10 Funds That Are Better Than They Look

These funds could be well positioned to outperform when growth stocks take a back seat to steadier fare.

The past three years have rewarded risk-taking. The Morningstar US Growth Index is up 18% for the year to date through Aug. 14, outpacing the Morningstar US Core Index by 6 percentage points and leaving the Morningstar US Value Index more than 14 percentage points behind. (Morningstar US Style Indexes divide the Morningstar US Market Index into smaller subsets based on their market capitalization and/or style orientation scores.)

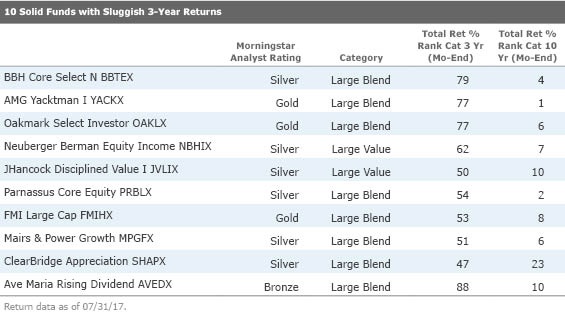

Not surprisingly, funds that ply more conservative strategies have lagged of late. In fact, many solid funds that our analysts rate highly don't look all that impressive over a three-year period. Some of these middling three-year performers deserve a second look, though.

To find some short-term laggards that might be poised to ourperform their category peers if market sentiment turns from risky to safer fare, I employed Morningstar Direct software. First, I screened for funds in the large-cap categories that earned medalist ratings. Then I ranked that subset by their three-year rank in category to find funds that were in the bottom half of their respective categories.

I ranked that subset of funds by their 10-year rank in category. The 10-year period includes the market whipsaw in 2008 and 2009, which can be a helpful lens through which to view a fund's performance in volatile markets. All the funds listed below have a top-quartile return over the 10-year period. But I also looked for funds whose return landed near their category's top quartile during 2008, when the S&P 500 Index lost 37%.

I included some additional criteria to get a fuller picture of each fund, considering the funds' Sharpe ratios, Morningstar Risk scores, standard deviations, and downside capture ratios over different trailing periods. Though not all funds on the list were category-beaters as measured by all of these metrics, many of them were standouts according to multiple criteria.

Here are some funds that made the cut, as well as excerpts from a few of the funds' analyst reports.

The past few years have not been easy ones for BBH Core Select, but it remains an excellent fund, says senior analyst David Kathman. The fund trailed both the large-blend Morningstar Category and the S&P 500 benchmark each year from 2013 through 2015, and it also trailed the category and the benchmark through the first 10 months of 2016. Yet it has been one of the top-performing funds in its peer group since lead manager Tim Hartch took over in 2005. Harch's disciplined strategy, which emphases profitable cash generators with strong balance sheets, has excelled in a variety of market environments and has done so with far less volatility than its average peer, Kathman said.

Big bets on financials and some energy stocks have dimmed returns here in recent years, but Oakmark Select's proven management, disciplined and often contrarian approach, and excellent long-term results still earn the fund a Morningstar Analyst Rating of Gold, says senior analyst Greg Carlson. Owing to this fund's concentrated portfolio of roughly 20 stocks, this fund is subject to wide performance swings; it doesn't score as well as other funds on the list in terms of volatility measures. But patient investors have been well-rewarded: The fund beat all of its large-blend peers on both a total-return and risk-adjusted basis since its November 1996 inception, Carlson said.

Parnassus Core Equity, which follows a socially conscious or ESG (environmental, social, governance) mandate, has lagged lately owning to Todd Ahlsten's quality focus. But the focus on quality is also what helped the fund keep a lid on losses in 2008, when it outperformed the S&P 500 and the large-blend Morningstar Category by more than 14 percentage points. And the fund has been a superior long-term performer: Since Ahlsten began managing it in May 2001, its returns have been among the best in the category and have trounced the S&P 500. These returns have been remarkably steady, beating the category in eight of the past 10 calendar years with much less volatility than the average large-blend fund, Kathman said.

An earlier version of this article stated that Ave Maria Rising Dividend had a Morningstar Analyst Rating of Gold; the fund is actually rated Bronze.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)