MSCI Takes a Step to Bring China A-Shares Into the Fold

While the near-term impact of the change may be small, the long-term implications could be tremendous.

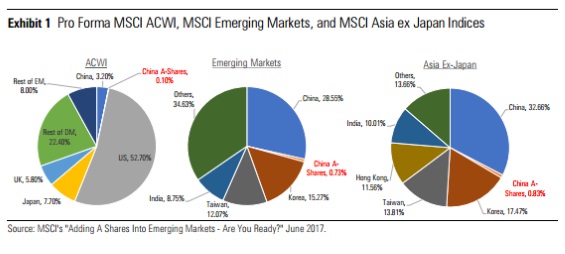

This week's big news in index land was MSCI's announcement that it will include China A-Shares in its Emerging Markets Index. A total of 222 A-Shares will be added to the index as part of a two-step process that will begin in May 2018. The A-Shares to be included are large-cap stocks that are eligible for the Stock Connect programs. Upon completion, China A-Shares will represent approximately 0.73% of the value of the MSCI Emerging Markets Index.

In its press release, MSCI stated that its decision to include A-Shares was primarily a result of the positive impact that (1) the Stock Connect program and (2) the local Chinese stock exchanges' loosening of preapproval requirements that can restrict the creation of index-linked investment vehicles globally have had on the accessibility of the China A-market.

Exchange-traded funds and index funds tracking the MSCI China, MSCI Emerging Markets, and other indices will add some or all of these 222 A-Shares to their portfolios and will ultimately react to any subsequent inclusions that materialize as part of this longer-term road map. This inclusion brings A-Shares deeper into the global investment arena, and we urge investors to make an effort to understand the fundamentals of investing in China A-Shares, which are slated to grow in importance in global benchmarks. We believe other index providers will also be likely to review their China A-Share inclusion plans. While the current A-Shares inclusion only represents a small weighting in global benchmarks (0.10% of the MSCI ACWI and 0.73% of the MSCI Emerging Markets), we would suggest that investors reassess their positions in regard to country weightings and industry weightings, especially as the different indices continue to adjust their scope of A-Share inclusion.

Sizing Up the Impact

- The 222 A-Shares to be included is an increase relative to MSCI's March 2017 proposal, which included 169 A-Shares. This was done in response to investors' recommendation to include China A large-cap stocks that also have an H-Share listing. This puts the A-Shares' weighting in the MSCI Emerging Markets Index at 0.73% (versus the March proposal of 0.50%).

- In short, the inclusion of A-Share large-cap stocks centered around the Stock Connect program (though it excludes suspended stocks).

- ETFs and index mutual funds tracking the MSCI China, MSCI Emerging Markets, and other related indices will be affected.

A 2-Step Inclusion Starting in May 2018 MSCI's inclusion of China A-Shares will be implemented in two stages to account for the existing daily trading limits on the Stock Connect:

- Inclusion factors of 2.5% and 5.0% will be applied to the relevant A-Shares' foreign inclusion factor-adjusted market-cap at the May 2018 and August 2018 reviews, respectively.

- This would place China A-Shares' weightings in the MSCI Emerging Markets Index at 0.37% and 0.73% as of the May and August reviews, respectively.

- MSCI may revise the implementation road map to a single phase if the daily limit on Stock Connect trading were to be abolished or significantly expanded before the scheduled inclusion dates.

Road Map of Future China A-Shares Inclusion Without providing any timelines, MSCI indicated that the next milestones on the China A-Shares inclusion road map could include (1) increasing the 5% inclusion factor and (2) the addition of China A mid-cap stocks, subject to:

- Greater alignment of the China A-Shares market with international market accessibility standards.

- The resilience of Stock Connect programs.

- The relaxation of daily trading limits on the Stock Connect programs.

- Continued progress on trading suspensions.

- Further loosening of restrictions on the creation of index-linked investment vehicles.

Not the First, Not the Last MSCI's inclusion brings A-Shares deeper into the global investment arena. China A-Shares will continue to grow in their importance in global benchmarks. We believe other index providers are likely to review their China A-Share inclusion plans.

Most notably, China A-Shares remain on FTSE Russell's watch list and will be reviewed for possible addition to the FTSE Global Equity Index Series as a secondary emerging market at the firm's next annual review in September 2017. However, recall that in May 2015, FTSE Russell introduced "China A-share Inclusion Indices" as a transitional tool for investors in anticipation of the eventual inclusion of China A-shares in its global benchmarks. The U.S.-listed

Investors should continue to understand further the fundamentals of the A-Share market, as well as the makeup of the indices tracked by the various funds tied to them, as A-Shares exposure could be quite different for a given index fund. While the near-term impact of MSCI's decision on the ETFs and index funds tracking affected benchmarks will be minimal, it’s likely that A-shares will account for a growing portion of these funds' portfolios down the road.

/s3.amazonaws.com/arc-authors/morningstar/4350bbc4-9f7e-4cd7-ab9d-ff0490158cb6.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4350bbc4-9f7e-4cd7-ab9d-ff0490158cb6.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)