The Case for Owning the U.S. Market Portfolio

This total market index fund should be the default option for most investors' core U.S. equity allocations.

There's no such thing as a sure thing in investing. Take

There are two sides to every investment story, and the market prices in investors' collective expectations, so virtually no investment is a slam dunk. But there are three obvious things investors can do to improve their well-being: minimize costs, diversify, and keep the taxman at bay. While there are many ways to do that,

This fund tracks the CRSP U.S. Total Market Index, which represents the composition of the entire U.S. stock market. This broad, market-capitalization-weighted index effectively diversifies firm-specific risk, promotes low turnover (making taxable capital gains distributions less likely), and harnesses the market's collective wisdom. Any deviation from this U.S. market portfolio represents an active bet. For every active bet, there is a winner and a loser. Before taking those active bets, it is important to understand your probability of placing a winning wager, who you're wagering against, and why they are willing to sit across the table from you. If you don't have any special insights, a total market index fund should be the default option.

Owning the market may seem like a surefire path to mediocrity. By definition, the market's performance will reflect that of the average actively invested dollar, before fees. But most actively managed funds charge substantially more than Vanguard Total Stock Market Index's Investor share class VTSMX (0.15% expense ratio). In fact, the median fund in the large-blend Morningstar Category charges a 0.90% fee. This sizable cost advantage should translate into superior category-relative performance over the long-term, which supports its Morningstar Analyst Rating of Gold.

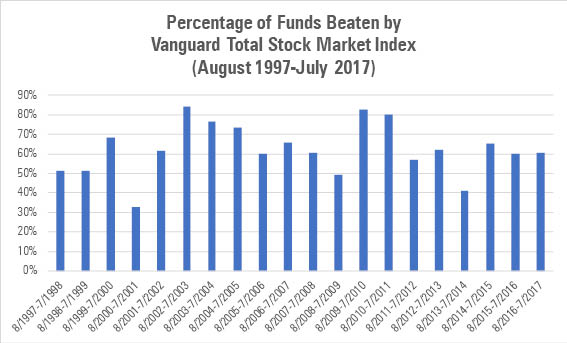

Exhibit 1 shows the percentage of funds in the large-blend category that Vanguard Total Stock Market Index beat each year over the past 20 years, based on each fund's oldest share class. More often than not, the fund's performance fell in the middle of the pack. In 13 of the 20 years, it landed in the middle third of the category. But few of its peers were able to consistently overcome their fee hurdles. Only 11% of the 391 funds that were available in the category at the start of the period went on to survive and outperform Vanguard Total Stock Market Index. Only including the surviving funds, that figure climbed to 28%, which is still pretty low.

Source: Morningstar.

The fund's cost advantage won't always translate into above-average performance. There are times when its portfolio may not be representative of its peers'. That said, it accurately captures U.S. investors' opportunity set and often looks similar to the category norm, albeit with greater exposure to small-cap stocks and a smaller cash balance.

Tax Efficiency

Vanguard Total Stock Market Index's tax efficiency adds to its appeal. Because it holds every U.S. stock of significance and weights them by market capitalization, it does not need to trade much in response to changing market conditions, in contrast to many of its peers. Consequently, its turnover consistently falls in the single digits, leading to fewer capital gains distributions and higher aftertax returns. While most broad market indexes share this advantage, Vanguard has a unique structural advantage. It offers a separate exchange-traded fund share class,

The Market Isn't Perfect … but Neither Is Anything Else Sometimes investors do silly things, like extrapolating past growth too far into the future, underreacting to new information, overpaying for stocks that offer a small chance for a big gain, and focusing too much on the short term. And there are some good strategies that attempt to take advantage of these biases. But there is no easy way to beat the market. Each strategy comes with its own distinctive risks and cycles of underperformance.

Despite its imperfections, most investors should still stick with a broad, market-cap-weighted fund like Vanguard Total Stock Market Index for their core U.S. equity allocations. No matter how inefficient some pockets of the market may be, active investing will always be a zero-sum game. Net of fees, it is a negative sum game. This passive fund should do better than most of its peers over the long haul, especially after taxes. And it requires less of investors than an actively managed strategy. It eliminates the need to identify managers with durable competitive advantages and the risk of losing patience and selling out during the inevitable bouts of underperformance that active managers experience.

There are good actively managed funds. But even the best will likely underperform for extended periods at some point, and it is very difficult to tell when that will happen. If you aren't comfortable with that risk, stick with Vanguard Total Stock Market Index.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)