Can Nuclear Power Fit in a Sustainable Portfolio?

Nuclear operators in the U.S. have strong safety records and help utilities lower their carbon emissions, but the risk of a catastrophic accident remains.

Most discussion of how utilities generate electricity revolves around fossil fuels and renewables. Nuclear power, it often seems, is the odd source out. Yet nuclear remains a key component of the electricity generation mix in the United States, powering about 20% of it.

Investors traditionally have viewed nuclear power in largely black-and-white terms. It remains a commonly used exclusion among intentional environmental, social, and governance funds. But short of excluding utilities that use nuclear power, how should investors view a utility's nuclear exposure, particularly against the backdrop of climate change? That's the topic of research recently completed by Morningstar utilities analysts and Sustainalytics.

The research argues that nuclear energy's main advantage relative to other sources of electricity is its ultralow carbon intensity, comparable to that of renewables and, perhaps this will come as a surprise to some, its safety record. On the other hand, nuclear energy has clear--and familiar--disadvantages, including the threat of deadly radiation exposure that could come if a major accident were ever to occur, the lack of a long-term storage solution for radioactive waste, and intensive water usage. Against that backdrop, investors evaluating utilities with nuclear exposure should consider their carbon intensity, their waste-management policies and procedures, and their operational safety record.

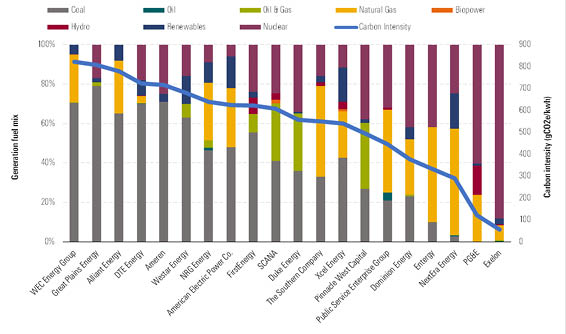

Nuclear power's low-carbon-emissions profile makes it a key contributor to meeting emissions-reduction goals, both for individual utilities and for the U.S. as a whole. Utilities with a higher proportion of nuclear in their energy generation mix have lower overall carbon emissions. Utilities with lower nuclear exposure, or none at all, must rely more on coal and natural gas for baseload power generation, resulting in higher emissions. Building more nuclear power plants is neither financially nor politically viable, but maintaining existing nuclear output is helping keep utilities on track to meet their portion of the emissions-reduction targets in the Paris Agreement. The main way for all utilities to lower their emissions is to reduce reliance on coal and substitute natural gas and renewables, but those with nuclear exposure start from a lower base. That puts them in a better position to meet tighter emissions standards and rising investor expectations for improved carbon performance, both of which are givens in the U.S. in the long run.

Generation Mix and Carbon Intensity of U.S. Utilities

Source: Sustainalytics.

That said, waste management poses significant risks for nuclear operators, a result of the political failure to decide on a long-term solution for spent nuclear fuel. That leaves nuclear operators to store increasing amounts of spent fuel on site, in addition to managing their lower-level radioactive waste. While nuclear operators have a strong safety record, a storage breach could be disastrous in terms of both its actual and reputational impact. Even if an incident turned out to have minimal actual impact, it would likely have significant reputational impact on both the utility and the industry overall.

Investors can differentiate utilities with nuclear exposure by evaluating their waste-management practices. Sustainalytics data shows that some U.S. utilities are better prepared than others to manage environmental risks associated with waste management.

The research suggests that the operational safety and security of nuclear power plants in the U.S. are far better than generally believed, given the headlines generated by the three nuclear reactor accidents that have occurred globally since 1979. Coal, natural gas, and even hydroelectric have had much higher employee fatality rates than nuclear. According to Sustainalytics' tracking of operational incidents, there have been 56 low-risk incidents over the past three years among the 20 utilities evaluated, but none rose to the level of a serious incident. Entergy, however, was responsible for 23 of those low-risk incidents, or 41% of the total.

In sum, the advantages of nuclear power include its contribution to lower emissions and its overall safety record. Nuclear power's disadvantages include the still-unsolved long-term radioactive waste storage issue, radiation exposure that could result from a serious operational accident, and heavy use of water. For some investors, these material risks outweigh an investment in utilities with nuclear exposure. But investors who don't exclude nuclear exposure altogether can use several metrics--carbon emissions, waste management, and operational safety records--to differentiate among utilities that use nuclear power.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)