10 High-Quality Stocks That Play Defense

We sifted through our consumer defensive coverage list for sturdy, competitively advantaged bargains.

The Morningstar Global Markets Index has gained 18.2% for the trailing one-year period through July 17. While stock investors have certainly enjoyed the overall gains, not all sectors of the global market have been equally buoyant.

While the Morningstar Global Technology and the Global Financial Services indexes are up more than 30% each, other global sectors such as energy and real estate have been comparatively sleepy, gaining only 1% and 4%, respectively.

This sector caught my eye on the list of laggards: The Morningstar Global Consumer Defensive Index has gained only 4.7% over the past year. This piqued my interest, because many (though certainly not all) consumer defensives are sturdy stocks with stable earnings, some of which pay healthy dividends. Consumer defensive stocks can add some stability to a portfolio, as they tend to hold up relatively well during downturns while also participating in rising markets. For example, in 2008, there weren't too many places to hide, but as the broader Global Markets index lost a savage 41.7%, the Global Consumer Defensive index lost 23.7%--still bad but not as brutal. This sector tends to get ahead by losing less: Over the 10-year period, the Global Consumer Defensive Index's 10% annualized return is right in line with the Global Markets Index's 10.7% per-year gain.

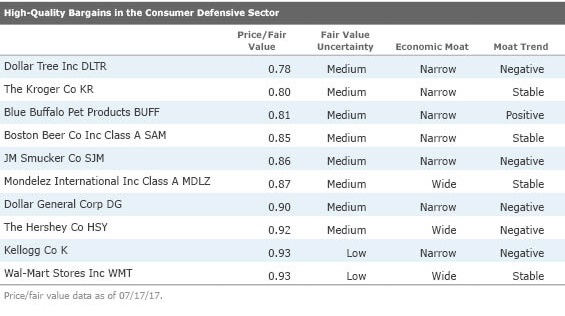

The sector's relatively sleepy return over the past year led me to wonder if there are any high-quality bargains there. To find competitively advantaged stocks in the sector, I screened all the stocks in the Morningstar Global Consumer Defensive Index and included only companies in each sector that Morningstar analysts have assigned wide or narrow economic moats, which means our analysts think they have structural advantages that will allow them fend off competitors and remain profitable for at least a decade.

I sorted through the remaining stocks to find those trading at the largest discounts to Morningstar analysts' fair value estimates. (I also weeded out any stocks that aren't available to U.S. investors.) These 10 stocks passed the screen. Below are some highlights from our research reports on three of the companies.

Blue Buffalo Pet Products

BUFF

Some people have adopted healthier eating habits, and they have followed suit when feeding their pets. Increasingly, pet owners have sought premium pet foods that mirror trends in human categories, particularly those favoring natural, clean-label, high-protein, and snack items. Blue Buffalo has benefited, with an all-natural lineup that constitutes about one third of subcategory sales. Equity analyst Zain Akbari says the premium subcategory is far more conducive to the development of durable brand intangible assets, which have given Blue Buffalo a competitive advantage. Owners hesitate to switch from a food that is well tolerated by their pet, Akbari said, and they are reluctant to cut pet spending in times of economic stress (he notes that no significant trade-down occurred during the 2008-09 recession).

JM Smucker

SJM

We believe Smucker's strong brand portfolio across its three U.S. retail operating segments (coffee, pet foods, and consumer foods) has given the firm a narrow economic moat. Akbari says Smucker faces competition from customers' increasing preference for the fresh items in the grocery store. However, with a presence in on-trend categories like peanut butter, premium at-home coffee, and premium pet food and snacks, Smucker has offset category erosion in some of its legacy businesses. Its sought-after brands and record as a proven supplier make it a valued partner for retailers, providing a platform for distributing new, on-trend products, Akbari said.

Mondelez International

MDLZ

Mondelez's share price has come under pressure over the past month. Sector head Erin Lash attributes a portion of this pressure to concerns surrounding the competitive landscape, particularly after

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)