Does Consumer Sentiment Predict Stock Prices?

Zigging when other investors are zagging.

Last week, William Blair published a brief note from Brian Singer, the head of its asset-allocation team. Striking a contrarian theme, Singer warned that if things seem too good to be true, they probably are. It has now been nearly a decade since anything resembling a global bear market, a situation that has comforted investors into believing that securities carry only "minor risks." Compliant government policies, such as ultralow interest rates, enhance the mirage.

Singer has my sympathies. Six months ago, I penned my own forewarning, "Is the Contrarian Bell Clanging for Stocks?" As with Singer, my contrarian sensibilities were offended by investor sentiment--specifically, the so-called "Trump Bump." Prior to the election, stocks gained when Hillary Clinton's fortunes rose; investors, it appeared, favored the status quo. After the election, stocks advanced again, because (we were told) investors favored change. Heads stocks win, tails stocks win. That felt like euphoria to me.

So much for my intuition--stocks have since soared, with scarcely a look backward. Well, nobody takes my stock market musings too much to heart. Probably not Singer's opinions, either, even though he is paid to make asset-allocation decisions. Even the gullible realize that predicting the stock market's direction for the next few months is a task that exceeds the grasp of mortals.

But can investor sentiment be a useful tool, from a longer perspective? No doubt, when investors feel secure their comfort may persist, and when they are worried their anxieties may increase. That makes sentiment an imprecise guide for the short term. Perhaps, however, the measure can inform about stocks' prospects if the time horizon is extended to several years.

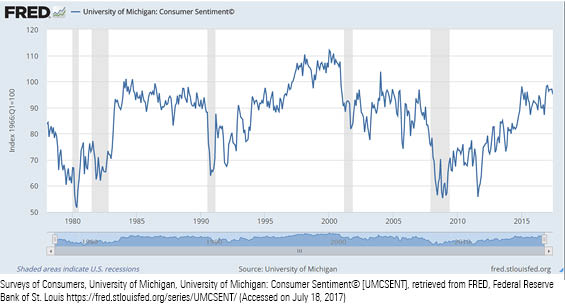

Let's look. The Conference Board publishes the heralded Consumer Confidence Survey. That does us little good, because the Board is chary of releasing the details of its findings, and this column's research budget (zero) doesn't cover springing for a data license. Fortunately, the University of Michigan conducts its own study, which yields almost identical results, and which has publicly available data points.

Below are the results for Michigan's Surveys of Consumers over the past 40 years:

That looks promising. The index bottomed in spring 1980, and that decade, of course, was the Great Bull Market. The sentiment indicator signaled to get invested in stocks when inflation and unemployment ran high, and spirits ran low. A good time indeed to be buying.

The next big trough was in late 1990, which once again was a terrific opportunity. That summer, the S&P 500 dropped 15% as Saddam Hussein (remember him?) invaded Kuwait, leading to a spike in oil prices and coinciding with a U.S. economic slowdown. Stocks recovered late in the year, and then took off for pretty much the rest of the decade, the '90s being an even Greater Bull Market than the original Great Bull Market.

The final valleys arrive as a pair, with the first coming in 2008 and the other three years later, in 2011. You couldn't ask for better calendar-year predictors. The two years following the 2008 dip delivered S&P 500 gains of 26% and 15%--handy profits indeed with inflation and fixed-income yields hovering just north of zero. The three years after 2011 were even better, at 16%, 32%, and then 14%.

So, the indicator looks to be perfect at identifying extended bull markets. What about the reverse? Can it discover market tops?

Not so much.

Sentiment clearly failed the test in the '80s, as it soared to false highs in 1984 and 1986 and rested at a relatively moderate level before October 1987's Black Monday. (To this day, if I meet somebody with an Oct. 19 birthday, I immediately think stock market losses.) A decade later, it did suggest exiting stocks prior to the 2000-02 decline--but it also had done so two years before.

Last decade, also, was mixed. To be sure, sentiment was much higher in early 2007--a good time to be reducing stock exposure--than it was two years later. However, investor sentiment had been higher earlier in the decade. Indeed, with Michigan's survey score surpassing 100 for the first time since late 1990s, the January 2004 reading was strongly bearish. That was accurate only if one looked out a full half decade, as until late 2008 stocks generally appreciated.

Thus went the first version of this column, entitled, "Sentiment Works Better at Predicting Bulls Than Bears." Until I realized that was wrong.

The problem is, those bear-market signals only become evident with hindsight, when the series' entire pattern is revealed. Living in the moment, all one knows is that sentiment has been falling and is lower than it previously was. It could go much lower yet. Michigan's score of 64 in October 1990 matched the survey's average from a decade before. Why in 1990 would 64 have been considered particularly low by historic standards?

Conversely, in June 2008, the index registered at 56.4, its lowest level in 28 years. What better time to buy stocks? Particularly as the index rose the next month, and then the following month, and then the month after that. You couldn't ask for a more powerful contrarian buy indicator than investor sentiment hitting a very long-term low then recovering. The dinner bell was clanging--two weeks before Lehman Brothers went bankrupt, and stocks headed straight south.

Besides, it's not as if any of this is new information. When sentiment dwindled before the bear markets of the '80s and '90s, and before the post-2008 recovery, so did stock prices. The S&P dropped 20% on an inflation-adjusted basis in 1981, and (as already detailed) took beatings in the summer of 1990, late 2008, and early 2011. Sentiment doesn't forecast stock prices. It coincides with them. It is driven by them.

What sentiment teaches us, then, is what we already know:

1) Stock market routs present buying opportunities.

2) However, it is hard to recognize when those routs have ended.

3) Also, most people find it psychologically difficult to buy stocks when the news is unrelievedly bad.

In other words, contrarianism sounds great in principle, works well if implemented properly, and is challenging to implement. Those are all useful investment precepts, but they can be learned without studying sentiment indicators. The history of stock market prices teaches that lesson just fine.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)