4 HSAs With the Best Investment Menu Designs

Diversification with minimal overlap is the best recipe for HSA investment menus.

In our inaugural report evaluating health savings account plans, we looked at 10 of the largest through two separate lenses: as a spending vehicle to cover current medical costs, and as an investment vehicle to save for future medical expenses.

When evaluating HSAs as spending vehicles, we focused primarily on the maintenance fees charged by each plan. When analyzing plans from an investment-vehicle standpoint, we focused on their investment menus and considered three main components to determine an overall assessment: menu design, quality of investments, and price. We also considered past performance of the funds, though we placed little emphasis on that as we don't believe performance is predictive of future results.

This article takes an in-depth look at how we evaluated HSA plans' menu design. We think it's a best practice for plans to offer investments in all the essential asset classes while limiting overlap among options.

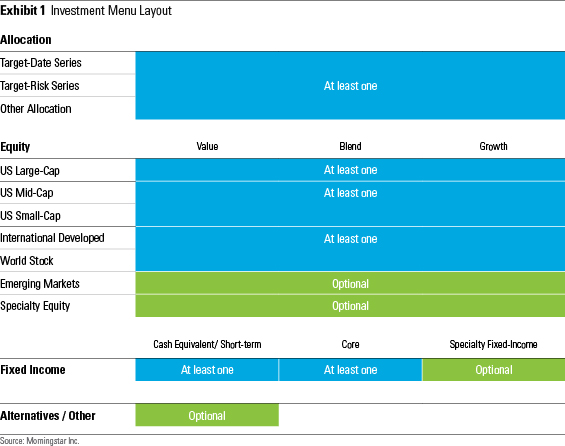

Broad Asset-Class Representation An HSA plan's investment menu should offer a comprehensive set of options so that do-it-yourself investors can build well-rounded portfolios. While there's plenty of debate around the exact asset classes investors should hold, a few are commonly agreed upon as being critical to build diversified portfolios. We refer to these as "core" asset classes, which include large-cap equities, small- and/or mid-cap equities, international developed equities or world stock, U.S. diversified bond (exposure typically gained through a core bond strategy), and either a cash-equivalent or short-term bond strategy. With these building blocks, investors of all ages can create diversified portfolios.

We also believe it's prudent to offer multi-asset-class funds, which offer built-in asset-class diversification, for hands-off investors who wish not to construct or closely monitor their portfolio. Static allocation strategies, such as traditional 60% stock/40% bond funds and world-allocation funds, represent examples of these approaches. Some HSA plans offer target-date funds, which gradually derisk by shifting assets from stocks to bonds as time passes. These vehicles were designed to help investors build sufficient savings to support regular withdrawals during retirement. Therefore, they represent an imperfect tool in an HSA plan, where participants will encounter less predictable expenses. However, accountholders seeking a set-it-and-forget-it approach, who plan to leave their money untouched until the target date, may find this option acceptable. The vehicles are highly diversified, and the average target-date fund reduces equities to 45% at the target date, which represents a reasonable allocation for someone aiming to balance growth and capital preservation. That said, accountholders selecting this option should understand and be comfortable with the allocations over time.

Many plans offer asset classes beyond the ones stated above. From an asset-allocation standpoint, there's plenty of investment rationale that supports having a portion of assets in more-specialized pockets of the market, such as emerging-markets equities and inflation-protected bonds. However, these asset classes typically represent small weightings within portfolios. Additionally, some plans may eschew them altogether because they're afraid an investor will use them inappropriately. (For instance, investing 100% of assets in an emerging-markets fund would be a risky and ill-advised strategy.) With that in mind, these asset classes didn't make the list of "core" asset classes. However, we also didn't penalize plans for including them, given their potential diversification benefits if used properly.

Exhibit 1 shows the typical layout of an investment menu and depicts the asset classes that we believe should be available in HSA lineups.

Limited Redundancy We also believe that HSA plans should resist offering overlapping investment strategies. Many studies have shown that an investor with too much choice often makes poor investment selections or succumbs to decision paralysis. Instead, plans should offer one best-in-class option within each asset class. Of course, there are some exceptions to that rule. In some cases, it's reasonable to offer an active and a passive manager, or a more-aggressive strategy to balance a more-conservative one, within one asset class to meet the needs of different investor types. But for the most part, offering one strong option is advisable to offering multiple similar strategies.

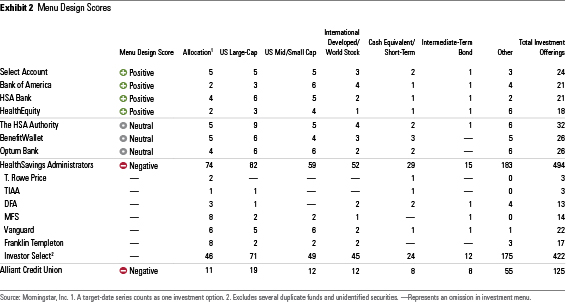

Menu Design Scores We assessed asset-class coverage and investment overlap to determine menu design scores. Plans that receive positive scores offer investment strategies in core asset classes and have limited redundancy of investment options. Neutral plans often omit one core asset class or have moderate overlap among offerings. Negative-scored plans typically have an unreasonably large lineup or they omit multiple core asset classes.

Positive Bank of America, SelectAccount, HSA Bank, and HealthEquity designed robust menus for investors. All four plans offer exposure to core asset classes while limiting overlap among choices. Within the domestic-equity space, each plan uses active funds and offers broad-based index options for participants who want to minimize investing costs. Investors can also choose from a nice mix of value and growth U.S. stock strategies, at least one foreign developed-equity fund, and an intermediate-term bond fund.

All four plans provide options in more specialized areas, too, such as high-yield bonds or REITs. Bank of America and HealthEquity have the farthest-reaching menus; they also include emerging-markets equities, inflation-protected bonds, and commodities, boosting their appeal for do-it-yourself investors. Hands-off investors might prefer SelectAccount or HSA Bank, which both offer at least four multi-asset-class strategies.

Negative Two plans receive Negative scores for having overwhelming lineups. Health Savings Administrators has a gigantic investment roster, with about 500 total investment options. The plan offers seven distinct investment menus. Six menus feature options from a single fund family: T. Rowe Price, TIAA, Franklin Templeton, Vanguard, DFA, or MFS. Only Vanguard offers a comprehensive investment lineup; the other four fund families omit anywhere from one to four core asset classes. Investors cannot mix and match investments among the menus, giving them mostly incomplete tool kits to work with. The seventh menu, Investor Select, features more than 400 unique funds from more than 40 different fund companies. Navigating this lineup would certainly not be an easy task. With multiple layers of required decision-making and mostly incomplete investment lineups, the plan's setup is far from ideal.

Alliant Credit Union also represents an egregious example of providing too much choice, where plan participants must comb through 125 investment options. The plan has nine large-blend U.S. equity strategies, eight intermediate-term bond funds, and five real estate strategies, to name a few of the many overlapping areas. Offering this many options will likely deter some participants from investing or result in subpar investment outcomes.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)