The Sustainable Exchange-Traded Universe Continues to Expand

Diversified offerings have grown more than 60% in the past 12 months.

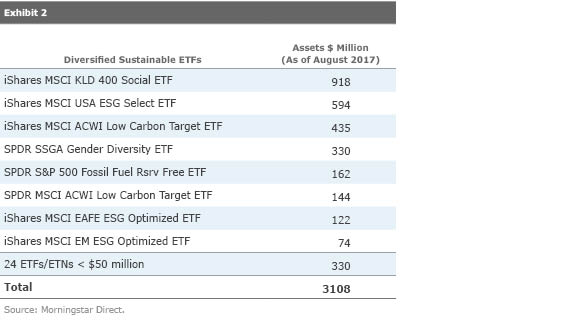

When I took stock of the universe of sustainable exchange-traded products at this time last year--just ahead of the Morningstar ETF Conference--I noted the rapid increase in the number of diversified equity offerings pursuing sustainable investing, meaning they incorporate environmental, social, and corporate governance considerations in their investment processes. A year ago, 20 such funds existed, 17 of them having been launched in 2015 or in the first eight months of 2016. Together, they totaled $1.9 billion in assets.

Fast forward a year and we've seen an additional 13 launches (and one closure), bringing the total number of sustainable diversified equity ETPs to 32. Thirty of those are ETFs, and two are exchange-traded notes. As of July, their assets totaled $3.1 billion. I expect this universe to continue growing because of the confluence of interest in both sustainable investing and low-fee passive investing among institutional and retail investors.

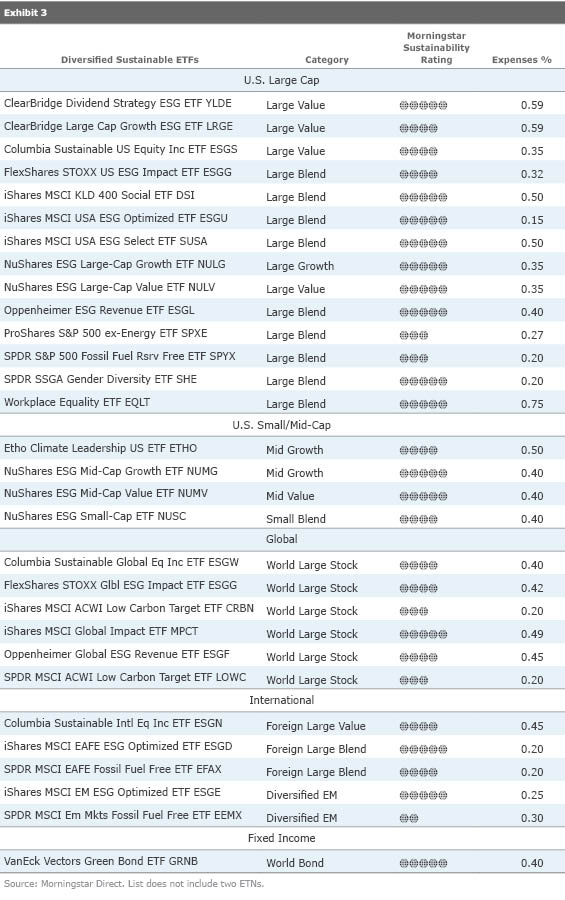

Notable additions this year include Nuveen's NuShares ESG series, which draws on Nuveen parent TIAA's long-standing experience with passive ESG investing and is offered in five U.S. style-box versions. The funds focus on ESG leaders in each sector, and the portfolios are fossil-fuel-reserves free and have low carbon footprints relative to their indexes. Investors could use these funds to set their market-cap and style exposures in the U.S. equity portion of their portfolios. In a similar vein, ClearBridge launched two large-cap style-focused ETFs:

State Street Global Advisors built out their fossil-free ETF lineup this year, launching

Finally, Van Eck launched

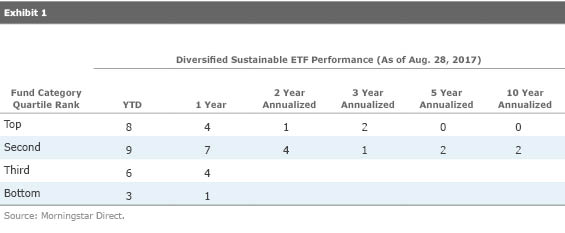

With plenty of sustainable ETF options on the equity side, investors can now use them to build out diversified portfolios. In so doing, however, they face several challenges. The first is the lack of established track records. Only three of the 30 ETFs have three-year records; most haven't even hit the two-year mark. Early returns look decent, but it's really too early to tell. Keep in mind, though, these are passive funds that track indexes, so it's worthwhile to look at the underlying indexes for clues as to how the funds will perform. If an underlying index has a longer record--not always the case, because indexes are often created just prior to an ETF being launched to track them--you can assume the fund's performance would have been similar, minus expenses. If the underlying index is the same age as the fund, there may be a back-test of some sort. Back-tests can provide insight into an ETF's likely performance but should be taken with a grain of salt because no ETF has ever launched based on a poorly performing back-tested index.

A second issue is asset size. While their ranks have been growing and AUM is up about 65% from this time last year, most sustainable ETFs are small and remain well below the size necessary to be viable over the long run. Only eight funds currently have assets greater than $50 million. This is a concern, because persistently low AUM puts an ETF at risk of closure. Because the growth of investor interest in ESG still seems to be in the early stages, I would expect that most recently launched ETFs will be given time to establish viable performance records and to attract assets on that basis. It's worth considering who the issuer is, as those with greater ETF and sustainable investing experience and deeper pockets may have more patience in letting their funds get to scale.

Finally, there are fees. For years, iShares has charged 0.50% for the two oldest and largest diversified ESG ETFs:

Fees are coming down. Several of the new U.S. large-cap offerings are charging 0.35%, and fossil-free and low-carbon offerings, which don't consider broader ESG issues, charge 0.20%. Just this month, BlackRock slashed the fees on three of their sustainable investing ETFs:

The universe of sustainable diversified ETFs is relatively new, small, and expensive when compared with conventional diversified equity ETFs. You can adjust for short performance records by examining the longer records of the indexes upon which a fund is based. If you are considering a small fund, take a look at the issuer and how well it is established in the ETF and sustainable investing spaces. Investing with better-situated issuers increases the odds that the fund will grow to scale and remain open. Focus on ETFs with expenses of 0.35% or less. They are more likely to perform better and grow assets. You can still play it safe by paying 0.50% for DSI or SUSA, purchasing the comfort of their size and established performance records, but their records might also be considered proxies for the smaller, newer, and cheaper sustainable ETFs now available. If DSI and SUSA were able to provide competitive performance over the long run at 0.50%, newer funds based on similar kinds of indexes and charging investors less could do just as well.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)