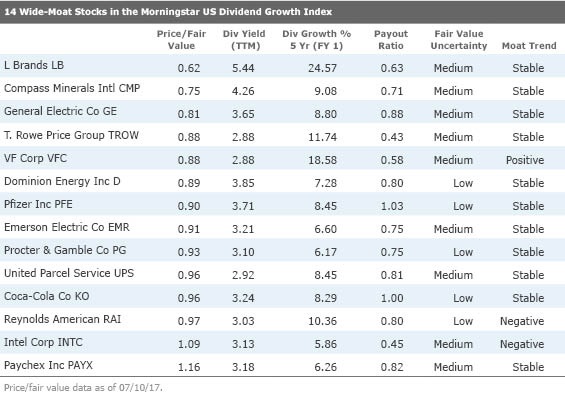

14 Wide-Moat Stocks Set to Grow Their Dividends

We look at some of the highest-quality companies in the Morningstar US Dividend Growth Index, which looks for cash-rich businesses with sustainable and growing yields.

The Morningstar US Dividend Growth Index focuses on companies with a history of dividend growth and the ability to sustain it. It is a core, total return-focused equity strategy with a defensive bent.

Rather than homing in on the market's juiciest yields, the Dividend Growth Index looks for companies whose cash flows have translated into a rising payout. Companies that are focused on growing dividends tend to be higher quality, cash-rich businesses that hold up well in down markets, participate in up markets, and are capable of excess returns over a full market cycle.

The first step to finding dividend growers is screening the U.S. equity market for securities that pay qualified dividends. (This excludes real estate investment trusts.) Then we look for companies that have a five-year history of increasing their dividend payments. To gauge the sustainability of dividend growth into the future, eligible constituents must display positive consensus earnings forecasts from the analyst community. As a safeguard against dividend cuts and financial distress, stocks must have reasonable payout ratios, and those with indicated dividend yield in the top 10% of the universe are excluded. Finally, existing constituents are allowed to remain if they have recently bought back shares and have not decreased their dividend payment. (Click here for more.)

We screened the Dividend Growth index for companies with wide economic moats, meaning we think they have advantages that will allow them to fend off competitors and remain profitable for at least 20 years. We also insisted the stocks carry fair value uncertainty ratings of medium or low, ensuring that we zeroed in on companies whose fair value estimates our analysts were most confident in.

Below are some highlights from our research reports on three of the companies.

VF Corp

VFC

VF Corp owns a large portfolio of brands including The North Face, Timberland, Vans, Lee, Wrangler, and Nautica. We believe the firm has achieved a wide moat rating given the pricing power it has attained through its intangible brand assets. Senior equity analyst Bridget Weishaar thinks VF Corp is poised to take advantage of three market trends. First, she believes the outdoor and action sports market is a high-margin and quickly growing opportunity, with significant room for innovation. Weishaar believes international markets (particularly China) have the potential to continue growing at high single-digit rates every year over the next five years, excluding the impact of currency. Finally, Weishaar believes VF's direct-to-consumer sales channel, which accounts for 28% of revenue, will grow to over one third by 2021.

United Parcel Service

UPS

UPS is the giant among global parcel shipment companies, and we consider its economic moat to be the widest among all freight transportation firms, said equity sector director Keith Schoonmaker. Its wide moat owes to its efficient scale, cost advantage, and network effect. This creates a powerful barrier to entry because re-creating these extensive express, ground, and freight networks would be costly; it would demand a huge quantity of trucks, trailers, terminals, sorting equipment, drop boxes, IT systems, and skilled labor. In terms of growth, UPS has turned to healthcare markets and developing nations, and Schoonmaker thinks the company has ample runway left to build speed. Even existing operations have revenue expansion potential via pricing power because UPS operates within a somewhat rational oligopoly in its largest market, U.S. high-service parcel delivery, he said.

Paychex

PAYX

Paychex's niche of providing payroll solutions to small businesses remains very profitable. With revenue growth that is routinely in the mid- to high single digits and EBIT margins just below 40%, this company continues to benefit from its expansive scale and the low incremental costs of providing payroll and new offerings to customers, said equity analyst Colin Plunkett. Paychex's wide economic moat stems from the onerous costs its 590,000 clients would face if they decided to switch to another payroll solutions provider. Its competitive advantage also owes to the cost advantages resulting from the scale the company has amassed within its niche over the years. In recent years, much of the company's growth has been attributable to human resource services. Revenue in this segment has compounded at more than 14% over the past five years, and while Plunkett does expect this growth rate to slow, he notes that interest rates should serve as a significant tailwind over time.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)