Our Ultimate Stock-Pickers' Top 10 High-Conviction and New-Money Purchases

Our top managers are turning over more rocks in search for buried treasure.

By Joshua Aguilar | Associate Equity Analyst

For the past nine years, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that not only reflect the most recent transactions of our grouping of top investment managers, but are also timely enough for investors to get some value from them.

In cross-checking the most current valuation work and opinions of Morningstar’s own cadre of stock analysts against the actions (or inactions) of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig a bit deeper into to see if they warrant an investment.

With nearly 90% of our Ultimate Stock-Pickers having reported their holdings for the second quarter of 2017, we have a good sense of what stocks piqued their interest during the period. While the story of 2017’s first quarter revolved around concerns of a fractured U.S. government unable to execute on an ambitious agenda, the story of the second quarter was active management's concern with what the industry perceives as overstretched valuations.

Many quarterly commentaries we surveyed highlighted this issue, specifically citing the trend toward passive investing boosting all valuations, regardless of merit. While these commentaries must be taken with a grain of salt given active management's pecuniary interest and their interest in their own survival, we do agree that the current stock-picking environment has become more difficult. While we don't make top-down forecasts, our own coverage, which we believe is moatier than the collective universe of equities, currently trades at an aggregate price/fair value of 102%. This is far and away removed from the post-financial-crisis levels, where our own aggregate price/fair value assessments reached as low as 55%.

Because of what many of our managers perceive as stretched multiples, the overall activity level of our top managers once again dropped noticeably during the period. In fact, overall activity for our top managers reached their lowest level of the past six consecutive quarters. In addition, our top managers remained net sellers, as was the case in the previous five quarters, and overall buying and selling also dropped during the period relative to last period. That said, the number of top managers that made new-money purchases during the period remained comparable to last period. As was the case during the first quarter, many of the positions that were initiated during the second quarter were relatively small, with a couple of notable exceptions coming from

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We also recognize that the decision to purchase any of the securities highlighted in this article could have been made as early as the start of April, with the prices paid by our managers being much different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

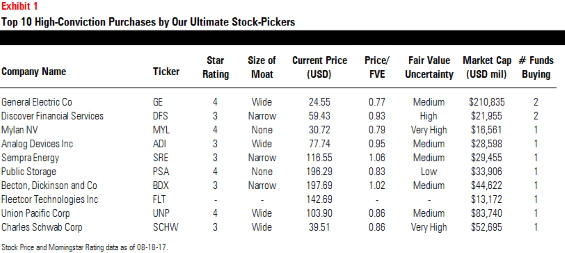

Looking more closely at the top 10 high-conviction purchases during the second quarter of 2017, the buying activity was similarly diversified compared with last quarter, with some concentrated bets in the industrials sector. Only one wide-moat giant,

Top 10 High-Conviction Purchases Made by Our Ultimate Stock-Pickers

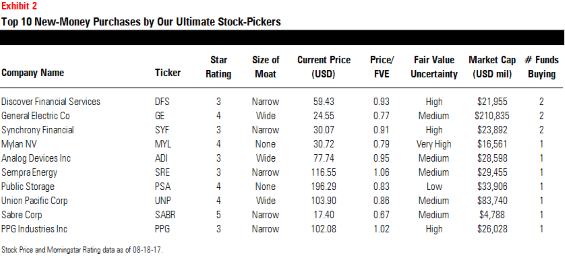

Unlike last quarter, there was a fairly high amount of crossover between our two top 10 lists this quarter, including wide-moat GE, Union Pacific, and Analog Devices, narrow-moat Discover and

Top 10 New-Money Purchases Made by Our Ultimate Stock-Pickers

This quarter saw a fair number of interesting and arguably lesser-known stocks on both of our top-10 high-conviction and top-10 new-money purchase lists trading at discounts to our analysts’ fair value estimates. As such, there are still a few names on either of these lists that might warrant a place on an investor’s watch list.

From a valuation perspective, Mylan is the most attractive name to make our top 10 list of high-conviction purchases. The maker of the epinephrine auto-injector EpiPen was under the media’s microscope just under a year ago for controversially raising the price of the lifesaving drug over the decade. Recently, Mylan was forced to lower its year-end outlook as a result of competitive headwinds facing both EpiPen and its North American generics segment, as well as management's decision to shift expected launches of generic Advair and Copaxone into 2018. During the company's most recent earnings call, CEO Heather Bresch downplayed scientific issues as a barrier to launch for the pair of generic drugs, instead suggesting that delayed launches resulted from the U.S. Food and Drug Administration reorganizing and changing its priorities. FPA Crescent was the only Ultimate Stock-Picker to not only purchase the name during the period, but also to hold the name as of this writing. That said, while the fund did not comment on the company in any of its recent commentary, well-known investor and value-oriented hedge fund manager David Einhorn of Greenlight Capital has been notably bullish on it recently. Einhorn commented on Mylan relatively recently at an investment symposium in Dallas:

“I think Mylan’s a really good opportunity right now. The reason is, is that they have this one product – we all know what it is – it’s EpiPen. And they have made the tremendous sin of raising the price from $100 to $600 over the better part of a decade. I think they raised it about 15% a year twice a year, so you had compounded price increasing of this. It’s gotten all of the national press. It’s gotten congressional investigations. It’s just front and center and yet it’s a tiny part of their business. This is a company that the vast majority of their business is generic drugs. And generic drugs are not part of this whole price gouging phenomenon.

So, when you think about Mylan’s earnings, and here’s how I think about it, the company’s earning something in the high $4s this year, of which a dollar will be EpiPen. Next year it’s supposed to earn something in the mid $5s. The following year we think it will be in the low $6s. Now EpiPen is something that already is ready for generic competition and we assume by then there will be generic competition. So, the earnings that we’re looking at in 2018 in the low $6s, we think only about 25 cents of that comes from EpiPen. So, you’re going to earn something in the high $5s, excluding EpiPen. And the stock is today in the mid-$30s. I think that means that there’s already been too much a penalty for EpiPen relative to the rest of the business, which is healthy and not really subject to this kind of thing.”

Morningstar healthcare strategist and analyst Michael Waterhouse covers Mylan and wasn't surprised by the firm's decision to lower its year-end outlook. While the delay of launching Advair and Copaxone doesn't dramatically alter his cash flow projections for these projects, Waterhouse recently lowered his fair value estimate to $39 and increased his uncertainly rating to very high after reducing his long-term generic segment and EpiPen revenue assumptions. That said, at current prices, the stock trades at a 21% discount to Waterhouse's fair value estimate. Waterhouse believes that Mylan should retain its position as the world's third-largest generic drug manufacturer and that acquisitions will likely play an ongoing role in offsetting waning growth prospects in core developed markets.

Investors should exercise an abundance of caution with Mylan, however, and may require a greater margin of safety before initiating a position. While Waterhouse agrees with Einhorn's assessment that the stock trades at a discount, he is more bearish on the firm's growth prospects and its competitive positioning in the generics space. Specifically, Waterhouse remains skeptical about Mylan's ability to receive generic approvals of Advair and Copaxone, which he believes makes management's updated adjusted EPS target of $5.40 in 2018 still seem aggressive. Waterhouse also suggests that the firm's track record doesn't give investors cause for optimism. Moreover, European price cuts and fewer U.S. drug patent expirations suggest to Waterhouse that headwinds are in store for Mylan. He also believes that industry growth in the generics space will slow as drug launch opportunities decline and nimble low-cost entrants continually emerge. Finally, Waterhouse believes that Mylan's recent acquisitions could leave the company more exposed to negative industry trends in Europe, particularly government-mandated price cuts.

Unlike Einhorn, Waterhouse is also not so confident in Mylan's preparation for increasing generic competition. While Mylan intends to overcome generic industry concerns by growing its specialty pharma and complex generic operations, which generally face limited competition and higher margins thanks to greater manufacturing and regulatory hurdles, Waterhouse remains skeptical of Mylan's success in some of these complex products. He specifically highlights his concern with Mylan's foray into biosimilars and generic insulins, and he thinks the company trails some of its peers in these efforts. While he acknowledges that the firm's specialty drug segment, composed primarily of EpiPen, has grown above his expectations, he thinks that the emergence of competing epinephrine products should continue to pressure the segment's growth and profitability. Lastly, Waterhouse says that beyond EpiPen, the firm simply lacks much of a pipeline of branded drugs, and as such, assigns the firm a negative moat trend. If an investor can stomach all of these potential pitfalls, however, Waterhouse acknowledges that better-than-expected success on a number of complex launches could cause Mylan to outperform his expectations.

Also of note on our list of top 10 high-conviction purchases is wide-moat conglomerate GE. The stock currently trades at a 23% discount to our analyst's fair value estimate. The stock has lagged both the general market and the industrials sector for a number of years, and investors have apparently grown tired, including Ultimate Stock-Picker Warren Buffett. Buffett's

“We like to look for management catalysts in companies that we think have a stale perception in the marketplace, and this fits that profile precisely. We have always admired GE’s businesses—we really like businesses where you sell a big piece of OEM equipment at a low margin and then collect a 40-year stream of high-margin service revenues that the customer is essentially locked into. GE has a lot of those businesses.

“The problem we had with GE is that the culture of capital allocation developed under Jack Welch and continuing under Jeff Immelt was one that bought high-multiple businesses and sold low-multiple businesses in a way that destroyed shareholder value … When Jeff Bornstein took over as GE’s Chief Financial Officer in mid-2013 you can draw a line when capital stewardship changed … (GE's capital allocation decisions) were all very impressive and executed as a contrarian value investor would.

“In another significant move, Bornstein drove a change in how GE’s top 6,000 or so executives are paid. The new incentive system put in place at the beginning of 2016 … pays out based on a scorecard of factors under managers’ direct control and tracked in real time, and it’s far more possible to get paid a lot or a little than under the old system. That’s a big change we expect to have a very positive impact over time.”

Since Nygren's and Murray's interview, CEO Jeff Immelt retired on the first of the month and was replaced by John Flannery, a 30-year GE veteran who was most recently CEO of GE Healthcare. Jeff Bornstein has remained as CFO and was recently promoted to vice chairman of the board. In an updated statement, Oakmark expressed confidence in Flannery's leadership, and continues to believe that GE is well-positioned for substantial earnings and free cash flow growth. Morningstar analyst Barbara Noverini covers the name and expresses similar thoughts. She believes that while investors may be hard-pressed to forget GE Capital's distress during the financial crisis, the company has since made great strides toward repositioning the portfolio for longer-term shareholder value creation. These strides include a move toward a stronger balance sheet, significant investment in research and development in key product categories in power, aviation, and digital, and divesting most of its consumer-focused assets. One decision Noverini specifically highlights that was met with enthusiasm in the stock market was GE's aggressive unwinding of GE Capital via a plan announced back in April 2015. Over 90% of nearly $200 billion in earmarked GE Capital assets were sold over the course of 18 months, about one year ahead of schedule. This enabled GE to return over $70 billion to shareholders between 2015 and the second quarter of 2017 in the form of dividends, share buybacks, and the 2015 Synchrony exchange. Oakmark's managers also specifically praised the tax-efficient manner in which GE spun off GE Capital and how it used that capital to repurchase shares.

Both Noverini and Oakmark's managers also commended GE management for selling the appliance business to Haier for $5.4 billion. Noverini points out that management seized an opportunity when antitrust concerns soured the original deal between GE and Electrolux, resulting in a higher price for the assets and a better multiple. Overall, Noverini adds that GE’s portfolio repositioning has left the company with a more streamlined portfolio, unencumbered by overdiversification and primed to benefit from adjacencies among the company’s seven industrial operating segments. She thinks that the company's massive installed base of industrial equipment remains the physical representation of a wide economic moat with formidable barriers to entry. Noverini adds that each of the firm's industrial segments benefits from a strong foundation that is difficult for competitors to replicate at scale, and that its network of physical assets continues to evolve into a software-supported ecosystem capable of capturing useful operational data and monetizing it. The firm has recently come under pressure for weak first-half 2017 cash flow, persistent headwinds in oil and gas and power, and increasing uncertainty surrounding 2017 and 2018 guidance, as Flannery plans to update the investment community in November following his initial review of the portfolio. Nevertheless, Noverini believes that steady operational execution will help GE manage through its near-term challenges, and patient investors will benefit from higher-quality cash flow over the long run as many of the positive changes made over the past two years gain traction. Lastly, like the managers at Oakmark, Noverini likes that management compensation has been recently pegged to metrics favoring growth in returns on invested capital, which she believes better aligns GE’s incentives with shareholders.

A surprise addition to both of our top-10 lists of high-conviction and new-money purchases is self-storage REIT giant Public Storage. Public Storage is the largest owner of self-storage facilities and currently owns 2,300-plus facilities. The stock currently trades at a discount of 17% to our analyst's fair value estimate. Industrial REITs in general have been taking it on the chin recently amid a slowdown. As a result, their stocks' total returns have trailed the total returns of the S&P 500, both on a trailing year-to-date and 1-year basis. That said, there are signs that investors are beginning to recognize the strength of the subsector's fundamentals. Online retail is seen as a catalyst for growth, buoying the demand for construction. The self-storage industry is particularly seen as both durable and somewhat inelastic, as storage providers are to an extent, able to raise rates in both good and bad economic times. Public Storage has had success in continuing to pass along 8% to 10% rent increases to its existing tenant base, while categorizing its long-term tenants as sticky. Ultimate Stock-Picker

“Public Storage is the country’s largest owner of self-storage facilities. While the industry isn’t glamorous, self-storage properties generate attractive returns on capital and resilient cash flows. After hitting an all-time high of $276 in April 2016, the stock fell below $215 during the quarter. This is when we established our position. The stock dropped because new supply in several markets caused occupancy rates to fall and rent increases to slow. Despite this short-term weakness, the company’s long-term prospects are still bright. Public Storage has significant exposure to fast-growing and supply-constrained markets like Los Angeles, San Francisco and Seattle. And very importantly from a risk perspective, the company employs much less debt than other real estate companies.”

Morningstar analyst Brad Schwer covers the name, and while Public Storage's switching costs are well below his threshold to earn an economic moat rating, he maintains that the business model behind the firm's rent increases is lucrative for investors and should continue to boost returns. While not a pound-the-table bargain in Schwer's view, he does see the company as possessing significant data collection advantages over its mom-and-pop competitors in the fragmented storage industry. Schwer believes these data collection abilities should help Public Storage continue to fine-tune its rent increase strategy. These rent increases in supply-constrained markets, Schwer adds, should continue to drive growth for the firm in the next several years.

Schwer agrees with the fund managers at Parnassus' assessment that in the interim, pricing power has taken a hit as several markets have recently experienced a downturn. These include Denver, given large supply inflows, as well as Houston, whose oil-driven economy has struggled in recent years. In spite of these short-term headwinds, occupancy rates recently fell in line with Schwer's estimate of 94% by the end of 2018, prompting him to reaffirm his fair value estimate. Schwer specifically points to growth in supply-constrained markets like San Francisco and Los Angeles as bright spots for the firm and in support of his thesis. Occupancy rates in these markets have reached 96%-plus. Schwer points out that these two markets were coming off 2016 same-store growth numbers in the mid-7s, so he still views second-quarter figures of 3.6% and 5.7%, respectively, favorably. Furthermore, these markets benefit from both restrictive zoning laws and high-priced land, discouraging new entrants. Finally, like the fund managers at Parnassus, Schwer concurs in the assessment that Public Storage's balance sheet has long been the "gold standard" among REITs, which have historically been highly levereagd vehicles for owning real estate. The company is light on debt and heavy on progressively cheaper preferred stock, with a good portion of acquisitions and facility developments fueled directly with cash flow from operations.

Turning to our list of new-money purchases, the only firm we have left to highlight is narrow-moat Sabre. The stock currently trades at 67 cents on the dollar according our analyst's fair value estimate. Travel technology companies have recently taken a hit in the stock market, and Morningstar analyst Dan Wasiolek currently sees long-term opportunities in a couple of names in the space. Sabre specifically operates two distinct businesses in the structurally attractive travel market. First, the travel network segment, which is a leading global distribution system, or GDS, for travel suppliers, and second, airline hospitality, which is a leading software supplier to air carriers and hotels. Ultimate Stock-Picker

“The global travel market is notable for its massive fragmentation of service providers and customers, both leisure and business, and the high opportunity costs of unsold inventory. As such, we believe there is a durable and growing opportunity set for companies like Sabre that provide transactional intermediation and marketing optimization to improve outcomes for both the suppliers and users.

“Sabre is a GDS industry market leader in the Americas and Asia and holds strong market positions in key travel software categories. The company has a loyal customer base with very high retention rates and a substantial mix of recurring revenue, and we believe it possesses important competitive advantages including positive network effects in GDS and multiple forms of switching costs in both businesses.

"Given our view that the global travel industry is likely to be a ‘GDP plus’ grower on a steady-state basis for many years, we foresee attractive revenue growth potential for Sabre. Further, with the operating leverage inherent in its volume-driven business, we believe the company can generate attractive free cash flow growth and returns on capital over the long term. In the stock’s price range where we made our purchases, our valuation work suggests fairly low embedded growth expectations and a substantive discount to our estimated intrinsic value per share.”

Dan Wasiolek has similar viewpoints and expects Sabre's GDS market share to increase slightly over the next several years, aided by expansion into new markets, the 2015 acquisition of Asia-Pacific GDS company Abacus, and a growing presence in technology services for travel suppliers and agents. Wasiolek sees the company's share of GDS bookings among the top three operators reaching between 32% and 33% by the start of the next decade. Wasiolek also believes that the company's technology share of passenger boardings will reach the mid-20s in 2021 from a low-20s percentage in 2016.

As for its competitive positioning, Wasiolek agrees with BBH's assessment that Sabre's narrow moat is predominantly driven by a network effect in its core GDS business, which constitutes 70% of its 2016 revenue. Wasiolek believes that this network advantage is strengthened by Sabre's continued expansion into IT solution markets, a business that constitutes 30% of the company's 2016 revenue. He thinks that this expansion serves to further integrate the connection that supplier and travel agent customers have with the company's GDS platform. Like BBH, Wasiolek believes that the IT solutions business also provides the overall firm with a secondary switching cost advantage, as contract lengths are five to 10 years. Furthering the switching cost argument, Wasiolek adds that IT implementation takes over a year, with high costs, and that renewal rates in that business are comfortably over 90%. In addition, Wasiolek also sees efficient scale as a third moat source benefiting the firm's core distribution business. He argues that this is the case because three players control the entire market, and high technology costs are needed to replicate GDS networks in what he sees as a business with returns on invested capital in the mid-teens.

Finally, from a growth perspective, Wasiolek sees attractive revenue growth potential for Sabre. The network and airline hospitality revenue growth rates Wasiolek models for Sabre are above the 2.2% and 4.8% annual industry GDS and airline traffic growth Morningstar models over the next decade, driven by new technology products that lead to increasing integration with its GDS platform, as well as greater market penetration into underrepresented regions.

Disclosure: As of the publication of this article, Joshua Aguilar has a position in Berkshire Hathaway, while Eric Compton has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)