Which Funds Are Gaining and Losing Favor in Six Charts

We look at the organic growth rate trends of funds and fund companies.

The massive size of the U.S. fund industry means that while asset flows measured in dollars tell much of the story, some of the nuances can get buried. That’s why organic growth rates - which measure net new flows against assets under management - can be another helpful lens for capturing investment trends.

That’s especially the case for spotting mid-sized and smaller fund companies, or individual funds, that are either gaining favor among investors or losing favor.

Organic growth rates also lay out starkly the significant headwinds being faced by fund companies whose focus is on actively-managed strategies.

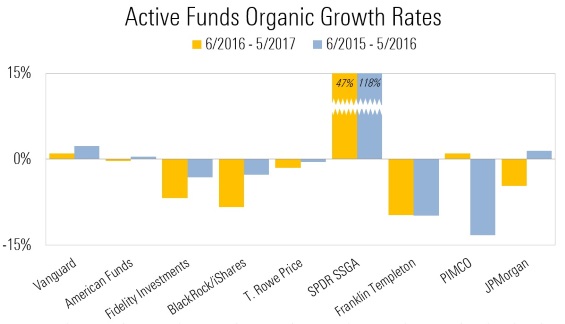

The following chart looks at the organic growth rates among the top ten fund managers. Six of the nine families with active strategies are posting negative organic growth rates for the past twelve months, ranging from -0.3% for American Funds to -9.8% for Franklin Templeton. While the overall story isn’t new, the flow data shows the situation worsening for many companies from the twelve months ended May 2016.

Among the exceptions is Pimco, which has seen a marked change in fortunes as its actively-managed bond funds have seen investors return following the management upheaval that followed Bill Gross’ departure in September 2014. Pimco went from a -13.2% growth rate for the year ended May 2016 to 1.0% for the past year.

SPDR State Street Global Advisors stands out with some outsized percentage gains, but in a way, it’s not great news for the traditional active management industry. The firm’s growth rate of 47% for the last twelve months and 118% for the prior twelve months all comes from gains in Jeff Gundlach’s SPDR® DoubleLine Total Return Tactical ETF- an active ETF.

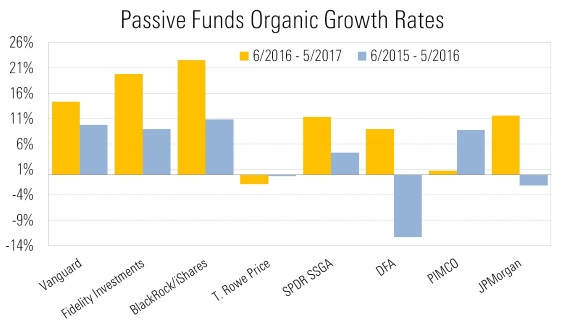

On the passive side, however, it’s pretty much good news across the board.

One note on the passive data for the largest fund companies, Franklin Templeton clocks in at a mega 456.2% growth rate for the last twelve months, but that’s off a very small base. Franklin had passive assets under management of $103 million as of June 2016 and saw subsequent net inflows of $471 million.

Widening the lens, the organic flow rate data tilts away from the usual suspects.

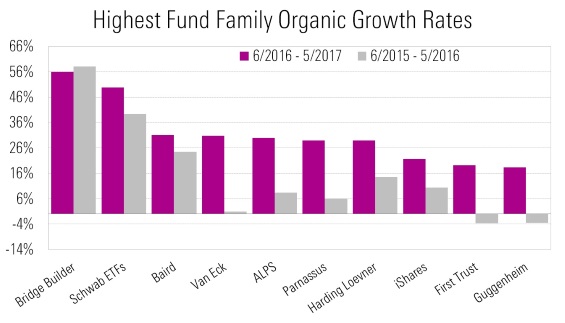

First, here’s a look at the fastest organic growth rates among the 100 largest fund families.

While this table shows more evidence of the popularity of exchange-traded products, the leader of the pack is something of a throwback for the fund industry: Bridge Builder.

Edward Jones’ Bridge Builder fund family enjoyed the highest trailing-12-month organic growth rate. The Bridge Builder funds are intended to be used exclusively in fee-based advisory accounts (available to all Edward Jones financial advisors), a strategy which spurred the recent growth.

Schwab, meanwhile, has continued to gain market share because of its low-cost ETF line-up and an efficient distribution system, which offers free trading to Schwab account holders.

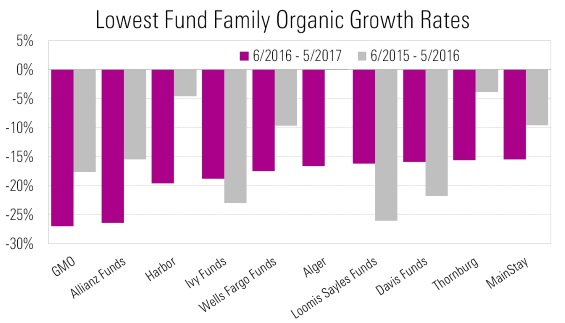

But at the bottom of the list, the active vs. passive story comes back to the forefront. While there are some specific performance issues at work, across the board, those with the worst growth rates among the 100 largest funds are mid-sized and smaller active-managers.

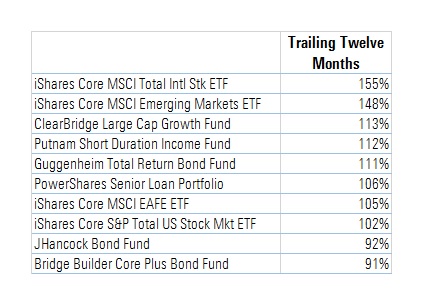

Lastly, a look at trends among individual funds. First, funds with the highest organic growth rates among the 500 largest funds. While a number of ETFs make the list, investors are also showing stepped interest in a number of bond funds.

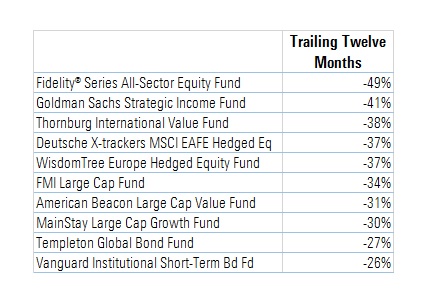

And at the bottom end of the scale, it’s more of a mixed picture.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)