How Does Your Health Savings Account Stack Up?

We evaluated 10 plans, and only one looks attractive for use as both a spending and investing vehicle.

We released a report that evaluates HSA plans through two separate lenses: as a spending vehicle to cover current medical costs, and as an investment vehicle to save for future medical expenses.

Health Savings Accounts are growing rapidly, but the general public is just getting up to speed on how they work. HSAs, which are offered in conjunction with high-deductible health plans, are tax-sheltered accounts for individuals to save for medical expenses that aren't covered by the HDHP. Despite the increased interest in HSAs, they remain a very under-researched corner of the market. Investors have few resources available to navigate the hundreds of plan providers that exist. The lack of resources has likely contributed to these plans' underutilization as savings vehicles despite their valuable tax benefits.

An HSA is triple tax-advantaged: Pretax dollars go into the HSA; the money grows on a tax-free basis; and withdrawals are tax-free as long as the money is used to cover qualified healthcare expenditures. In addition, HSAs are more flexible than many think and can be used in two different ways. Most frequently, an HSA is a place to set aside dollars to cover immediate healthcare costs. But the HSA can also serve as a longer-term investment vehicle. Rather than using the HSA to pay for current healthcare costs, invest it. Let that money grow year over year. Then tap into the HSA during retirement to cover in-retirement healthcare costs.

We evaluated HSA plans through two separate lenses: as a spending vehicle to cover current medical costs, and as an investment vehicle to save for future medical expenses.

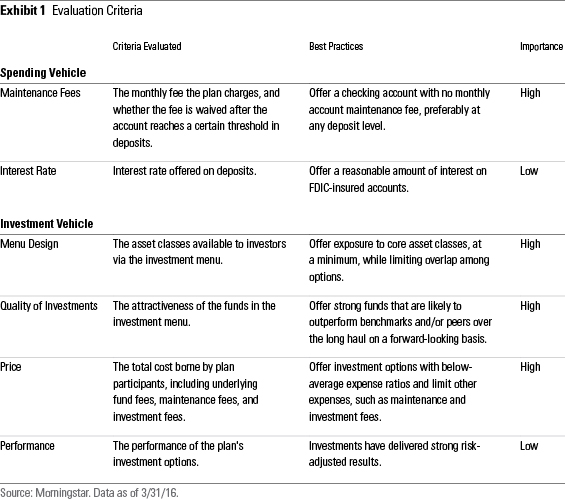

When evaluating HSAs as spending vehicles, we focused primarily on the maintenance fees charged by each plan. We also considered, to a lesser degree, the interest rates offered by their checking accounts. Interest earned on HSA deposits is rather small because of the current low-interest-rate environment. If yields rise, the interest offered may become a more important consideration.

From an investment-vehicle standpoint, we focused on HSAs' menu of mutual funds. We considered four components when reviewing plans' investment lineups: menu design, quality of investments, price, and performance. The first three components carry the most importance since we don't believe that past performance is predictive of future results.

Exhibit 1 outlines the components and the criteria we evaluated when determining assessments on the spending-account and investment-account sides. It also includes what we consider to be best practices, as well as the importance of each component in determining our assessments.

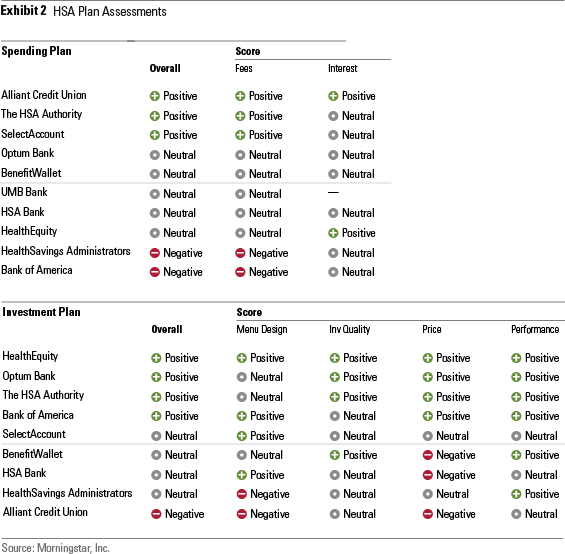

For Exhibit 2, we ranked spending plans and investment plans from best to worst. (UMB Bank would not share its investment menu with us, so we excluded that plan from the investment-vehicle evaluations.)

Key Take-Aways HSA Plan Assessments: Out of the 10 plans we evaluated, only one looks compelling for use as a spending vehicle and an investment vehicle. The industry has a lot of room for improvement.

- The HSA Authority is the only provider to receive a positive assessment as both a spending vehicle and an investment vehicle.

HSA as Spending Vehicle: Account maintenance fees represent the most important consideration for those intending to use their HSAs as a spending vehicle. The current low-interest-rate environment means accountholders will generate little income from the checking accounts offered by HSAs.

- Alliant Credit Union, SelectAccount, and The HSA Authority receive positive assessments for use as a spending vehicle, meaning they are the most compelling plans for accountholders using their HSAs to cover current medical costs. The three plans offer checking accounts without monthly maintenance fees.

HSA as Investment Vehicle: There's room for HSA providers to improve their investment menus. We gave only four plans positive overall assessments for their investment lineups. Only one plan offers a well-designed investment menu, strong underlying managers, and attractive fees.

- Bank of America, HealthEquity, Optum, and The HSA Authority receive positive assessments for use as an investment vehicle, meaning they represent the best choices for accountholders looking to invest their HSA assets. The four plans have at least two of the three following features: a well-designed investment menu, quality underlying managers, and below-average fees.

Menu Design: Only four plans that we evaluated boast robust investment menus, as defined by offering exposure to core asset classes with limited overlap among options.

- Bank of America, HealthEquity, HSA Bank, and SelectAccount receive positive scores for having well-designed investment menus.

Quality of Investments: Most plans offer many strong underlying funds; in seven out of the nine plans we evaluated, more than half of the funds in the investment lineup are Morningstar Medalists.

- BenefitWallet, HealthEquity, Optum, and The HSA Authority receive positive quality of investments scores for having the strongest manager lineups.

Price: As compared with retail mutual funds, the all-in cost of investing in the HSA plans we evaluated ranges from cheap to expensive.

- Bank of America, HealthEquity, Optum, and The HSA Authority receive positive price scores for offering investments at a total cost that is meaningfully lower than retail mutual funds.

Performance: The underlying funds in the HSA plans we evaluated have generally outperformed their peers.

- Bank of America, BenefitWallet, HealthEquity, HealthSavings Administrators, Optum, and The HSA Authority earn positive performance scores for turning in especially strong risk-adjusted returns versus competitors.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)