11 Stocks of Summer With Some Sizzle Left

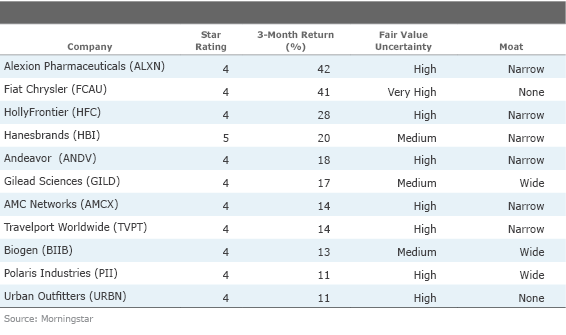

These names all gained more than 10% during the past three months yet remain undervalued by our metrics.

Labor Day weekend is a good time to reflect on summer 2017.

It was the summer of Wonder Woman, Spider-Man, and some oddballs guarding the galaxy--again. The Pittsburgh Penguins and the Golden State Warriors enjoyed championships. Many of us found ourselves humming "Despacito" even if we didn't want to. And no matter the weather, millions gazed upward (hopefully, with protective eyewear) to view the total solar eclipse.

It was a pretty memorable summer for stocks, too.

Many stocks, however, gained far more during the three-month stretch. In particular, these 11 stocks returned more than 10% during the summer months and are still trading in 4- and 5-star range. While it's impossible to say whether they will continue to generate outsize returns, these stocks remain bargains by our standards.

Below are summaries of the three stocks from the list that carry the best Fair Value Uncertainty Ratings; these are the companies whose fair value estimates our analysts are most confident in.

Hanesbrands

HBI

The only 5-star stock on the list, this narrow-moat, channel-agnostic inner- and outerwear maker produces replenishment products with brand loyalty.

"We have a high degree of confidence in the defensibility of Hanesbrands' competitive position, given advantages that are difficult for competitors to replicate: the firm's large owned and controlled supply chain, core product positioning in a space where brand is more important than price, and economies of scale achieved through a growing portfolio of synergistic brands," writes Morningstar senior equity analyst Bridget Weishaar in her latest company report. Weishaar anticipates significant operating margin growth due in part to cost savings and manufacturing efficiencies.

"The company continues to gain market share, with 2016's flat basics revenue topping industry growth and the transition to e-commerce is proceeding well with the online revenue growth rate accelerating throughout 2016," she continues. "As online sales increase as a mix of business (we model penetration topping 20% in three years), we think total company growth will rebound to low-single-digit growth."

Gilead Sciences

GILD

This drug maker's HIV and HCV drugs support its strong cash flows and wide-moat rating. But the company faces some challenges, which could require patience on the part of prospective investors.

"With

. "We're maintaining our wide moat rating, given Gilead's dominance in HIV and HCV and strong returns on invested capital over the next several years, even in our bear-case scenario."

Just a few days ago, Gilead announced an acquisition of

"The Kite deal moves Gilead into new territory with Kite’s cell therapy focus," says Andersen. "While Kite is ready for axi-cel's U.S. commercial launch, we expect Gilead's history of smart clinical trial design and marketing expertise could boost the launch speed and long-term potential of Kite's portfolio." The deal is expected to close in the fourth quarter.

Biogen

BIIB

This drugmaker's dominance in multiple sclerosis treatment and its innovative neurology pipeline support its wide-moat rating.

In the second quarter, Biogen produced 15% top-line growth. In particular, sales of spinal muscular atrophy drug Spinraza were strong and help diversify revenue; sales for the drug could top $2 billion. Management is focused on innovative development in neurology, and leaner operations and fewer share repurchases will free up cash for pipeline spending.

"We remain bullish on the firm's long-term strategy despite near-term concerns about MS competition and Spinraza's growth trajectory, writes Andersen in her latest company report.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)