Sustainably Minded Indexers Get More Choices

Recent trends show that passive sustainable funds are growing significantly faster than active ones.

Sustainable investing, which seeks to stay aligned with environmental, social, and governance (ESG) principles, has become increasingly mainstream in recent years, as noted by my colleague Jon Hale. As a result, an ever-increasing number and variety of ESG-oriented mutual funds are now available to investors. At the same time, lots of money has flowed into passively managed vehicles, such as exchange-traded funds, exchange-traded notes, and open-end index funds, at the expense of actively managed funds. In the first five months of 2017, actively managed funds saw $6 billion in net outflows, while passive funds had $145 billion of net inflows.

At the intersection of these two trends are the many sustainable ETFs, ETNs, and index funds that have cropped up in recent years, giving ESG investors many more passive options than they used to have. Last year, both Jon Hale and Ben Johnson surveyed the expanding world of sustainable ETFs, in "How ETFs are Incorporating Sustainability" and "ESG + ETF = BFFs?". Since then, money has continued to flow into these funds, and fund companies have launched dozens of new sustainable mutual funds and ETFs just in the past couple of years. It's worth taking a closer look at recent trends in this area, including some of the newest funds that have been attracting assets.

The Growth of Passive ESG It wasn't that long ago that virtually all of the sustainable investing options available to retail investors were actively managed. Of the 292 U.S.-based mutual funds and ETFs tagged as "socially responsible" in Morningstar's database, 220 are actively managed and 72 are passive. Of the 220 active funds, 58 were launched before 2000, but only two of the 72 passive funds were launched that long ago.

In contrast, recently launched ESG funds have been about evenly split between active and passive. Of those launched since the beginning of 2016, 32 have been active and 31 have been passive. The active funds in that group have more assets than the passive ones, $2.2 billion versus $927 million, but that's a much smaller gap than we find in ESG funds as a whole, where actively managed funds have over $100 billion in assets while passive funds have $13 billion. Passive ESG funds are growing significantly faster than active ones, and it wouldn't be surprising to see them take a decisive lead over active ESG funds at some point in the future.

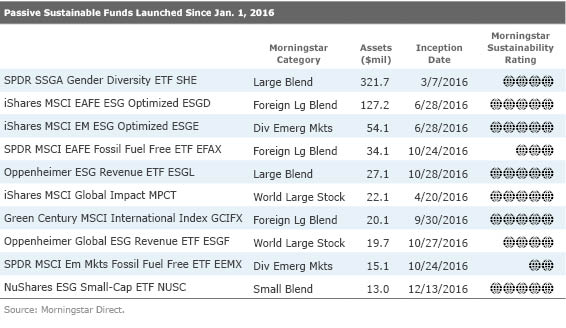

Sustainable Newcomers What kinds of funds are benefiting from this growth? The table below shows the 10 largest passive funds by assets that have an ESG mandate and have been launched since the beginning of 2016. (We've excluded funds with a religious mandate, which tend to differ in significant ways from secular sustainable funds.) Nine of these are ETFs, but the list also includes one open-end index fund, Green Century MSCI International Index GCIFX. We show each fund's Morningstar Category, size in millions of dollars, inception date, and Morningstar Sustainability Rating. The Morningstar Sustainability Rating for funds, which we launched in March 2016, measures how well a fund's holdings align with ESG principles; it can range from High (5 globes), representing the top 10%, down to Low (1 globe) for the bottom 10%.

Highlights It's worth highlighting a few of the new passive funds listed in this table, as well as a couple of things that are not on the list.

SPDR SSGA Gender Diversity ETF SHE tracks a market-cap-weighted index of U.S. companies that rank in the top 10% of their sector for their ratio of women in high-ranking positions. It's already the largest of several ETFs, ETNs, and open-end mutual funds with gender-diversity or workplace equality themes. The fact that it has attracted so many assets in a little more than a year suggests that there is a lot of investor interest in such themes, though it also helps to have an investment powerhouse like State Street behind you.

IShares MSCI EAFE ESG Optimized ESGD is the largest of seven global or foreign stock funds among the 10 funds in the table. Investors have lately shown an appetite for overseas stock funds in general, and that appetite has been expanding into the sustainable fund space. Sustainable foreign stock funds used to be considerably less common because of the difficulty of finding ESG data for evaluating overseas companies, but that's less of a problem now, and the creation of many new sustainable foreign stock indexes has led to the inception of new passive vehicles to track them.

Going fossil-fuel free is one of the most popular trends in sustainable investing right now, and it makes sense that passive ESG funds would be part of that trend, given how easy it is to modify an index to exclude fossil fuel stocks. SPDR MSCI EAFE Fossil Fuel Free ETF EFAX and SPDR MSCI Emerging Markets Fossil Fuel Free ETF EEMX are also part of the movement toward sustainable foreign stock ETFs, as noted above. However, these two ETFs don't have any ESG screens other than the lack of fossil-fuel stocks, which is why their Morningstar Sustainability Ratings are so mediocre (average and below average, respectively).

Impact investing is a version of ESG or sustainable investing that emphasizes owning companies that solve specific problems and have a positive impact on society, rather than just avoiding companies that do "bad" things. Numerous funds and ETFs with "Impact" in their names, including iShares MSCI Global Impact MPCT, have launched in the past few years, and Domini Social Investments recently changed its name to Domini Impact Investments. This ETF tracks an index composed of "positive impact companies that derive a majority of their revenue from products and services that address at least one of the world's major social and environmental challenges as identified by the United Nations Sustainable Development Goals."

No Sustainable Bond ETFs The active list includes four bond funds, reflecting the growing popularity of sustainable or green bond funds, but the passive list consists entirely of stock funds, undoubtedly because of the scarcity of sustainable bond indexes. The only passive sustainable bond fund sold in the United States is VanEck Vectors Green Bond ETF GRNB, which launched in March, but it doesn't make this list because it only has $5 million in assets.

No Sector Funds As Jon Hale pointed out in his overview of sustainable ETFs, there are more than a dozen alternative energy and water exchange-traded portfolios, which are classified as "socially conscious" by Morningstar. These are really sector funds, and while they can have a role in a diversified portfolio when used in the right way, they're very different from the diversified sustainable funds we've been looking at. Just about all of them were launched between 2005 and 2010, but they haven't been attracting many inflows in recent years and are no longer very popular, as their absence from this list indicates.

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)