard's investment stewardship officer, preferred a car metaphor: "Passive ownership is like being in a car you can't get out of. We need a good driver, i.e., the board and management. Governance structures are the seats and airbags."

As permanent owners, the Big Three are more focused on issues that preserve or create shareholder value over the long term, like strengthening corporate governance, rather than on the short-term management and capital-allocation issues that often spark the attention of activist investors. BlackRock gets involved in a governance issue, says Michelle Edkins, global head of investment stewardship, when it is considered material to long-term shareholder value.

Consistent with a long-term perspective, among the firms' points of emphasis in their stewardship activities have been two sustainability issues: gender diversity on boards and climate-risk disclosure.

Increasing the number of women on corporate boards is considered a way to improve board quality, based on research suggesting that diverse decision-making groups make better decisions. All three firms are pushing companies to add women to their boards, with an initial goal of 30% female representation. State Street has been most out front on this, leading a public campaign symbolized by the "Fearless Girl" statue on Wall Street and, according to BloombergMarkets, voting against the re-election of the chairs or the most senior member of a board's nominating committee at 400 companies with no women on their boards.

Making sure that boards understand and are appropriately overseeing material long-term risks is the overarching reason for the three firms' push for companies to disclose on climate risks. BlackRock wants "climate competent" boards overseeing companies in sectors with significant exposure to climate risks. "Regardless of one's perspective on climate, there's no doubt that changes in global regulation, energy consumption, and consumer preferences will have a significant economic impact on companies, particularly in the HTMLenergy, industrial, and utilities sectors," Vanguard's Booraem wrote.

The firms' stewardship activities are similar. BlackRock, State Street, and Vanguard each signaled concerns about these issues this year in "open letters" to companies they own (that is, virtually every company). These public declarations also attract the attention of the media, company stakeholders, and investors. While it is impossible to engage in direct dialogue with every firm on every issue, this type of engagement is considered the most effective because participants can freely discuss the issue in private. Direct dialogue is usually associated with at least an implicit threat that, if not resolved, the issue could come to a shareholder vote.

In the case of gender diversity on boards, for example, few companies want to be publicly singled out as laggards. At the beginning of this year's proxy season, there were 35 shareholder proposals on the topic. Most of them, 27 to be exact, were withdrawn after companies gave assurances that they would address the issue. Companies don't like having to deal with shareholder resolutions. It takes time and money to run a proxy-vote campaign urging shareholders to support management's position. And if too many shareholders vote against management, it is considered a public rebuke.

That's what happened this year at

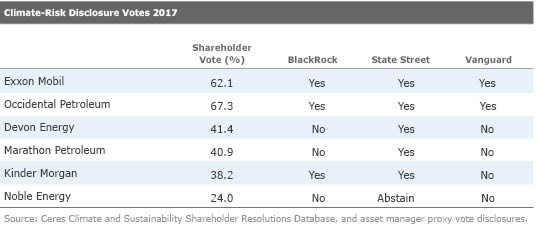

This year, the votes of BlackRock and Vanguard put the climate-risk resolutions over the top at Exxon and Occidental, but those resolutions had garnered 38% and 49%, respectively, in 2016. State Street was already in the "yes" camp, having voted in favor in 2016. These were the first climate-risk disclosure resolutions Vanguard has supported. In the view of most of their shareholders, Exxon and Occidental have been dragging their feet on climate-risk disclosure. The disclosure practices of Exxon and Occidental, according to Booraem, "weren't on par with emerging expectations in the market." BlackRock's take was that despite its efforts to engage with the firms and strong shareholder support for disclosure in prior years "left us concerned that the companies' reporting failed to sufficiently address the impact that material economic risks could have on the performance of the business."

Similar climate-risk disclosure shareholder resolutions did not receive as strong support at several other firms, partly because BlackRock and Vanguard didn't support them, but all of them were supported by significant numbers of shareholders.

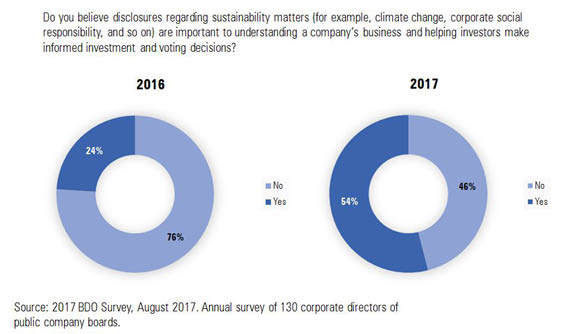

What's the Impact? On one hand, the impact of these kinds of efforts is intended to be company-specific, strengthening board quality and its oversight of material risks with the goal of enhancing long-term shareholder value. But when the three largest asset managers in the world act more publicly on stewardship matters, as they are now doing, they have more widespread impact by signaling to other companies the need to address these same issues, and by building investor and public support for their efforts. Some evidence of this more general impact is evidenced in a survey of corporate directors conducted by consulting firm BDO USA that has just come out. In it, two thirds of directors surveyed said their board is now "proactively addressing the issue of board diversity." According to the same survey, a majority of directors now believe climate-related disclosure is "important to understanding a company's business and helping investors making informed investment and voting decisions." In the 2016 survey, only a fourth of directors thought so.

In the end, the likes of BlackRock, State Street, and Vanguard have different stewardship agendas than activist shareholders who tend to be more focused on improving short-term results by forcing management, board, or strategy changes. Large passive managers are using their position more to try to improve the overall strength of companies, which should help their investors over the long term. It also helps their own businesses because many of their investors are concerned about the same issues and increasingly expect their asset managers to address them with the companies they own. This is particularly true of their largest institutional investors, but individual investors are becoming more concerned about the same things.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)