New Kids on the Block: Credit Risk Transfer Deals

These new securities have been strong performers, but also introduce new sources of risk into bond funds.

Executive Summary

- Created in 2013, credit risk transfer deals are issued by Fannie Mae and Freddie Mac.

- The structures are designed to move mortgage credit risk from the agencies' balance sheets to investors.

- The goal is to reduce the likelihood that the government (and taxpayers) will need to backstop the agencies in the event of another housing crisis.

- The deal tranches offered to investors boast relatively juicy floating coupons and have been strong performers since their creation.

- However, the securities are untested, and may not be as safe as they first appear.

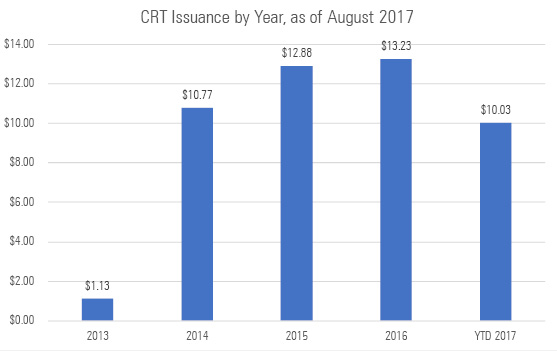

What Are They? Created in 2013, CRT deals are issued by Fannie Mae and Freddie Mac and are designed to move mortgage credit risk from the agencies' balance sheets to private investors. Gross issuance has exploded since 2013's first deal, reaching a cumulative total $48 billion as of August 2017. (There is a nascent market for bank-issued transfer deals, but it's still small.) The programs are required by a mandate from the Federal Housing Finance Agency, which is still the conservator for both Fannie Mae and Freddie Mac. There are a couple of twists, but FHFA's mandate states that the agencies should target at least 90% of new single-family agency mortgages' principal for risk transfer.

Asset managers and hedge funds have been drawn to CRT deals by their attractive yields, as well as back-testing that suggests they would have held up well during the financial crisis. They have also been gobbled up by investors hunting a replacement for legacy non-agency residential mortgages—which have been strong performers since bottoming out during the financial crisis—as the sector has been steadily shrinking.

Source: Finsight.com

Notably, CRTs don’t represent ownership of actual mortgage pools. Rather, the securities’ cash flows are structured so that they reference the activity of specific pools of mortgages held by Fannie and Freddie. This first point is significant: CRT deals are not actually mortgage securitizations, but are instead more akin to credit-linked notes. The agencies use mortgage pools on their balance sheets as a reference (that is, reference pools), and sell tranches of securities with different risk profiles whose cash flows are based on activity in the reference pools. Those cash flows are paid by Fannie and Freddie (rather than directly from the mortgage pools), but the agencies are only obliged to pay investors based on the promises of each individual security. If the underlying mortgage pools experience defaults, CRT investors will bear the brunt of those losses. In other words, CRTs are completely different from traditional agency-backed mortgages.

Credit risk transfers are typically split into senior, mezzanine (usually rated BBB or BB), and subordinate tranches (usually rated B or not rated). They have floating coupons, usually one-month Libor plus a spread. The structure is effectively a stack of synthetic tranches based on the reference pools, but the agencies only sell the mezzanine and subordinate tranches of each stack. In fact, the senior pieces don’t actually exist as securities. Whatever risk or benefit would theoretically accrue to them is effectively borne—or retained—by the agency offering the deal.

As long as the referenced mortgages perform, the agencies will continue to make payments on the CRTs until they are paid off. Unlike non-agency mortgage tranches (which are paid off sequentially), CRT tranches are paid off pro-rata at the same time as long as defaults in the reference pool don’t get too large. If mortgages in the reference pool begin to fail and subordination falls below a target, though, principal payments are diverted away from—and the impact of losses is thus felt by—investors holding the CRT tranches. The risk is “transferred” to investors, away from Freddie and Fannie.

Concerns Clearly CRTs look a lot like other collateralized mortgage obligations, but they've thus far been distinguished by how "thin" the tranches are that are being sold to investors. For most securitizations with credit risk, the biggest appetite is for the senior tranches. By definition, they carry the most credit enhancement, such that all of the tranches below them would have to be wiped out before the senior pieces would be at risk of principal loss. As we've noted, though, the agencies are selling mid- and lower-level CRT tranches to investors, without offering up senior tranches. And because senior tranches typically compose the lion's share of a deal—95% in the case of one 2014 CRT deal—even the middle-tier tranches being sold to investors are low in the structure, and very thin. The "safest" middle-tier tranches, for example, have very little capital underneath them (that is, credit enhancement) to absorb losses. In other words, the initial subordination is very small on each tranche, so that in a severe housing crisis the securities could very quickly go from hero to zero.

Another concern is that some investors may infer a false sense of security with CRTs. Because the interest payments are coming from Fannie and Freddie, and not directly from the reference pool of mortgages, some firms have technically classified them as “agency” securities, despite their inherent credit risk. As we’ve already mentioned, CRTs are not mortgage bonds. They are debentures, or obligations of the agencies, whose cash flows reference pools of mortgages used to calculate credit quality, losses, and interest payments. The agencies are obliged to pay investors based on those calculations, but that money is a promise from the agencies, and CRTs don’t actually represent ownership in anything.

Despite the sector’s explosive growth, the volume of CRT bonds outstanding (roughly somewhere between $30 billion and $40 billion) is still a drop in the bucket compared with other fixed-income sectors, and a liquidity crunch is certainly possible. They have become increasingly popular with asset managers and hedge funds, and some reports suggest that liquidity has been reasonable and improving. Given the sector’s size, and very modest sponsorship from dealers, though, the situation could easily deteriorate in the face of market trouble.

Finally, there’s one other risk factor that may look remote today, but which could become more important down the line. It’s in the agencies’ best interests to transfer as much risk as possible into the deals given that the more mortgage credit risk they can shed, the better it is for their own balance sheets and for taxpayers. So to the degree that the agencies can pick and choose which mortgages to hold back, and which to insert into CRT pools, the interests of CRT investors and the agencies selling them have room to diverge.

Conclusions Credit risk transfer deals are clearly designed to be beneficial to Fannie, Freddie, and taxpayers. But the verdict is still out on whether they will prove to be good for investors over the long haul. Credit risk transfer securities have been among the strongest performers in the fixed-income market since their creation, and the relatively high quality of the mortgages in the first reference pools meant that early investors could get comfortable with the risks. Not surprisingly, though, we have begun to see lower-quality mortgages and higher loan-to-value ratios in more recent deals.

The tranches sold to investors may continue to perform well, but expensive valuations and limited credit enhancement on many deals are strong reasons for caution. The relative uniqueness of the securities also requires a level of research beyond that needed for plain-vanilla agency mortgage securities.

For investors interested in checking the holdings of their funds, today’s CRTs show up under the names “CAS” (Fannie) or “STACR” (Freddie). The deals have started to appear in more and more bond funds (particularly in the intermediate-term bond and multisector bond Morningstar Categories), but thus far mostly in small amounts. It makes sense for investors to keep an eye on their funds’ exposures, though, given that many may be courting a new and unfamiliar source of risk and return.

/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)