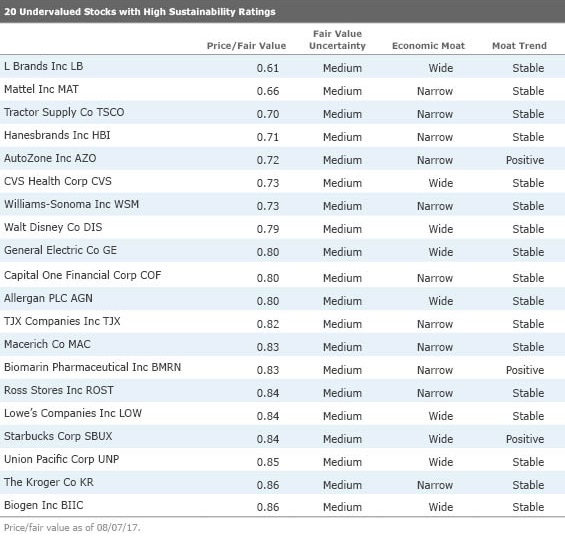

20 Undervalued, Sustainable Stocks

These stocks are positioned to outperform their peers, and they also score well on environmental, social, and governance metrics.

When some people hear "sustainable" or "ESG" (environmental, social, and governance) used in an investing context, they groan.

"Investing for me has little to do with values--it's about maximizing returns," these investors contend.

It's true that originally, socially responsible investing was more about investors trying to align their investments with their values by excluding companies from investment mandates. But sustainable investing now is more about considering relevant nonfinancial factors in the search for alpha, says Jon Hale, head of sustainability research for Morningstar.

And regardless of whether ESG factors align with your ideas of social responsibility, there are reasons to believe that stocks that score highly on such metrics are well positioned. For instance, a company's controversy score takes into consideration events that would be expensive to address and could cause reputational damage, such as customer privacy and data breaches and product safety concerns. Such headlines would undoubtedly have a negative impact on a company's stock price.

Likewise, poor corporate governance is a material financial risk factor. Companies that achieve high governance scores have management teams that look out for the long-term interests of their shareholders. Its board acts with integrity and is able to execute on its business strategy, remuneration is fair, and financial reporting is clear and detailed.

Efforts to reduce environmental impact often help companies save money. Corporate initiatives such as going paperless and reducing waste, and seeking ways to lower utility bills at facilities such as insulating and using renewable energy sources are all ways companies can reduce costs over the long run.

We screened the Morningstar US Sustainability Index to find some undervalued stocks that score well on ESG metrics. Sustainability assessments are provided to Morningstar by researcher Sustainalytics (of which Morningstar has a 40% ownership stake). Sustainalytics assigns ESG scores on 7,500 companies and controversy scores on 14,000 companies. Like Morningstar equity analysts, Sustainalytics considers both qualitative and quantitative inputs in its security-level research. Sustainalytics assesses 60 to 80 ESG indicators; companies that score the highest when measured by these rigorous criteria are added to the Morningstar Sustainability indexes.

We sorted through the US Sustainability index for companies with wide or narrow economic moats, meaning we think they have advantages that will allow them to fend off competitors and remain profitable for at least a decade. We also insisted the stocks carry fair value uncertainty ratings of at least medium, ensuring that we zeroed in on companies whose fair value estimates our analysts were most confident in. Here are the 20 cheapest stocks turned up by our screen.

Learn more about Morningstar’s approach to ESG investing.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)