Newly Public Schneider Emerges as a High-Quality Transport

Its truckload division isn’t in the fast lane to a moat, but the network effect delivers for intermodal and logistics.

Schneider completed its initial public offering in April, though it’s been in operation for more than 80 years. Before its IPO, Schneider was a quiet company with limited public disclosure surrounding its logistics operations. However, it’s become evident to us that the company is a high-quality, well-diversified truckload carrier with sufficient scale and a solid competitive foothold in the intermodal and truck brokerage marketplaces.

We think all three of the company’s divisions are positioned to benefit from a likely tightening in truckload industry capacity in the year ahead, which we expect due to freight demand growth and widespread adoption of electronic logging devices among small carriers.

Schneider’s trucking and logistics operations overlap with a wide swath of transports. In asset-based truckload shipping, a handful of top-tier peers include Knight Transportation KNX, Heartland Express HTLD, Swift Transportation SWFT, and Werner Enterprises WERN. In intermodal, Schneider primarily competes with the intermodal divisions of J.B. Hunt JBHT, Hub Group HUBG, XPO Logistics XPO, and Swift. In highway brokerage, it dwells among the largest providers in a landscape that includes non-asset-based leaders C.H. Robinson CHRW, Landstar LSTR, and Echo Global Logistics ECHO. In our view, this is no small accomplishment considering that in an industry with thousands of providers, only around 30 brokers post more than $200 million in gross revenue. There are differences, but when looking at the company’s broad exposure to trucking, intermodal and logistics, we see Schneider as most comparable to J.B. Hunt and Knight-Swift (Knight and Swift recently struck a deal to merge by the third quarter). J.B. Hunt’s intermodal unit has become its flagship business at about 60% of revenue, versus 20% for Schneider. However, like Schneider, it’s also a leader in the for-hire and dedicated-truckload markets and has expanded meaningfully into asset-light truck brokerage. Following its acquisition of dedicated-truckload carrier Estenson, Hub Group’s service mix looks slightly more like Schneider’s, though the scope of Hub’s pure-play truckload operations is still limited (outside intermodal drayage). Because of its sizable intermodal and brokerage operations, XPO Logistics appears on the radar screen as well, though it plays in the North American less-than-truckload niche and now runs a large European contract logistics business. In contrast to Schneider and Hunt, Hub was founded on intermodal (not trucking), and XPO was a non-asset highway brokerage rollup story before branching out into other transportation sectors.

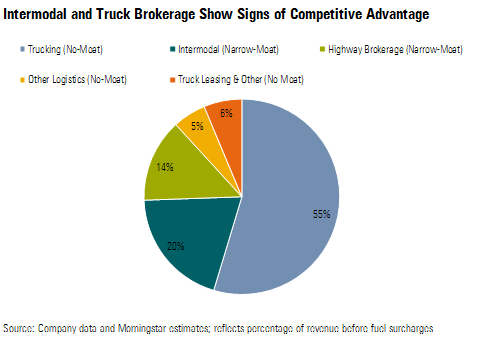

Although well run and comprehensive in scope, Schneider’s flagship asset-based trucking businesses do not bestow a sustainable competitive edge. Thus, we don’t think Schneider (as a whole) has carved out an economic moat. On the other hand, we think the company’s intermodal and asset-light highway brokerage segments (one third of revenue combined) benefit from the network effect, given the broad scope of the company’s shipper and carrier relationships. Despite the lack of an economic moat in trucking and a limited history as a public entity, Schneider appears to be a high-quality, solidly profitable transport, and we wouldn’t hesitate to recommend the stock at a sufficient margin of safety relative to our fair value estimate.

Schneider operates a broad portfolio of transportation services, but its flagship asset-based full-truckload shipping unit competes in an industry that offers negligible opportunities to carve out an economic moat. Thus, we have an overall no-moat rating on the company--we do not award a moat to any pure-play truckload carrier in our coverage universe, regardless of quality. By no means are we implying that investors should shun high-quality trucking stocks like Schneider. Rather, we would avoid them when the market becomes speculative and overoptimistic about future results (not the case right now for Schneider) and be enthusiastic buyers at an appropriate margin of safety. Additionally, the company’s intermodal and asset-light truck brokerage operations (about one third of revenue and a ballpark 25% of operating earnings, combined) exhibit signs of a narrow moat. Moats are common among the large logistics providers, where the self-reinforcing network effect can create noteworthy value.

Schneider's Trucking Operations Can Deliver the Goods but Not a Moat Carriers in the $330 billion for-hire truckload industry move full trailer loads (in excess of 20,000 pounds) for individual customers from origin to destination, with a significant focus on retail and consumer-related end markets. Full-truckload shipping doesn't necessitate an extensive terminal network, though the large providers do have strategically placed maintenance facilities to minimize downtime. Schneider offers a wide range of truckload shipping services, including for-hire, dedicated contract, refrigerated, flatbed, expedited, and final mile. The final-mile white-glove delivery market (residential and commercial) for heavy goods--furniture, exercise equipment, carpet, and so on--has been growing at a faster clip than traditional dry van shipping, given favorable e-commerce trends. Schneider significantly boosted the scope of this offering with its acquisition of Watkins & Shepard Trucking in June 2016, and these services make its asset-based truckload offering slightly more diversified than a few close peers like Knight and Heartland. On the other hand, although Schneider's executional know-how and strong reputation should allow it to capitalize on attractive final-mile growth opportunities, we don't think final-mile services add to the company's underlying competitive positioning. The company isn't alone in its endeavors, and given low barriers to entry among all trucking sectors, we expect the landscape will become increasingly crowded in the years ahead. In addition to thousands of small providers, J.B. Hunt participates in final-mile delivery, XPO provides it via third-party providers, and Werner recently announced it is investing heavily in such services.

Overall, we award no-moat ratings to the pure-play asset-based truckload (and less-than-truckload) carriers we cover because we see limited opportunities for providers to differentiate and craft a sustainable competitive edge. The mark of a moatworthy company is the ability to generate economic profit over time. A handful of truckers have managed to outearn their cost of capital on average over extended periods, but most have been hard-pressed to achieve that, and even the best carriers see returns dissolve when capacity becomes readily available to shippers--irrational rate setting and painful margin compression during periods of sluggish freight demand point to the highly commoditized nature of the business. This was evident throughout 2008-09 as carriers slashed rates to unsustainable levels to keep trucks moving. Capacity tightened in 2014 and 2015 as a result of healthy demand growth coupled with regulatory changes, the driver shortage, and carriers’ limited fleet expansion in the early stages of the recovery; this provided for a season of robust pricing gains and acceptable capital returns. The tide turned again in 2016 as demand softened, and over the past year, carriers across the board have been slashing rates, once again erasing economic profit for most.

Barriers to entry are few and far between in full-truckload shipping. All that’s needed is the ability to finance a tractor and acquire a commercial driver’s license. This is the reason the industry is immensely fragmented. The sector consists of more than 200,000 for-hire carriers, and 90% operate fewer than six trucks. Even the top 15 players make up less than 6% of the market. Moreover, switching costs are low because trucking is commoditized; shippers can painlessly shift to another carrier offering a better rate, and the change can be done instantaneously (shippers usually have a long list of carriers in their routing guide). Service quality matters greatly in trucking, but it’s not necessarily a rarity.

Importantly, increasing fleet size doesn’t automatically translate into lower costs, thus scale economies have largely proved insufficient. This is partly because a truckload carrier can’t boost route density by adding more customers--by definition, it hauls a full-trailer load from point A to point B for one customer at a time. To boost volume, a truckload carrier must purchase another truck and hire another driver. There is a minimum utilization (miles per tractor) needed to be profitable, but that can only go so far, and most large truckers are already actively investing in IT infrastructure and maximizing network optimization. Overall, the largest carriers are not the most profitable. Swift and Schneider are the largest North American truckload carriers, but smaller operators like Knight and Heartland surpass the large companies’ operating margins.

Moats Are Common in Intermodal Shipping, and Schneider's on the Right Track On the intermodal front, Schneider contracts with the major Class I railroads for the underlying line-haul movement of its owned/leased containers (between ramps) and provides drayage services, mostly via its owned fleet of trucks and chassis. Intermodal shipping is a $17 billion industry driven by U.S. consumer spending trends and truck-to-rail conversion activity. The dominant intermodal marketing companies, or IMCs, are J.B. Hunt, Hub Group, XPO, Schneider, and to a lesser degree Swift. XPO and Schneider are close on the revenue front; XPO probably had a slight edge in 2016 even when adding an estimate for fuel surcharges (not disclosed) for Schneider. We consider XPO and Hub to be closer to the asset-light side of the spectrum. Both companies own significant container capacity, but their vast container drayage operations primarily use owner-operators and third-party carriers (although Hub has been gradually shifting to employee drivers). J.B. Hunt and Schneider are more asset-intensive because their drayage fleets mostly employ company-owned tractors and employee drivers. Either way, the IMCs don't control costly line-haul infrastructure (rails and locomotives).

While not sufficient in magnitude for us to award a moat to Schneider’s overall transportation portfolio, its intermodal division shows signs of a narrow moat rooted in a combination of the network effect and scale-based cost advantages. The company’s intermodal margins don’t match the impressive levels of industry frontrunner J.B. Hunt, which enjoys much greater network scale and an unusually favorable revenue-sharing arrangement with Class I railroad BNSF. However, Schneider’s intermodal unit is the third-largest provider by container count, following narrow-moat J.B. Hunt and Hub Group, and we estimate its operating margins exceed those of Hub Group, making it the second-most profitable provider.

Large intermodal providers can carve out a moat under the right circumstances. In third-party logistics, the network effect implies that all parties benefit from using a larger intermediary, and that dynamic is tough to replicate. Schneider’s intermodal network has developed sufficient scale to be highly attractive to both shippers (customers) and the Class I railroads that handle the underlying line-haul service. Similar to J.B. Hunt and Hub Group, Schneider’s immense volume of loads and significant control of containers make it an ideal customer to the railroads, which are better equipped to sell to large captive shippers moving commodities. The rails also prefer intermediaries manage their own containers and thus provide the large IMCs with preferred ramp access and lane capacity--no small benefit, considering that the truck-versus-rail decision is heavily influenced by service levels. Along those lines, we think Schneider’s vast customer base of shippers across the size spectrum generates significant buying power with the railroads, yielding superior discounts and contract terms relative to the broader landscape of small freight brokers that dabble in multimodal solutions. Aside from the major IMCs, many truck brokers offer intermodal as well (small providers often use the rail-managed fleets), but most are limited in their capabilities. Even brokerage giant C.H. Robinson lacks the intermodal network scale to materially accelerate its intermodal market share; it only owns about 1,000 containers, while Schneider owns more than 18,000. These dynamics enable shippers to capitalize on Schneider’s buying scale, efficient access to rail capacity, and solid service capabilities at intermodal terminals relative to smaller freight brokers. As the company’s customer base expands, so does its value proposition to individual shippers and the rails.

To some degree, we believe Schneider (as well as the other four major IMCs) benefits from barriers to entry that arise from its massive fleet of 18,000-plus intermodal containers--the third largest in the industry. The five major IMCs have remained constant for many years. The capital investment required to replicate such equipment capabilities would prove formidable for small freight brokers, which usually prefer to remain asset-light. The same goes for Schneider’s growing fleet of 6,300 company-owned chassis and its drayage operation, which runs 1,250 tractors. In terms of chassis, IMCs can supplement their owned equipment with rail-owned or other third-party rental chassis (J.B. Hunt owns its fleet, but Hub Group and Schneider employ a mix of third-party assets). However, things may be changing on that front as providers look to maximize network efficiency. Schneider, for example, is moving away from renting chassis to a company-owned model like J.B. Hunt’s to boost service reliability (rented chassis are often beaten up), drive down costs, and improve control and driver satisfaction in drayage activities. In fact, Schneider set aside $110 million of IPO proceeds for this project.

Signs of a Narrow Moat Also Emerge in Asset-Light Truck Brokerage Asset-light truck brokers don't operate power equipment but instead match shippers and asset-based truckers (mostly full truckload, but also LTL), earning a spread, or gross margin, in the process. The broader truck brokerage market approximated $62 billion in gross revenue last year (according to consultancy Armstrong & Associates) and is still quite fragmented. Only about 30 providers generate more than $200 million in gross revenue. For reference, gross margin is defined as net revenue divided by gross revenue, while net revenue is gross revenue less the cost of capacity paid to asset-based carriers. Net revenue is a broker's true operating top line.

Most of Schneider’s logistics division revenue stems from asset-light highway brokerage (72% of logistics; 14% of total company revenue before fuel), with the remainder coming from contract logistics services such as supply chain consulting, outsourced transportation management, and import/export solutions (warehousing and port drayage via owner operators). Many of the large asset-based truckload carriers have migrated into the asset-light brokerage space over the past decade to grab greater wallet share of customers’ freight spending, boost returns on invested capital, and capitalize on attractive growth potential linked to industry consolidation and increased outsourcing among shippers. That said, Schneider’s brokerage business is among only a handful of traditionally asset-intensive truckload carriers that have successfully broken into the top ranks of the fragmented brokerage landscape (comprising more than 9,000 providers)--a list mostly composed of pure-play third-party logistics providers.

To succeed in brokerage, which we characterize as having low barriers to entry but high barriers to success, an asset-based trucker generally must move beyond a simple overflow model where brokerage serves as a safety valve for retaining freight when its trucks are full, or even a model where it uses brokerage to fill its own empty miles. Building network scale requires a separate, independent sales organization focused on enticing shippers and third-party carriers to join the network, along with heavy IT investment in real-time data analytics that can integrate with customers and suppliers and translate lane experience into better pricing decisions. Schneider, J.B. Hunt, and Knight are among the few large truckload carriers to have successfully made that commitment.

Schneider doesn’t disclose its brokerage gross margin, which would provide insight into its relative buying power and pricing sophistication. But although we’re unable to compare Schneider’s logistics net operating margin (EBIT/net revenue, our preferred metric) with its peers, we contrasted traditional operating margins (EBIT/gross revenue). This metric is somewhat noisy because a truck broker’s gross profit margin percentage (net revenue/gross revenue) varies throughout the truckload industry supply/demand cycle, driven by the interplay of buy rates for capacity and sell rates to shippers. However, it can still provide insight into the company’s positioning relative to moaty peers. Importantly, we calculate that Schneider’s adjusted logistics EBIT margins comfortably exceed those of narrow-moat Echo Global Logistics. When also bearing in mind the scale of Schneider’s independently run brokerage network and the power of the network effect, we think this performance points to a potential narrow moat for the segment. To be fair, Echo has much higher deal-related intangibles amortization (given its acquisition strategy) and is grappling with near-term productivity headwinds from IT integration efforts associated with Command (acquired in 2015); but even before Echo’s integration issues, Schneider’s logistics margins held roughly a 50-basis-point lead on average between 2013 and 2015. The company isn’t on par with wide-moat C.H. Robinson’s profitability, but that’s not surprising, considering the scope of Robinson’s unrivaled network of shippers and asset-based truckers and its history of unparalleled execution.

Conceptually speaking, attributing a narrow moat to Schneider’s logistics unit isn’t unreasonable. Under the right circumstances, the network effect can be a powerful ally for truck brokers. As a broker’s customer base grows, its buying scale expands, translating into stronger lane density, lower cost of hire for capacity, and higher gross profit margins relative to less capable peers. Additionally, its value proposition to shippers (customers) expands with negotiating power because large brokers can usually secure lower carrier rates than small or midsize shippers could negotiate on their own. Gross profit margins of the largest truck broker (C.H. Robinson) have historically led the industry for this reason, and although not disclosed, we suspect Schneider’s are above the pack of thousands of smaller, less sophisticated operators. A growing customer base also attracts more suppliers to a providers’ network because small truckers (which make up most of the highly fragmented asset-based full-truckload industry) benefit from a broker’s ability to aggregate demand across thousands of shippers. By accepting brokered loads, truckers can minimize empty miles, outsource sales functions, and obtain faster payment. A broad base of carrier relationships is a major advantage for large brokers like Schneider. Customers place a significant premium on efficient capacity access, especially during periods of supply disruption. This dynamic was evident throughout much of 2014 and 2015, when full-truckload supply tightened and the top highway brokers saw substantial growth in spot freight opportunities and robust pricing gains. In fact, assuming steady underlying growth in U.S. freight demand, we expect full-truckload capacity to firm up in the year ahead, driven by widespread adoption of electronic logging devices among small truckers, coupled with the limited driver pool, which makes it harder for carriers to boost fleet size quickly.

The network effect is a key reason the truck brokerage industry is gradually consolidating. Small providers can profit from becoming a part of a larger entity with superior access to truckload capacity, greater buying power, and proprietary IT infrastructure, which boosts pricing visibility (in terms of both buy and sell rates) and shipment margins.

/s3.amazonaws.com/arc-authors/morningstar/064f053d-8b4f-43d1-9844-86633e1e6749.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/064f053d-8b4f-43d1-9844-86633e1e6749.jpg)