Making Sustainability Part of Your Defined-Contribution Plans

ESG criteria could help plan participants reach their goals.

Investors are very interested in sustainable investing, but one of the main ways most people invest, through their workplace defined-contribution, or DC, retirement plans, typically have no sustainable options. Among DC plans for which Vanguard serves as record-keeper, for example, only 8% had a sustainable option in 2016. I expect that to change in the not-too-distant future. Here is my reasoning, as well as some ideas for how DC plans can incorporate sustainability into their lineups.

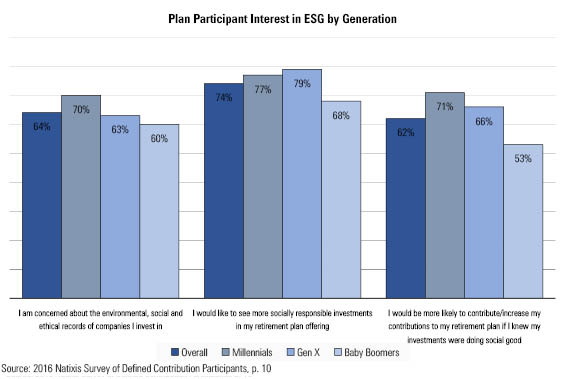

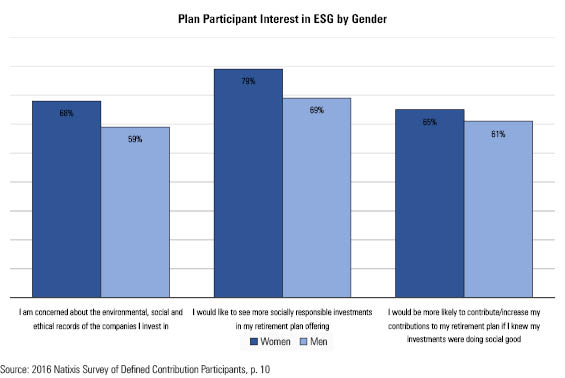

First, the demand is there. The Natixis 2016 Survey of U.S. Defined Contribution Plan Participants found significant interest in sustainable investing, which I define as any investment that considers environmental, social, and corporate governance, or ESG, criteria and their impact. Although interest in the Natixis survey was highest among younger people and women, clear majorities of men and of all age groups expressed interest.

In the survey, 64% of respondents agreed with the statement, "I am concerned about the environmental, social, and ethical records of the companies I invest in." Among women, 68% agreed, compared with 59% of men. Support among millennials (ages 18-34) was highest, at 70%, but 60% of baby boomers (ages 51-plus) also agreed with the statement.

An even greater percentage of respondents said they "would like to see more socially responsible investments" in their retirement plan offering. Overall, 74% agreed with the statement, with women and younger people (millennials and generation X) exhibiting higher levels of agreement.

Most important of all, a significant majority of respondents said, "I would be more likely to contribute/increase my contributions to my retirement plan if I knew my investments were doing social good." Again here, millennials (71%) and women (65%) showed the highest levels of agreement, although majorities of baby boomers (53%) and men (61%) also agreed with the statement.

I don't know how well these questions get at the true level of demand for ESG. The questions themselves could elicit socially desirable responses, but it's hard to deny that ESG is an appealing concept to many investors, especially those who are just starting to save for retirement.

Moreover, the answer to the question about contributions suggests that having ESG options in a DC plan could make plan participants more successful investors by getting them to contribute earlier or contribute more to their retirement plan. Why would that be? Because, as Professor Meir Statman argues in his book, Finance for Normal People, many people don't approach investing from a purely utilitarian standpoint (for example, to finance their retirement). Just as they do as consumers, plan participants may also want to express their values through their investments and receive the emotional benefits they get from feeling like they are doing something good and impactful with their money. All of which is perfectly normal, Statman argues. Rather than discourage normal behavior, therefore, DC plans should encourage it by adding ESG options to their lineups.

Doing so removes the lack of enthusiasm for retirement saving among those who may think investing puts them on the side of "corporate greed," corporate polluters, or other corporate behaviors they don't like. Tilting their investments toward more-sustainable companies can connect participants more closely to investing, leading them to invest earlier and at higher levels. In so doing, they paradoxically stand a better chance to achieve the utilitarian purpose of financing their retirement. DC plan sponsors should consider sustainable investments to be an additional "nudge" that encourages plan participation and launches participants toward a successful retirement.

Retirement plan fiduciaries have no reason for concern that they are shirking their fiduciary duty by selecting ESG options for a plan lineup. In guidance issued in October 2015, the Department of Labor reiterated its long-standing "all things equal" test for including ESG options in retirement plans. Simply put, the risk/reward characteristics of an ESG option must be commensurate with those of similarly situated conventional choices. It's essentially the same test that's applied anytime new investment options are added to a plan lineup. The new investment has to have an expected risk-adjusted return as good as, if not better than, the category of competing options. ESG options get no special break because they are trying to "do good." They also have to do well against all competitors, not just other ESG strategies.

Given the DoL guidance, the demand among plan participants, and the suggestion that having sustainable investing options available could encourage participation, how should plan fiduciaries go about adding sustainable investing options to a plan?

The best answer would be to add sustainable target-date funds. As of this writing, though, only one such target-date series exists, from the aforementioned Natixis Global Asset Management. Launched in February, the Natixis Sustainable Future Funds combine active and passive ESG strategies managed by Natixis subsidiaries Mirova, which is an experienced ESG asset manager based in France, and Active Index Advisors. The series also uses two conventional Loomis Sayles bond funds. Because the series is new, uptake may be slow going until it can establish a longer track record. (Fiduciaries may be able to evaluate past performance of the underlying strategies.) But the idea of a plan offering an ESG target-date series alongside a conventional series is a good one, and I wouldn't be surprised to see other asset managers enter the fray, as an ESG focus would be a point of differentiation in the $880 billion and growing target-date market.

The next-best answer would be to add ESG options in both equity and fixed income. That way, plan participants can allocate to funds in a way that fulfills their preferred overall asset allocation. This can be done easily with a U.S. all-cap equity fund (or with two U.S. funds, a large-cap and a small/mid-cap fund), a non-U.S. equity fund, and an intermediate-bond fund. Most lineups contain additional supplemental strategies that aren't absolutely crucial to a reasonable basic asset allocation but that sustainable investors can nonetheless use if they want a more robust allocation.

Finally, plan fiduciaries could use the Morningstar Sustainability Ratings to establish a sustainability threshold for equity funds. This would be consistent with another point made by the DoL in its October 2015 guidance. Given research that suggests ESG factors are material to financial performance, a plan fiduciary may include ESG in the analysis of the economic merits of competing choices, regardless of whether the choices involve ESG-intentional funds.

For example, a plan could require that any option that has a Sustainability Rating of Low be placed "on watch," and if the rating doesn't improve over time, the fund could be removed. Or a higher threshold could be applied to new additions to the plan lineup, helping ensure an improved sustainability profile over time.

If you are a plan participant, you can ask your HR department or DC plan oversight committee to add sustainable investing options. Chances are, they'll recognize that adding such choices will enhance the attractiveness of the plan and encourage participation. And if you are a plan sponsor or consultant, it is easier than ever to find appropriate sustainable investing options to meet participant demand.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)