Are Strategic-Beta Bond Funds Smart Enough to Protect You in Market Crashes?

Don't count on it.

Strategic-beta fixed-income funds are often marketed as a better way to invest than market-cap-weighted indexing. Among many features, these newer products typically emphasize their ability to manage risk better than their cap-weighted counterparts.

This article compares the drawdowns of three popular strategic-beta fixed-income funds and replicating portfolios of traditional index funds during three recent acute stress periods. The strategic-beta funds outperformed on only one of the three occasions.

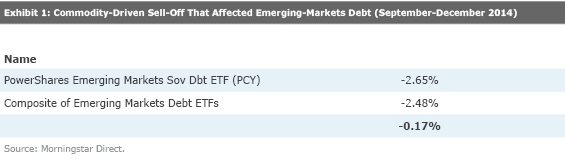

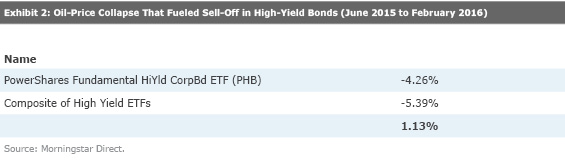

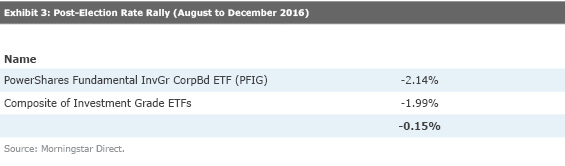

In the past three years, there were three distinct bond-market stress periods, defined as a spread movement of 100 basis points or more in less than a year. They include the commodity-driven sell-off that affected emerging-markets debt (from September 2014 to December 2014), the oil-price collapse that fueled a sell-off in high-yield bonds (from June 2015 to February 2016), and the post-election rate rally (from August 2016 to December 2016).

Commodity-Driven Sell-Off That Affected Emerging-Markets Debts

On the surface, the equal-weighted portfolio appears to be more diversified than a simple market-cap-weighted portfolio. But many issuers and countries share common risk factors, so equal-weighting may not actually better-diversify underlying risk factors, like commodity and energy prices, economic risk, and interest rates. For example, as of August 2014 the fund invested in 24 countries, eight of which were natural-resources-dependent Latin American countries. Consequently, during the latest commodity price-driven emerging-markets rout from September 2014 to December 2014, the fund underperformed a replicating portfolio of market-cap-weighted exchange-traded funds. Further, the opacity in the country selection process introduces uncertainty because it is difficult to anticipate how the portfolio will evolve over time.

Oil-Price Collapse That Fueled Sell-Off in High-Yield Bonds

One of the most frequently mentioned potential flaws of cap-weighted bond indexing is that debt issuance dictates index composition. As a result, a portfolio is skewed toward the most debt-laden entities that might not offer the best risk-adjusted return. To address the aforementioned concerns regarding cap-weighting in bonds,

Going into June 2015, neither PHB nor the replicating portfolio of cap-weighted high-yield ETFs had disproportionately large exposure to energy companies. Nevertheless, the fund outperformed the replicating portfolio by more than a full percentage point during the energy-driven high-yield sell-off. As of May 2015, this fund had large holdings of finance and consumer companies, while the replicating portfolio was filled with telecom companies that were actively issuing merger-and-acquisition-related debt. These companies were highly leveraged, and because they were the largest issuers, they dominated the replicating cap-weighted portfolio. So, these debts were more vulnerable to sell-offs during the risk-off environments that played out from June 2015 to February 2016.

Though the fund fully deserves credit for preserving its capital, it isn’t clear whether the fund’s security selection criteria led to this outperformance. It could have been simply that the relatively more conservative credit risk-profile contributed to the success given the portfolio’s exclusion of bonds rated below CCC and the stake in investment-grade bonds. To put this in perspective, during the same period, an investment-grade ETF,

Post-Election Rate Rally

Defaults of investment-grade debt have been muted. Thus, the duration risk has become a principal driver of investment-grade instruments. While the fund goes through accounting data to find bonds, it does not emphasize bond duration in its construction process. If the most attractive bonds selected through the proprietary scoring system have long maturities, they are likely to lengthen the portfolio’s duration. In fact, going into August 2016, PFIG’s duration was longer than the replicating portfolio, taking on more rate risk. Accordingly, when rates moved upward significantly, the fund suffered a larger drawdown than the replicating portfolio.

By moving away from the most active debt-issuing entities, the fund might have been able to reduce credit risk. However, the fund trades interest-rate risk for credit risk.

Repackaging Risk While strategic-beta funds may employ complex portfolio construction techniques, at the end of the day, they effectively repackage traditional risk factors, such as credit, duration, and country. These products aren't necessarily better or worse than market-cap-weighted alternatives; they simply reside on a different part of the risk/reward spectrum. Accordingly, they will respond to stress periods in a manner consistent with their risk exposures, which investors could largely replicate with market-cap-weighted funds.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)