The Performance Chase Is On in Value

Somewhat ironically, investors' bad behavior ensures the value premium's longevity.

A version of this article was published in the May 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

In 2016, after years of underperformance, value stocks staged a comeback. The Russell 3000 Value Index outperformed the Russell 3000 Growth Index by about 11 percentage points for the year. All was right with the world, as relatively cheap stocks once again outperformed their relatively more expensive counterparts.

Here's an excerpt of an article I wrote on the topic in January 2016:

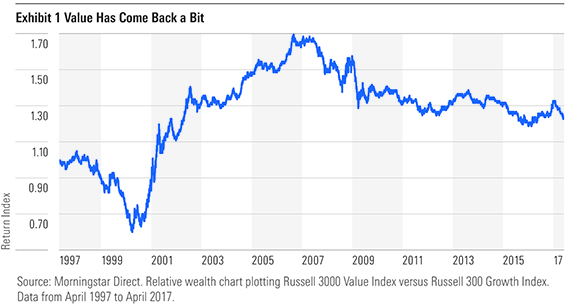

Value investing is simple in theory, difficult in practice. Today, value investors find themselves in the middle of a particularly tough stretch. Exhibit 1 is a relative wealth chart that plots the performance of the Russell 3000 Value Index versus the Russell 3000 Growth Index. When the line slopes up, the value index is outperforming. When it slopes down, the growth index is outperforming. You'll notice that value got the best of growth for a stretch of six-plus years emerging from the aftermath of the tech bubble, but ever since the second half of 2006, value has been giving ground. From Aug. 8, 2006 (the value index's growth relative peak in Exhibit 1), through Dec. 31, 2015, the Russell 3000 Growth Index outperformed its value counterpart by 3.89 percentage points on an annualized basis. Value investors may be using their well-worn copies of Security Analysis as a doorstop and logging in to their Amazon Prime accounts (always a good value!) to order a copy of Philip Fisher's (the so-called Father of Growth Investing) Common Stocks and Uncommon Profits.

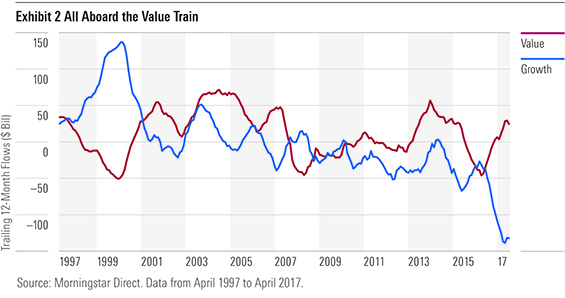

And It's Falling Out of Favor In fact, there is evidence that some value investors are beginning to capitulate after years of watching growth outperform. Exhibit 2 plots trailing 12-month flows of investor capital into and out of value, growth, and blend mutual funds and exchange-traded funds across large-, mid-, and small-cap stocks dating back to the beginning of 1994. As of the middle of 2015, the trend turned negative for value funds, perhaps signaling that after nearly a decade of underperformance value investors were throwing in the towel.

Does Value Still Work? Yes, value investing still works. I believe it always will because it is 1) intuitive and 2) at least partly driven--in my opinion--by bad investor behavior that will persist indefinitely. In fact, I believe the current outflows from value-oriented funds are evidence of exactly the type of behavior that will ensure the value premium will be with us for a long time. Here's how it plays out in practice: Fed up with years of underperformance, value investors will flee value funds and drive up prices elsewhere only to subsequently come down with a case of buyer's remorse as their new funds of choice disappoint. Value will inevitably rebound, and those "value" investors will invariably chase performance back in the same direction they came from. The net result of this isn't pretty for the performance-chasers, but their flightiness could yield long-term rewards for the steady hands--the true value investors. Remember: It's simple, but it ain't easy.

Fast Forward Sure enough, value's 2016 rebound did not go unnoticed by investors, who--surprise, surprise--have scrambled aboard the value train. Here, I've updated the exhibits I shared in my January 2016 article to include data through the end of April 2017. You'll notice the Russell 3000 Value Index's aforementioned 2016 mini comeback versus its growth counterpart plotted by the corresponding uptick in the line drawn in the relative wealth chart in Exhibit 1. It's important to note the value benchmark has since given back some ground. It lagged the growth index by a little more than 8 percentage points through the first four months of 2017.

In Exhibit 2, you can see that the rebound in value's relative performance turned the tide of flows that had been rolling out of U.S. value-oriented mutual funds and ETFs. Right around the middle of January 2016, value funds started attracting new money from investors again. During the 12-month period ended March 2017, mutual funds and ETFs in the large-, mid-, and small-value Morningstar Categories amassed more than $25 billion in net new assets from investors, while their growth-oriented counterparts witnessed nearly $132 billion in outflows.

No one can say for certain what portion of these flows is actually attributable to performance-chasing behavior, but this scenario has all the makings of a classic case of investors scrambling to buy what they wish they had owned a year or two or three ago.

This sort of behavior is a key contributor to the differences between funds' time-weighted returns and their Morningstar Investor Returns--the "behavior gap" we've recently covered here and here. From this perspective, the pattern I've discussed here is discomforting. It means that many investors have again saddled themselves with an unnecessary cost as a result of their own flightiness.

However, more-patient adherents to the value discipline should take heart in what they've witnessed. Value works because buying and holding cheap stocks can be unpleasant, and the payoff for dealing with the discomfort may be a long time in coming. But this pain also helps explain value's very existence. Those who cry "uncle" help ensure the premium persists.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)