Tapping the Brakes on M&A

After two consecutive years of record consolidation, merger and acquisition activity slows amid political upheaval.

- Deal value fell especially sharply in Europe, where investors worried that Brexit's separatist sentiment would manifest in other elections.

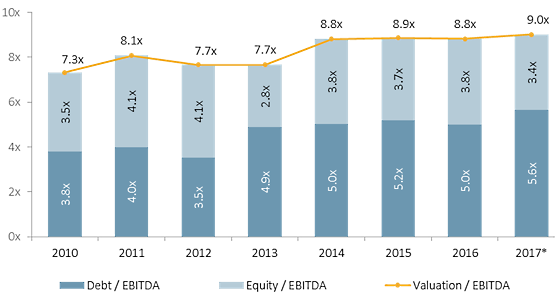

- Inorganic growth continues to be expensive. The median enterprise-value-to-EBITDA multiples hit 9.0x for transactions completed through June 9, 2017.

- We expect M&A activity to intensify in the second half of the year as investors react to recent elections and regain confidence in their own capital deployment strategies.

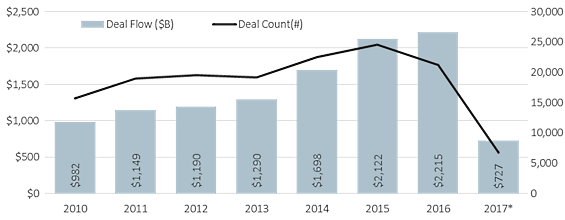

M&A activity in the first half of 2017 was strong on a historical basis, but well behind the pace we’ve witnessed in the last two years. Through June 9, North American and European investors completed 6,819 transactions totaling $727.2 billion, each on pace for greater than 25% year-over-year decreases.

North America and European M&A Activity

Source: PitchBook | Data as of 6/9/2017

Despite the slowdown, prices continue to increase. The median enterprise-value-to-EBITDA multiple reached 9.0x for transactions completed in the same timeframe, up slightly from the 8.8x recorded for the entirety of 2016. Corporate balance sheets remain full of cash, and private equity firms have record levels of dry powder to deploy, creating intense competition for a shrinking pool of desirable acquisition targets.

North America and European M&A EBITDA Multiples

Source: PitchBook | Data as of 6/9/2017

Deal value fell especially sharply in Europe, where the economic fallout from Brexit has not yet been what many expected, but the uncertainty stemming from the recent Dutch and French elections put many dealmakers on hold, fearing further political and economic disintegration. As more becomes known after the Brexit negotiations begin, and since the EU remains otherwise intact in the near term, we expect European deal flow to increase in the back half of the year, especially if public equity prices continue to rally, giving strategic acquirers more buying power in terms of their own stock.

Across the Atlantic, the U.S. is still seen as a bastion of stability compared to Europe and emerging markets, though it too has seen a decrease in M&A activity this year. While the ECB continues its quantitative easing (QE), the Fed has proceeded with its long-anticipated, albeit modest, rate hikes. This has inspired confidence in both corporate and financial sponsors while maintaining historically cheap credit markets to finance larger and larger acquisitions.

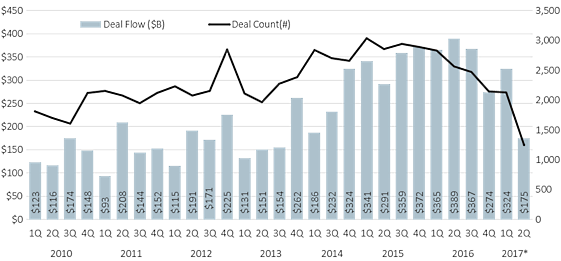

U.S. M&A Activity

Source: PitchBook | Data as of 6/9/2017

Along with the Fed’s normalization, much speculation about a new infrastructure bill and corporate tax cuts fueled first-quarter M&A activity in the U.S. Since then, the likelihood of such legislation being passed by year-end has diminished, but other market dynamics should encourage plenty of U.S. consolidation in the second half of the year. Most notably, large strategic acquirers continue struggling to create the kind of organic growth that shareholders expect, so growth by acquisition becomes the next-best option.

More Quarter-End Reports

Market Stock Market Outlook: Equity Valuations Look Lofty

Economy Midyear Economic Forecast: Lower Inflation, Slow Growth

Credit Markets Credit Market Insights: Bond Indexes Perform Well in a Quiet Market

Equity Sectors Basic Materials Outlook: Propped Up and Too Expensive

Communication Services: AT&T and Verizon--A Duopoly No More

Consumer Cyclical: Amazon Reshapes Retail in Real Time

Consumer Defensive: Retailer Consolidation Sparks Concerns, but Opportunities Exist

Energy: Despite OPEC Cuts, a Crude Awakening Is Near at Hand

Financial Services: Our Take on U.S. Tax Reform and Bank Deregulation

Healthcare Outlook: ACA Repeal Efforts Unlikely to Yield Major Legislative Changes

Industrials: China Shows Signs of Softening, but the Sector Remains Healthy Overall

REITs: Some Scattered Opportunities in a Fairly Valued Sector

Tech: A Tectonic Shift Toward Enterprise Cloud Computing

Utilities: Tough to Stop This Sector's Powerful Performance

Mutual Funds First Half Winners and Losers for Funds

Second Quarter in U.S. Stock Funds: Growth on Fire

International-Stock Funds Continue to Prosper

Bonds in the Second Quarter: The Flattening

Portfolio Planning With Christine Benz Trends and Takeaways From 2017's First Half

PitchBook Reports Private Equity: Capital Deployment Remains a Challenge

Venture Capital: Less Is More?

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)