Rays of Hope in This Week's Economic News

While growth is likely to remain slower than usual, the risk of an outright recession now seems further out versus a month ago.

We have argued for many months that the economy was losing some momentum and showing signs of a recovery that was nearing its end. We outlined in our weekly column on June 10 the myriad sectors that were clearly slowing down. We went on to say that an aging economic recovery is more vulnerable to outside shocks.

This week we thought we might spend a little time talking about just what might go right. In many cases the good news was buried in some of this week's releases, especially the Markit Flash Purchasing Managers' Report. Though that report's headline reading for the U.S. was nothing to write home about, the report itself did suggest that wages were moving sharply higher, employment levels a little higher, and that corporations were able to selectively raise prices to cover those costs. We are careful to use the word "selective," as food, raw material prices, and energy continue to experience downward pressure. In our video this week we modified our economic forecast and officially reduced our inflation forecast. (The details of that forecast appear at the end of this report.)

With this month's PMI news that wage growth may be in the process of accelerating at the same time that inflation forecasts are coming down, the consumer might be able to do a little better than we hoped just a few weeks ago. As recently as February, total inflation was 2.8%, and hourly wage increases were just 2.7%. At least for one month, workers were losing ground after gaining ground by as much as 2% in early 2015. We don't believe that we will return to a gap quite that wide anytime soon. However, by December we suspect that hourly wage growth could move to the high end of our 2.5%-3.0% range, while headline inflation could drop 1.5%-2.0%, providing consumers with additional firepower.

Housing could also be another source of good news, at least if home prices don't spike too high. The demographic set-up for the housing market is a little stronger than we realized. The age group that typically constitutes first-time buyers continues to accelerate, while baby boomers continue to occupy their homes. That trend is likely to continue until baby boomers reach the average age of death of about 81. The leading edge of the baby boom is currently about 70 years old.

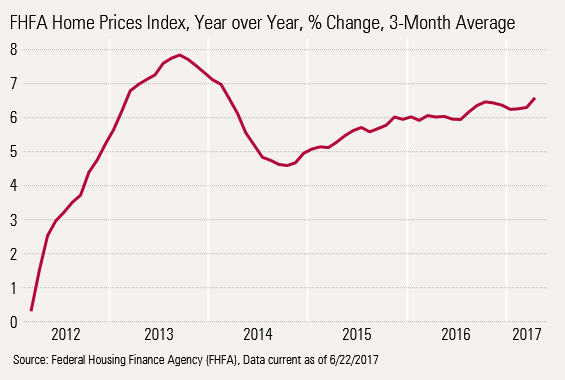

Meanwhile, the number of people currently turning 81 remains unusually small because of low birth rates during the Great Depression. Evidence of this trend turned up in this week's existing-home sales report that showed incredibly low levels of inventory, which continue to weigh on existing-home sales. That low inventory is pushing up existing-home prices at an ever-increasing rate, according to this week's FHFA home price report, which shows home prices accelerating to 6.6% year over year, compared with 6.2% at year-end. The year-end 2016 consensus for 2017 was that home price increases would slow, perhaps meaningfully, in 2017.

We aren't abandoning our cautious outlook. However, we are pleased to have some good news to share, for a change. We admit to having to dig to get to it. Still, while growth is likely to remain slower than usual, the risk that it tumbles into an outright recession now seems a little further out than we might have guessed a month ago.

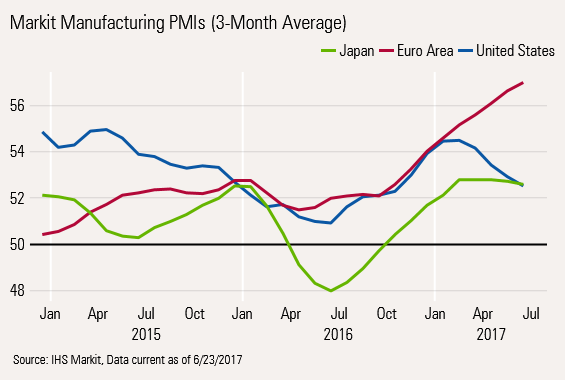

Manufacturing Loses a Little Steam Markit reports flash purchasing manager data for three major economic regions and select countries. However, no data for China will be available until after the first of the month.

The headline data was nothing special. Despite another month of growth (readings above 50), the rate of growth slowed in all three major reporting regions on a single-month basis. The slowing is also evident in our preferred three-month moving-average data.

Europe continues to outshine the other regions, with full second-quarter (versus single-month) readings suggesting the best results since 2011. Markit suggests that GDP growth in Europe might accelerate versus the first quarter, which would be good news for incumbent European politicians. Employment continues to look good, too. That in turn should continue to improve internal demand and reduce dependence on exports.

The U.S. headline data continued its slow erosion process. However, below the covers was both some good news and bad news that seemed far more important than the boring headline figure. On the good-news side of the ledger, job growth picked up from April lows, which will hopefully turn up in the official government report in a couple of weeks. It also suggests that raw material input prices were down materially. That was only partially offset by wage increases. To top it off, it appears that in June many companies were able to raise prices, helping margins and encouraging more investment and hiring.

The service side of the index faced steeper wage increases, as one might suspect. Inflation is in a delicate balancing act now--too high, and consumers, the dynamo of the recovery, will be hurt. And if price increases are too low, businesses will be discouraged from investing, hiring, and passing out wage increases if they don't believe they will get an adequate return on the physical and human capital.

Despite our intentionally rosy outlook this week, we would be remiss if we did not point out that Markit's own correlation work suggests that second-quarter GDP growth is likely to be right around 2%, even after fudging the data for a weak first quarter. The consensus forecast is closer to 3% and our forecast is for 2.5%-3%.

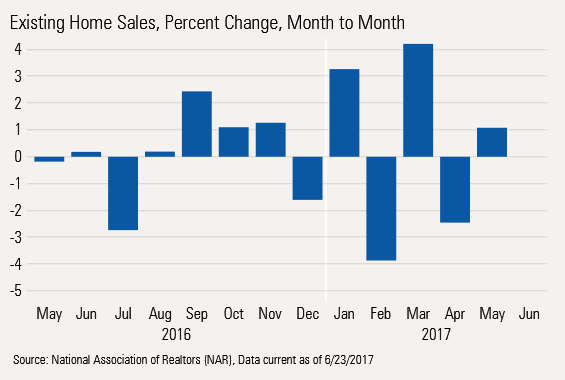

Existing-Home Sales Remain Low and Volatile on a Monthly Basis Month-to-month existing-home sales growth is widely tracked and reported in the media. May's data looked good, showing a small increase and registering one of the highest absolute levels of sales of the recovery. Unfortunately, we seem to have fallen into a pattern where good numbers are immediately followed by bad month-to-month numbers.

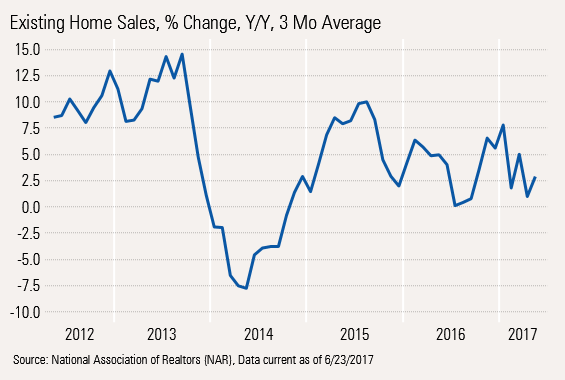

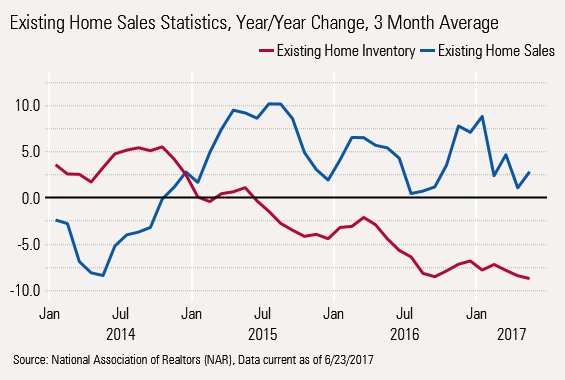

Year-Over-Year Data Captures the Slowing Overall Trend Unfortunately, the year-over-year, three-month averaged numbers don't look so great, with a relatively abysmal 2.5% or so growth rate after being as high as 10% in 2015. Still, the trend isn't crystal clear using a three-month lens.

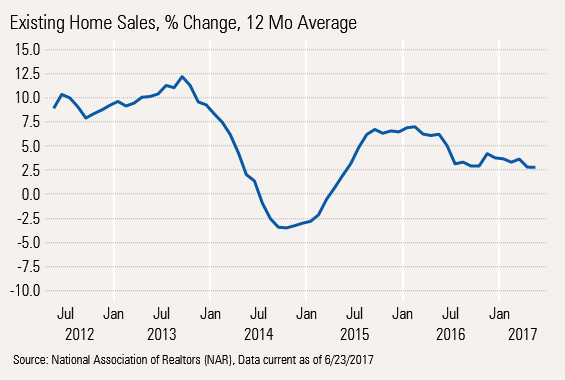

The Trend Becomes Even Clearer Using 12-Month Data Using rolling 12-month data, which isn't great for finding turning points, provides a very clear picture of a slowing existing-home market, and it isn't pretty.

With the exception of 2014, when the taper tantrum caused mortgage rates to spike by almost a full percentage point, the existing-home sales growth rate is one of the worst of the recovery.

Inventories a Real Impediment to Existing-Home Growth Like the job market, the problem seems to have shifted dramatically from a lack of demand to a lack of supply, which has made the Realtors' job all but impossible. The fact that sales have held up as well as they have is a tribute to the whole industry. To be able to sell more with less inventory is hard to accomplish. However, the graph below shows the slow downward tug of lower inventories.

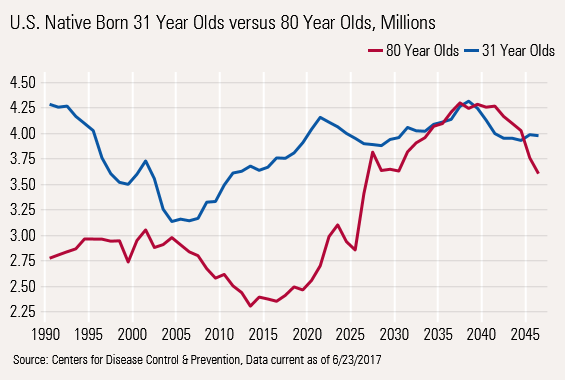

Demographics of an Aging Population Contribute to Low Home Inventories The demand for homes is accelerating as the number of people entering the normal homebuying age are accelerating and those leaving it via death is decelerating. Although this way oversimplifies things, the number of people turning 31, the typical age of a first home purchase, is accelerating. Those departing this world, at age 80 or so on average, is slowing, creating a huge supply and demand issue.

Picking on 80-year-olds and 31-year-olds only might be a bit simplistic, but it does give some hints about the nature of the problem. It's fascinating that the housing market peaked in 2005-06, just about the time the gap between 31- and 80-year-olds was at its smallest. That gap is now back to an exceptionally wide level and is likely to remain elevated for another five to eight years, suggesting that new home construction and new living arrangements are the only real hope for greater supply.

And Higher Prices Aren't the Best News or Even Much of an Incentive to Sell In a report released this week, home prices continued to plow ahead, not totally surprisingly, given our demographic tale. Home price growth has continued to accelerate in 2017, defying almost every pundit's expectations. Even our recent single-point price forecast, raised earlier this week, looks too low at just 6% versus the May reading of 6.6%. Low interest rates and the supply situation have made us all look at least a little silly. We had hoped that more apartment supply and affordability issues would keep price growth in check, but that hasn't happened. From experience, if price increases get as high as 8%, the market would likely falter as it did in 2014.

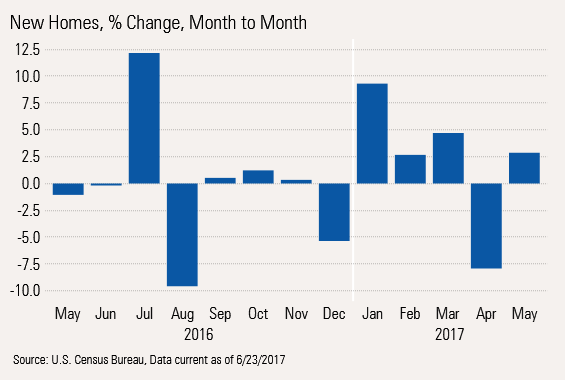

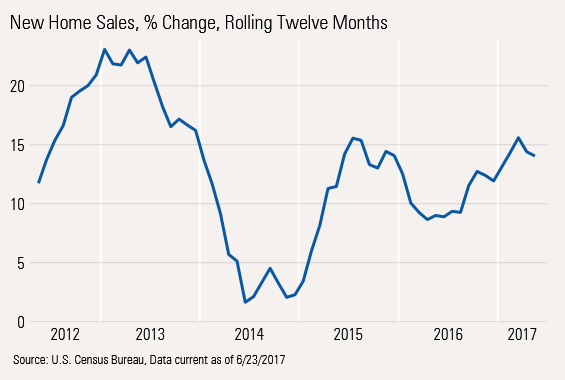

New Home Sales Provide Some Help, but Not Enough Even the month-to-month new home sales data has looked much stronger and relatively more consistent compared with the slow-growth existing-home market.

Year-Over-Year Trends Still Very Healthy, but Not Accelerating While existing-home growth is stumbling around in the 2.5% range, limited by inventory and demographics, new home sales remain strong, generally in a 10%-15% range.

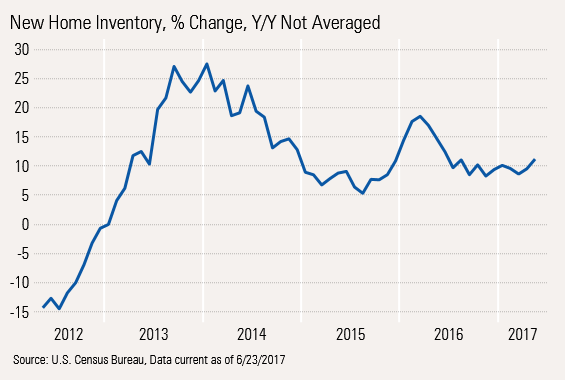

Inventories Are Healthier Than in Existing Homes New home sales growth has been supported by builders that have continued to build inventory. We believe they would be increasing inventories even faster if they could find enough available land and more workers, which are both major gating factors.

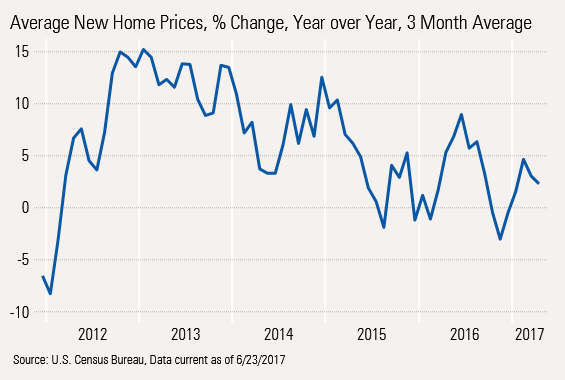

Still, Price Data Suggests More Interest in Smaller Units One interesting note is that the average price growth of new homes has not matched cost growth or even the prices of existing homes. That's because builders are finally providing more starter home-type inventory. That may not be the world's greatest news for the GDP report (which is based on square footage and not units), but it is fulfilling a genuine market need.

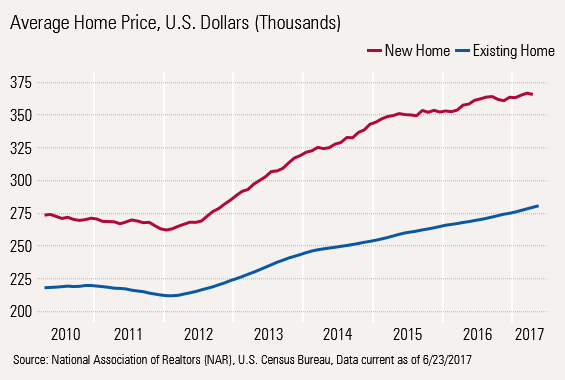

And New Homes Remain Out of Range for First-Time Buyers We still caution that despite more starter home inventory, the average price of a new home exceeds that of an existing home by a considerable margin, a margin that has generally narrowed and not widened.

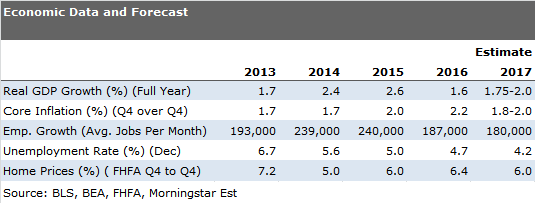

Economy Still Expected to Increase Modestly in 2017 We have just completed our midyear economic forecast for 2017, which shows only modest improvement from 2016.

Here is our new forecast along with actual data.

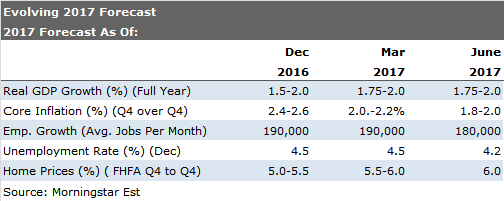

Inflation and unemployment rate are key changes to our forecast; however, our latest forecast is little changed from our last forecast.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)