There's Likely More Risk (and Less Reward) in Foreign Small Caps

Small-cap stocks are riskier than recent history suggests.

The article was published in the August issue of Morningstar ETF Investor. Download a complimentary copy of ETF Investor by visiting the website.

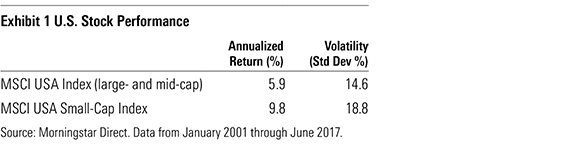

U.S. small-cap stocks have provided wonderful returns since the turn of the millennium. From January 2001 through June 2017 the MSCI USA Small-Cap Index rewarded investors with a 3.9% annualized excess return over the standard MSCI USA Index, albeit with greater volatility. Thus the risk/reward relationship, as expressed through annualized returns and standard deviations, held up fairly well.

But these past 16 years exposed a wrinkle in the risk/reward relationship of foreign small-cap stocks. The excess returns were there, but the risk of these stocks, as measured by standard deviation, was similar to that of large-cap stocks—an unexpected outcome to say the least. A closer look at the behavior of foreign small-caps over this span shows that they were indeed risky, but standard deviation may not have fully captured that risk.

Why do we expect small-cap stocks to be riskier than large-caps? For one, small companies tend to lack the global scale of their large-cap counterparts, with a large portion of their revenue coming from their local economy. This is true both in the U.S. and abroad, and makes these firms more susceptible to local economic conditions and policies. They are less likely to have competitive advantages than larger companies. In general, small-caps should be more volatile than large-caps, and may provide a higher rate of return as compensation.

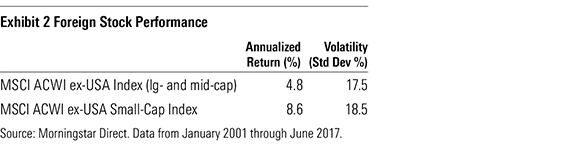

It would be easy to assume that what has been observed in the U.S. also holds up in other markets around the world. But simply assuming that U.S. market characteristics also occur in other markets can make for poor investment policy, especially when global indexes are available that allow investors to conduct out-of-sample testing. Confirming that observations hold up in multiple circumstances also improves confidence that the observation has merit, is more likely to persist in the future, and is less likely to be a consequence of data mining. In this instance, I examined foreign stocks over the same time period as U.S. stocks using the MSCI ACWI ex-U.S. Index. The results are compiled in Exhibit 2.

The excess return was clearly there, and similar to that observed in U.S. stocks, at 3.8% annualized. Curiously though, the risk/reward relationship doesn’t appear to hold up as well, as both the standard index (composed of large and midsize stocks) and the small-cap index weighed in with similar volatility. This is an interesting outcome, and not one that would be expected based on the observations of U.S. indexes and the more general risk-reward expectations.

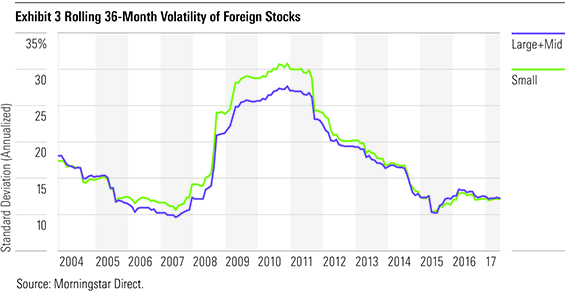

A closer examination of the past 16 years provides some possible explanations for this discrepancy. First and perhaps most obvious, the global economy as a whole experienced a substantial shock during the 2007 to 2009 period, with financial firms being hit particularly hard. Foreign large-cap indexes, such as the MSCI ACWI ex-U.S. Index under examination here, have historically had about 20% of assets allocated to financial firms, while small-cap stocks weighed in at around 10%. This difference sounds like an obvious explanation—a larger helping of volatile financial stocks could indeed make large-caps riskier than small-caps. The problem with this reasoning is that the volatility of foreign small-cap stocks increased substantially relative to large-caps during this period as evidenced by the 36-month rolling volatility shown in Exhibit 3.

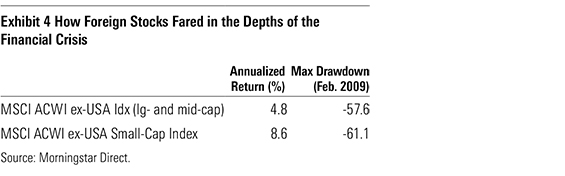

Another way of examining this situation is realizing that volatility, as measured by standard deviation, is really a proxy for risk. The probabilities of historical outcomes computed using standard deviation don’t always match those calculated with actual historical data, because historical returns aren’t normally distributed (although they’re close). So perhaps it’s beneficial to look at an alternative measure of risk: drawdown.

This measure of risk appears to align better with the expected risk/reward relationship. Furthermore, the additional 3.5% drawdown that small-caps experienced appears small. But losses compound in the same manner as gains.

Normally this sort of event should be reflected in the standard deviation. However, this was a one-off event over a 16-year span. Risk, as measured by extreme drawdown, was there. But it occurred so infrequently that it was hidden on the far-left end of the distribution of returns, and accounted for a larger percentage of the fund’s performance than a normal distribution would suggest (the so-called fat-tail phenomenon).

I am somewhat cautious that the volatility of foreign small-cap stocks is likely to remain similar to large-caps. My hesitation stems from the relatively short period of time for which this data was available (“only” 16 years), meaning the data may not be fully representative of the true long-term nature of these stocks. It’s certainly possible that a longer set of data may show a greater degree of separation in volatility between foreign large- and small-cap stocks.

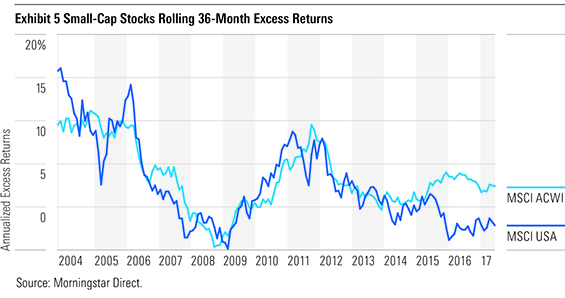

Historic risk/reward relationships aside, the more important question is, will the outperformance of small caps continue into the future? I think it’s reasonable to assume it will, simply because small-cap stocks are riskier and should—in theory—offer investors some form of compensation for assuming that risk. But investors should understand the nature of the risks that they are harboring. The excess returns provided by small-caps have historically tended to ebb and flow, as Exhibit 5 shows.

Investors that expect these stocks to outperform should take a conservative perspective regarding the magnitude of the expected excess return. While small-cap stocks can outperform, their strong performance over the course of the past 16 years probably isn’t representative of what to expect going forward. History has shown that in certain instances these stocks have not always provided an excess return. Take the Russell Indexes as an example. From January 1979 through June 2017 the Russell 2000 Index (small-cap) underperformed the Russell 1000 Index (large-cap) by 0.21% annually, despite its higher volatility[1].

But small-caps can still help diversify a portfolio of large-cap stocks. Rather than explicitly targeting small-cap stocks, it may be better to get exposure to small-caps through a very broad investable market index such as

References

1. Source: Morningstar Direct.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)