July Fund Analyst Ratings Stay the Course

A handful of upgrades and downgrades during the month.

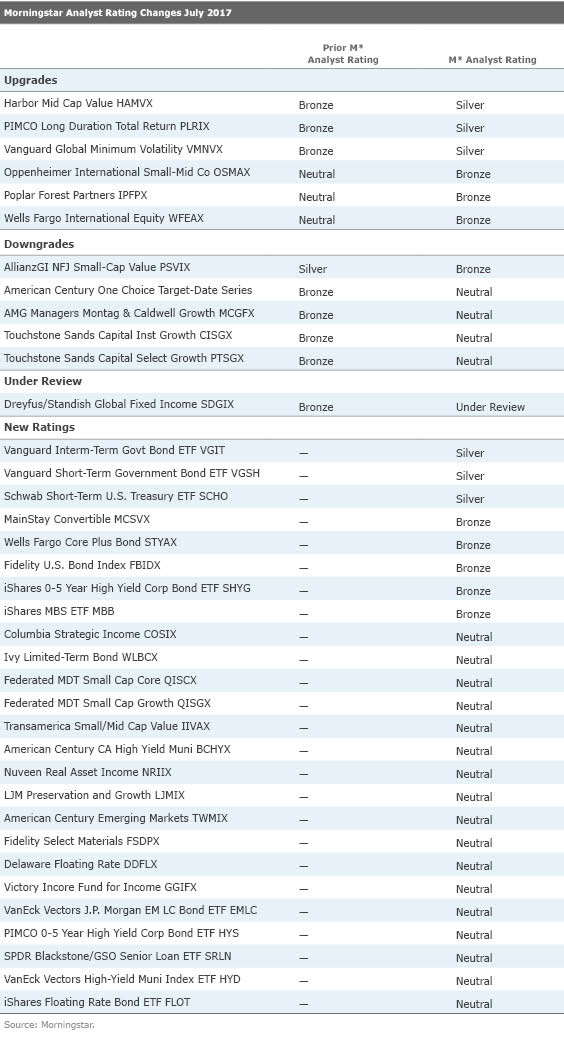

In July, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 71 funds, upgraded the ratings of six funds, downgraded the ratings of four funds and one target-date series, placed one fund under review, and assigned new ratings to 25 funds. Below are some of July's highlights, followed by the full list of ratings changes.

Upgrades

The fund's longtime manager, Steve Rodosky, took a brief leave of absence in 2016, and PIMCO prudently added Mike Cudzil and Mohit Mittal as comanagers. Rodosky has taken on leadership responsibilities across the firm since his return, and Cudzil, who specializes in long-duration portfolios and leads a PIMCO liability-driven investment team, handles the day-to-day duties here.

The fund is built for institutional investors looking to match long-term liabilities and relies on a mix of macro calls and bottom-up analysis, a PIMCO hallmark. Despite the fund's elevated volatility levels, which are higher than long-term bond peers, the fund has edged its Bloomberg Barclays Long-Term Government/Credit Index benchmark since its inception and during Rodosky's roughly 10-year tenure.

The fund's managers, members of Vanguard's Quantitative Equity Group, rely on a quantitative model to scan the FTSE Global All-Cap Index and then construct a low-volatility portfolio, all while limiting tilts toward individual countries, sectors, and stocks. Diversified across more than 350 stock holdings, the fund hedges its currency risk to mitigate uncompensated volatility over longer periods of time.

As expected, the fund's volatility has been among the lowest in its world small/mid-stock Morningstar Category over the past three years, and it has posted strong absolute and risk-adjusted returns. Currency hedging has helped as the U.S. dollar has strengthened in recent years, but its defensive strategy will likely cause it to lag peers in a strong bull market.

Downgrades

Sands is a true growth investor, willing to pay above-average price multiples for industry-leading firms with competitive advantages. This has often led the strategy to take big positions in technology stalwarts such as

Taking on such significant risks has helped the funds beat the benchmark on an annualized basis since inception, but risk-adjusted performance metrics have fallen short. Despite posting strong gains for the year to date through July, the funds' risk profiles are heightened this far into a growth-led bull market.

New Ratings

/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)