Have You Been Hit by These Inflation 'Trouble Spots'?

Overall inflation levels may be moderate, but readers say the rising costs of services, dining out, housing, and healthcare have strained their budgets.

Coming into 2017, expectations were high that inflation would rise. It was a good bet given the prospect of increased infrastructure spending and a low unemployment rate. But inflation hasn't exactly materialized--at least, not according to overall Consumer Price Index numbers. Current levels are lower than expected; in fact, the Labor Department reported that the CPI declined 0.1% in May from April. Many economists and market participants have ratcheted down their inflation outlooks.

But as we know all too well, many times individuals and households experience inflation in different ways than what is reflected in government statistics. We asked Morningstar.com readers where they have been feeling inflation the most in their household spending, and where inflation seems to be relatively benign. Encouragingly, many noted that rising costs haven't weighed too heavily on their wallets recently.

"I have not noticed any inflation," said flhtc9. "Life is good."

Morningstar's director of economic analysis, Bob Johnson, said inflation is "relatively calm"; in fact, it has been lower than he expected. He noted that in the May report from the Bureau of Labor Statistics, there was a "massive list of items going down in price that touch many demographic groups." Used cars, most grocery prices, and almost any physical good (clothes, tools, electronics, furniture, etc.), are flat to down, Johnson said. "So almost everyone will have some offsets to the big categories that are going up."

By and large, this mirrored what our readers said they have experienced this year.

"Add the 'discounts' to the 'increases' and the result is tepid," said Holiday.

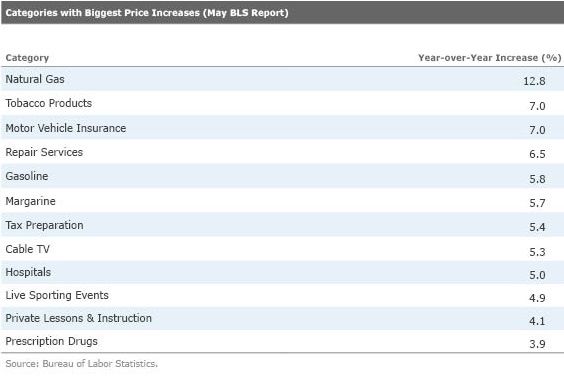

'Trouble Spots' Not everything is rosy, though. Johnson eyeballed the BLS report and pulled out the following "trouble spots"--categories that have seen larger year-over-year increases and that would be more likely to affect consumers and household budgets.

Cost of Services on the Rise General services, specifically repair and maintenance, was an area where many of our readers have noticed big price increases.

"Things like landscaping, music lessons, and legal fees are all up in the 3%-6% range," Johnson said.

"You can't get anyone to do anything for under $50/$75/hour. It's very expensive to have someone come and do anything, even simple labor," said Camaro68.

Holiday said quotes/costs for concrete driveways, tree removal, painters, roofing, and construction have increased.

Meanwhile, whynotbynite said prices of dry cleaning and haircuts are on the rise.

KTInvesting said in the San Francisco Bay area, "Handymen are charging $90 an hour, plumbers $120-$150."

Home-Cooked Meals Cheaper Than Dining Out Johnson said one peculiarity of the current environment is a "year-over-year decline in grocery prices (but decent-size increases at restaurants)." He pointed out that beef prices are down over 4% year over year, and the agriculture cycle is now back in "glut mode."

"My food costs have basically remained the same or, in a few cases, actually declined a little bit," said mlott1. "Staples like potatoes, onions, rice, and fresh fruit have been about the same price the last few years. Meat prices in general have gone down a bit, very reasonable."

Bluepacific said: "The good news for us on the inflation front is food ... we don't eat packaged stuff and prepare 80% of our meals at home from fresh (mostly organic) meats and veggies. Over the last five years our grocery bills haven't gone up hardly at all."

On the other hand, many respondents, including Nittwit, whynotbynite, ae0201, dawgie, orygunduck, and Peter5, said restaurant bills have increased significantly.

"I think landlords are raising rents to the extent that menu prices had to increase," said ae0201. "I don't believe it's due to food prices or wages."

Whynotbynite added that in Greenville, S.C., "basic beverages with meals [are] up as much as 70%."

Housing-Related Costs Accelerate "Rents are still going up almost 4% a year, and that is one of the biggest CPI categories," said Johnson. He points out that rents can be a regional issue, though.

Reader dotkos said in California, "homes start at $550,000."

KTInvesting said in the Bay Area, "1,000 square-foot cottages are selling for $700k-$900k. They were $500k five years ago. Rent for a one-bedroom is $2,000-$2,500, substantially less five years ago ($1,400-$1,500)."

"[Housing] prices have become ridiculous again in the South Florida area and rents are absurd," said Raven27936.

Other readers said property tax and homeowner's insurance bills have risen along with rents and housing prices in their areas.

"Real estate taxes keep going up significantly and my neighborhood is not something one would brag about," said hdw4567.

Retiredgary added: "In the last couple of years we have seen the largest price inflation in homeowners' insurance and in the various 'fees,' i.e., stealth property taxes, our city's government attaches to water bills. Prices of houses and probably rent seem to be going up in our town, though we have not experienced this ourselves since we own our house and have not moved."

Prescription Drugs, Health Insurance Get Pricer Srercrcr, bluepacific, Raven27936, hdw4567, santabarbara all mentioned that prescription drugs have weighed on their budgets. This isn't too surprising: According to the BLS report, prescription drugs have increased 3.9%.

"The drug I have taken for the last 20 years started out at $33/month and now is about $900 for a month's supply. That's about what--18% per year," said bluepacific.

"My copay for mail order prescriptions went up 50% in the last year," Raven27936 said.

Finally, although health insurance cost inflation looks moderate according to the CPI report, at a 2% year-over-year increase, some respondents reported feeling much more acute price increases there.

"The cost of health insurance is insane--about $12,000 per year for each of us last year. We were notified at the end of last year that it was going up to almost $14,000 per person for 2017," said bluepacific.

KTInvesting said: "My medical insurance premium increases were 12% for two years then started dropping to 8%, 5%, and now 2% for the past two years."

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)