31 Undervalued Stocks

With the second quarter in the books, our equity analysts name their best ideas in every sector.

The Morningstar Global Markets Index has returned 11.7% year to date and 19.5% over the past year. The run-up in equity prices has led to some steep valuations in aggregate: The market-cap-weighted price/fair value estimate ratio for our equity analysts' coverage universe was 1.02 as of June 30, indicating that the median stock under our coverage is slightly overvalued.

Elizabeth Collins, Morningstar's director of equity research for North America, points out in her second-quarter wrap-up that it's getting harder to find undervalued stocks with so much optimism factored into stock prices.

Despite the lofty valuations, however, there are bargains to be found for investors who do some digging and pick their spots carefully.

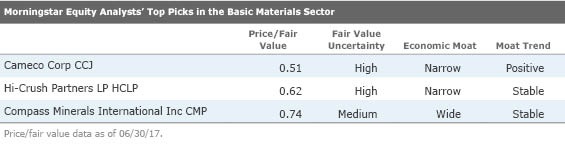

Basic Materials The basic materials sector is the most overpriced sector in aggregate, with a price/fair value estimate ratio of 1.13. Valuations in the sector have been bolstered by unsustainable, debt-fueled Chinese construction spending, says Dan Rohr, director of basic materials equity research. He also believes mined commodity and miner share prices are overvalued. Even in this overheated sector, though, there are a few opportunities.

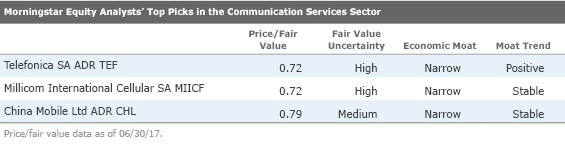

Communication Services The communication services sector overall looks fairly valued at a price/fair value ratio of 0.99. To read the second-quarter wrap-up on the sector by Brian Colello, director of technology, media, and telecom equity research for Morningstar (and find out more about our best ideas in the sector), click here.

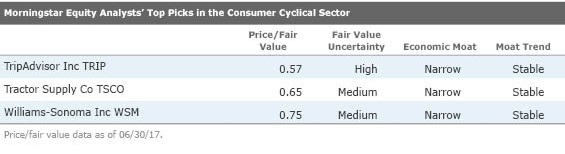

Consumer Cyclical

The consumer cyclical sector is just about fairly valued right now, as restaurants and travel-related stocks help offset the carnage in retail following

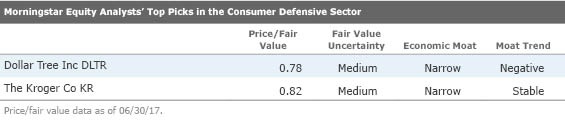

Consumer Defensive Consumer defensive valuations generally remain inflated, with the sector trading at about an 8% premium to our fair value estimates. Director of consumer sector equity research Erin Lash says the tie-up of Amazon and Whole Foods has sparked worries related to heightened competitive intensity that have created pockets of opportunity.

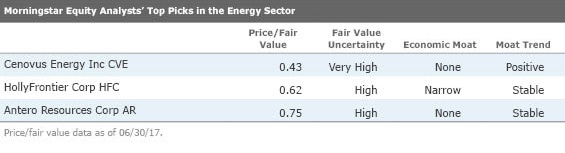

Energy At an aggregate price/fair value ratio of 0.96, the energy sector is the most undervalued sector in aggregate in our coverage universe. Equity analyst Joe Gemino says OPEC's production cuts and strong demand growth have 2017 crude fundamentals in their best shape since oil prices crashed two years ago. The consensus outlook is that market fundamentals are now strong enough to remain healthy even after OPEC returns to higher production; however, Gemino thinks the OPEC output cut extensions don't appear to be enough to balance the oil market. A "crude" awakening for energy investors could be near at hand, he said.

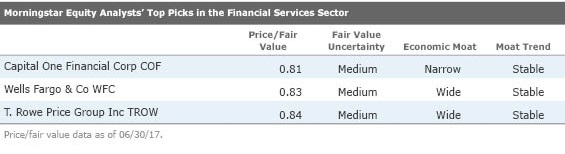

Financial Services The financial-services sector is slightly overvalued, trading at a 2% premium to our fair value estimates. In our analysts' opinions, tax reform may still happen even as banking deregulation in the U.S. faces more hurdles. Click here to read our financial services quarter-end wrap-up.

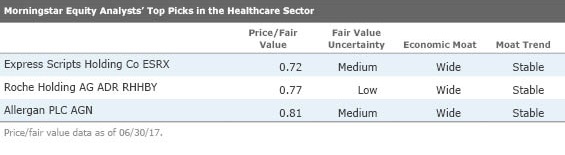

Healthcare In aggregate, the healthcare sector's price/fair value of 1 is largely flat from the end of the last quarter and up from 0.87 at the start of the year as the continued abatement of concerns over branded drug prices is helping valuations, says Damien Conover, Morningstar's director of healthcare equity research and equity strategy.

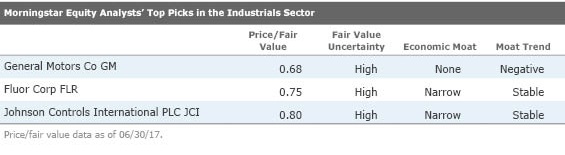

Industrials Currently, our industrials coverage is trading at roughly a 8% premium to our fair value estimates on average. Fewer than 20% of stocks we cover trade in 4-star or 5-star territory. Nonetheless, the space isn't without its opportunities, writes equity strategist David Whiston.

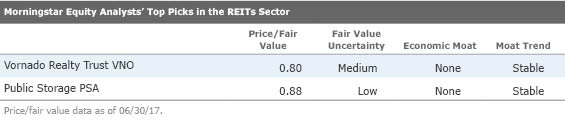

Real Estate Morningstar's real estate coverage was fairly valued as the second quarter drew to a close. Equity analyst Brad Schwer writes that investors should continue to be particularly discriminating, as we expect actions by the president's administration, as well as potential for increased central bank interest-rate activity throughout the remainder of the year, to continue to affect property and capital markets activity, asset pricing, and overall volatility in the near term.

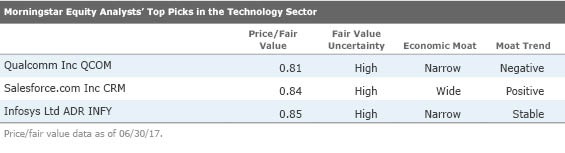

Technology Overall, we view the tech sector as notably overvalued at a market-cap-weighted price/fair value of 1.13. Semiconductors appear overvalued due to the hype around artificial intelligence, says Colello. Former best ideas within the enterprise software and IT Services sectors have appreciated in recent months, but we still see a handful of undervalued names in these spaces.

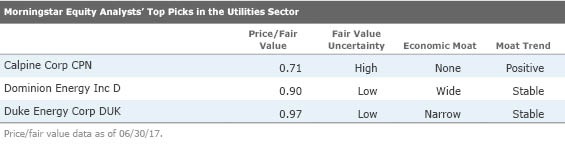

Utilities On a global basis, utilities continue to be overvalued, with a 1.11 market-cap-weighted price/fair value ratio as of the end of June. When seeking investments in the sector, senior equity analyst Andrew Bischof recommends focusing on utilities with constructive regulation and a strong pipeline of organic growth opportunities, which should drive strong annual earnings and dividend growth over the next five years.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)