Venture Capital: A Good Investment If You Can Get It

The problem is getting it.

A Clearer View The performance of venture-capital funds, which invest in companies that are not yet publicly traded, is notoriously difficult to measure.

As with hedge funds, venture-capital funds do not register under the Investment Act of 1940, meaning that they file only limited information with federal agencies. If the sponsor of a venture-capital fund does not wish for its returns to be seen, chances are the fund's returns will not be seen.

What's more, whereas hedge funds at least can mark their assets to market prices (for the most part), venture-capital funds cannot. The value of their holdings can only be estimated until its companies issue public shares (or they are bought by another firm). Complicating matters, those actions are spread across many years, so the funds are constantly receiving new information about their asset values and updating their results accordingly.

A 2016 paper, "How Do Private Equity Investments Perform Compared to Public Equity?" (by Robert Harris, Tim Jenkinson, and Steven Kaplan; published in Journal of Investment Management) gives the best attempt yet at solving the performance question. The authors gained access to an unusually thorough database, which helped their paper win that year's Harry M. Markowitz Award, an honor that is determined by the votes of four Nobel laureates. If not the last word on the subject, the article certainly rates as the current best word.

(The authors' paper evaluates both venture-capital funds, which invest in startup companies, and buyout funds, which take existing publicly traded firms private. This column looks only at the former, although most of the comments also apply to the latter.)

Vintage Rankings The word is quite favorable indeed.

Because venture-capital funds, unlike mutual funds or investment indexes, have finite lives--they are born when they raise assets and expire when they cash out their final holding--and cannot be priced accurately until their lives are over, the authors couldn't generate average monthly and annual total return figures as one would do for mutual funds. Instead, they calculate average "vintage" returns: the lifetime performances of venture-capital funds that were founded in a given year.

The authors' calculations begin in 1984. For the 24 venture-capital funds in their database that began operations in 1984, the median lifetime total return was 6.3%, expressed in annualized terms. The average lifetime return was higher, at 7.3% annually. That the average exceeded the median indicates that that the return distribution for the funds was skewed to the right, meaning (in very loose terms) that the very best funds were better than the very worst funds were bad.

The weighted average was higher yet, at 7.7%. That is, when taking into consideration each venture-capital fund's size, so that the larger funds count for proportionately more than the smaller funds, the reported results improve. This is the opposite of what one often assumes of risky investments: that the smaller nimble funds post the biggest gains. It also represents good news for venture-capital investors, as their dollars tended to go into the strongest funds.

(These patterns persist across time. Throughout the data tables, the unweighted average return for venture-capital funds beats the median return, and the asset-weighted average is higher yet--sometimes, much higher.)

At first glance, 6.3% as the conservative estimate and 7.7% as the most liberal measure aren't overwhelming. Over time, publicly traded U.S. stocks have gained about 10% annually. Why commit money to funds that won't return those assets for a decade and that have little transparency and only infrequent pricing, to gain less than what an index mutual fund can accomplish?

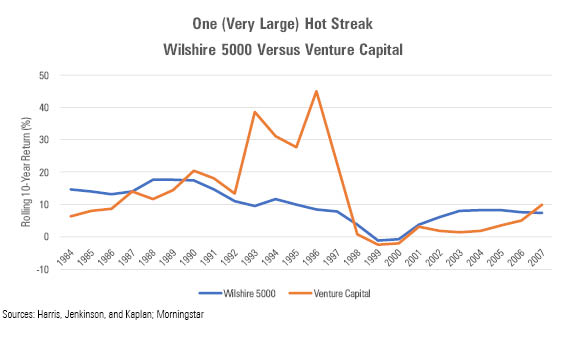

That's where the concept of vintage comes in. The proper comparison for the venture-capital class of 1984 is the stock-index class of 1984, not stock-index totals from different eras. We can set the two investments on the same footing by running a series of rolling performance calculations. The first begins on July 1, 1984 (the year's midpoint, a reasonable estimate for the typical starting date) and ends on June 30, 1994 (a decade being roughly the average life of venture-capital funds). The next rolling period starts in 1985 and ends in 1995, and so forth, until finishing with the period that runs from summer 2007 to summer 2017.

(As not all of the more recently launched venture-capital funds have completed their operations, the paper's authors engaged in some fancy footwork to estimate the results; while that process introduces some errors, those inaccuracies should not affect the general conclusions.)

Great on Occasion For the venture-capital totals, I used the lowest of the three possible calculations, the median. For the index totals, I chose the broadest of the U.S. stock benchmarks, the Wilshire 5000 Index. The results are shown below.

Publicly traded stocks were more persistent. The Wilshire 5000 Index outlegged the venture-capital vintages during the 1980s and again for most of the 2000s. However, when venture capital succeeded, it really succeeded, racking up huge gains during the mid-1990s: a five-year stretch of vintage medians that appreciated by 39% annualized, then 31%, then 28%, then 45%, then 23%. (Remember, those aren't one-year totals--they are average results across a decade. That 45% annualized gain translates to a cumulative 4000%. Gulp.)

The temptation is to regard those few extraordinary years as being anomalies, point to the other years as being typical, and write venture capital off as an illiquid and expensive way to get exposure to U.S. stocks. However, I view the matter differently. It seems to me that there is a cycle. Venture capital becomes too popular, gets overbought, and performs poorly for several years; investors become jaded and look elsewhere; flows into venture-capital funds dry up; what funds remain then enjoy great opportunities and post high returns; venture capital becomes popular again; and the cycle repeats.

The authors suggest that is indeed what occurs, as they find a statistically significant relationship between venture-capital fund sales and future performances. The higher the sales, as a general rule, the weaker the expected returns. (For example, there were 23 funds founded in 1996, when the vintage scored that record amount of 45%, but 88 and 109 funds founded in 1999 and 2000--the two vintages that lost money during their lifetimes.)

Targeting Target-Date Funds Thus, venture capital would seem to be an excellent portfolio addition to a younger person's 401(k), or any other investment account that has a very long-term horizon and that won't be touched for decades. That can't happen now because of regulations that prevent unregistered funds from being sold to everyday investors. Which is fine; even if the laws permitted such a thing, it would be dangerous for most investors to dabble directly in venture capital. They would likely land on the wrong part of the cycle, by buying high and selling low.

However, registered mutual funds are permitted to invest a minority of their assets into unregistered securities. It seems to me that the longer-dated target-date funds, to name one example, could benefit from holding venture-capital funds. That would give those mutual funds problems with daily pricing--perhaps some of the existing regulations would need to be tweaked accordingly--but, I think, the rewards would compensate.

Venture-capital funds' success illustrates that institutional investors enjoy some advantages over retail buyers--advantages that accrue not to being wiser, or more disciplined, but simply the availability of investments that retail buyers are not permitted to own. The giant mutual funds, however, are also institutional investors of a sort (and sometimes, very large ones indeed). They can do what their shareholders cannot.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)