Have Strategic-Beta Bond ETFs Outsmarted Their Peers?

The jury is still out.

A version of this article was published in the June 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

Go is a board game played on a 19-by-19 grid where each player makes one move per turn in an effort to capture territory on the board. A typical game lasts approximately 150 moves with an average of 250 potential variations per move, suggesting a level of game complexity of 10360, according to calculations from Victor Allis, a computer scientist. By contrast, a chess game's estimated complexity is 10123. In May, AlphaGo, the Google-made Go program, defeated the world's top-ranked Go player, Ke Jie. AlphaGo's victory adds another trophy to the shelf for artificial intelligence. Will algorithmic approaches to building bond portfolios get the best of flesh-and-blood bond managers, too?

In setting out to answer this question, I will evaluate the performance of a select group of strategic-beta fixed-income exchange-traded funds. I compare these funds with comparable peers selected from two groups. The first comparator comes from the cohort of traditional market-cap-weighted ETFs that is most broadly representative of the fund's Morningstar Category. Where possible, I've also compared these funds with a comparable actively managed Morningstar Medalist within the category. Thus, I am framing these hybrid strategies' performance in the context of their more vanilla passive and strictly active category peers.

Generally speaking, I've found that man is still besting machine in most categories. Though the strategic-beta ETFs examined here have outperformed their market-cap-weighted counterparts, sometimes by a wide margin, they haven't kept up with our favorite actively managed funds in four of the five categories I study here.

It is critical to note that the sample size here is small and the sample period is short. There were just seven strategic-beta fixed-income ETFs with at least three years of return history as of April 2017. Also, during the period, there were only three stress periods in the bond market: a commodity sell-off that affected emerging-markets debt (spanning September 2014 to December 2014), a sell-off in the energy space that affected high-yield bonds (June 2015 to February 2016), and the post-election rate rally (August 2016 to December 2016). So, given that this has been a relatively calm period, it is difficult to discern if these strategies will pass muster in a more protracted stress period.

The analysis that follows examines the performance of this sample of seven strategic-beta fixed-income funds against their closest market-cap-weighted ETF siblings and medalist active bond funds in their categories.

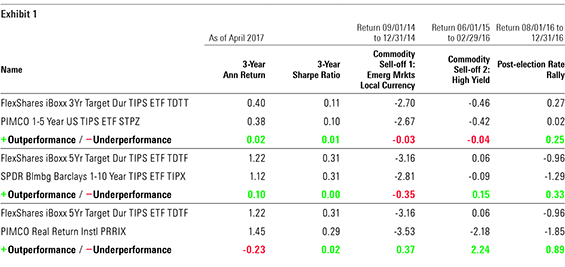

Inflation-Protected Bond

There are two strategic-beta ETFs that invest in inflation-linked bonds. Unlike their more vanilla ETF peers, they do not track market-cap-weighted indexes. Instead, they seek to maintain prescribed duration-risk profiles. They are FlexShares iBoxx 5-Year Target Duration TIPS TDTF and FlexShares iBoxx 3-Year Target Duration TIPS TDTT. They seek to maintain a target duration of five years and three years, respectively. Each charges a fee of 0.20%. Both funds produced virtually identical returns against their market-cap-weighted cousins over the three-year period ended April 30, 2017:

As far as duration is concerned, the FlexShares funds have performed as advertised, staying close to their respective duration targets. The duration of market-cap-weighted products moved in a fairly narrow range as well. STPZ's duration ranged between 1.9 years and 3.0 years, and TIPX's fluctuated between 3.1 years and 5.1 years during the same period.

The institutional shares of

Source: Morningstar.

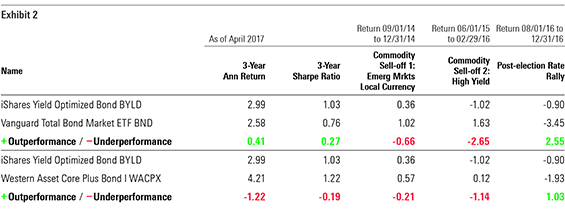

Intermediate-Term Bond

One of the oft-cited potential flaws of market-cap-weighted bond indexing is that debt issuance dictates index composition. So, for example, U.S. Treasuries currently account for nearly 40% of the Bloomberg Barclays U.S. Aggregate Bond Index, which pulls down its yield relative to active funds in the intermediate-bond category. IShares Yield Optimized Bond ETF BYLD (1) is an ETF of ETFs that seeks to deliver greater yields relative to the Aggregate Index.The fund limits its Treasury exposure to 10% of the portfolio. At present,

The fund's SEC yield is higher than that of a typical Aggregate Index-tracking fund. For example,

In the crowded intermediate-bond category, Gold-rated

Source: Morningstar.

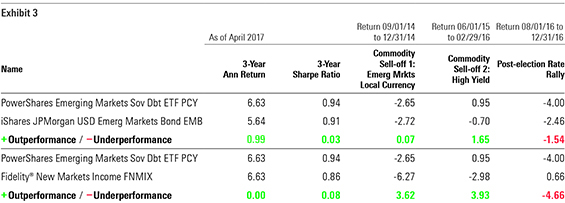

Emerging-Markets Bond PowerShares Emerging Markets Sovereign Debt PCY provides rules-based exposure to U.S.-dollar-denominated, emerging-markets sovereign and quasi-sovereign bonds with at least three years until maturity. The fund targets bonds with the biggest spread and equal-weights them by issue and by country. PCY has performed well by all measures.

This fund's outperformance against its closest market-cap-weighted cousin,

Despite PCY's attractive performance, it is unclear whether the fund can repeat its past success. EMB takes a systematic approach in selecting countries. An eligible country must have had a low or middle per capita income for at least two consecutive years as defined by the World Bank. On the other hand, for PCY, the Deutsche Bank Emerging Markets Index committee decides country inclusion based on rating, size, liquidity, and other considerations. According to Deutsche Bank, its Annual Country Review is made on the basis of "expert judgment." This inserts an element of subjectivity, and thus opacity, into the equation as the countries included in the benchmark will vary year to year based on a committee's judgment. For example, the number of countries in the fund changed from 23 in 2014 to 29 in 2015. The list grew to 31 as of December 2016.

PCY's performance was on par with Silver-rated

Source: Morningstar.

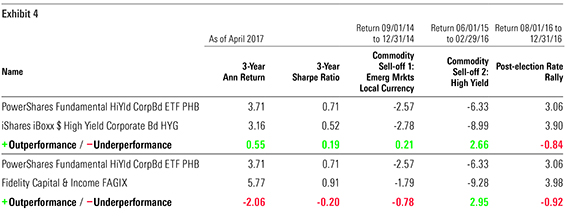

High Yield

To address the aforementioned concerns regarding market-cap weighting in bonds,

PHB outperformed HYG by a solid margin during the three-year period ended April 30, 2017. Again, I would caution against drawing conclusions based on this investment horizon. The principal driver of PHB's outperformance during this period was its relatively muted drawdown during the energy-led sell-off in high yield. This, in turn, can be attributed to the fact that PHB excludes bonds rated below CCC and has a stake in investment-grade issues.

Silver-rated

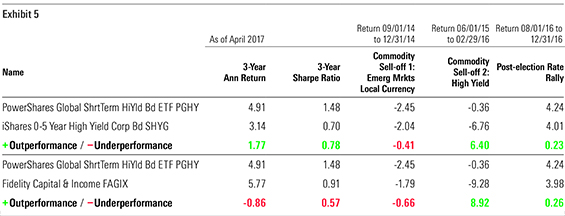

Another high-yield strategic-beta ETF, PowerShares Global Short Term High Yield Bond PGHY, invests in global high-yield bonds with less than three years until maturity. U.S.-based issuers makes up roughly half of the portfolio, and the balance is in emerging countries, including Russia, Brazil, and Turkey. All holdings are roughly equal-weighted.

There is no similar market-cap-weighted ETF for this fund. IShares 0-5 Year High Yield Corporate Bond ETF SHYG also invests in short-term high-yield bonds, but only in the domestic issues. PGHY's exposure to emerging markets has helped the fund outperform, but it had a larger drawdown than SHYG during the commodity sell-off affecting emerging-markets debt.

This fund, too, was not able to beat top-performing active funds such as Fidelity Capital & Income.

Source: Morningstar.

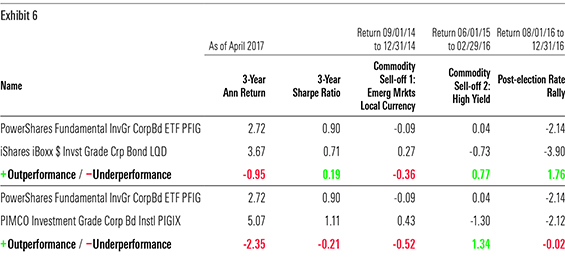

Corporate Bond PowerShares Fundamental Investment Grade Corporate Bond PFIG targets investment-grade bonds with maturities between one and 10 years. Similar to PHB, this fund weights its positions by the Research Affiliates-developed scoring system incorporating sales, book value, cash flows, and dividends.

The fund underperformed its closest market-cap-weighted peer,

Meanwhile, Silver-rated

Source: Morningstar.

Conclusion Based on the limited sample of funds and the short time frame I've examined here, it is safe to say that the jury is still out on whether or not rules-based approaches to mimicking the strategies plied by human bond-pickers will ever best their flesh-and-blood peers. And though strategic-beta ETFs have surpassed their market-cap-weighted competitors in some instances, a closer examination of their results shows that much of their outperformance can be attributed to dialing up and/or down credit, interest-rate sector, and/or country risk. Once these funds traverse a full market cycle, it will be much clearer how far the industry has advanced in developing products that can go toe-to-toe with their human counterparts.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)