25 Funds Investors Are Buying

Investors continue to flock to index funds in droves, but they've kept the faith in some actively managed bond funds and a few strong-performing active equity strategies.

Investors continue to embrace simpler and cheaper investment options such as index funds and target-date vehicles.

That's one take-away from our recent survey of individual funds that investors are buying. (Last week we covered the funds they've been selling.) A similar conclusion was reached in our research paper on U.S. fund fees, which showed investors paid lower fund expenses in 2016 than ever before. But fund fees in aggregate haven't fallen, according to the study; rather, investors have voted with their feet in favor of lower-cost funds.

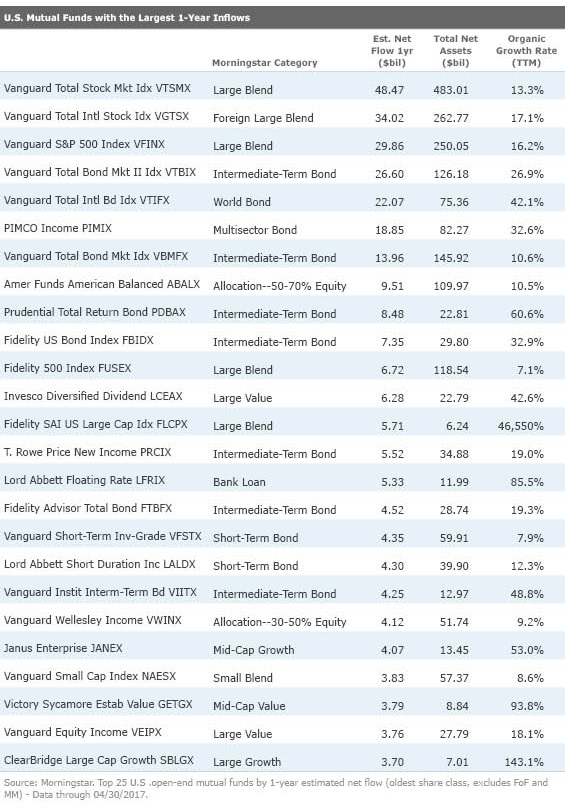

With the help of Morningstar senior research analyst Annette Larson, we took a look at the 25 funds that had seen the biggest inflows in absolute dollar terms in the one-year period through April 30, 2017. Although we screened for the largest inflows in dollar terms, this year we added a trailing 12-month organic growth rate data point, which allows us to put the flows in better perspective. For instance, two share classes of the mammoth Vanguard 500 Index fund (VFINX and VINIX) are on the list of top inflows and outflows over the one-year period; the story here is not really one of investor conviction; it's more about fund distribution and sales channels.

Index Funds Rake In Money It's no secret that investors have increasingly opted for index funds, which, among their many advantages, offer broad diversification, low fees, tax efficiency, and simplicity. Seven out of 10 funds with the highest estimated net inflows were index funds, and the top five spots on the list were claimed by Vanguard funds.

Increased investment in target-date funds partially explains the heavy inflows into a few of the more widely purchased Vanguard funds. Vanguard's target-date funds use Gold-rated

Similarly, that target-date series also uses various share classes of Gold-rated

The two share classes of Vanguard target-date funds (institutional and the investor) combined gathered more than $40 billion in new assets combined over the one-year period, by our estimates. But that doesn't explain the entire $48 billion inflow to Vanguard Total Stock Market Index--or even most of it, for that matter. Likewise, Gold-rated

Fixed-Income Investors Can Be Fickle

At number six on the list of top-flowing funds is

It certainly hasn't escaped investors' notice, either. In fact, "white-hot inflows" help explain why the fund's Morningstar Analyst Rating of Silver isn't higher, says senior analyst Eric Jacobson.

"PIMCO is focused on the size of the fund versus its broader mandate and opportunity set ... and is confident the fund can still meet its performance and income goals; it's not thinking about closing the fund," Jacobson said. "That's understandable, but we'd prefer to see the firm consider sheltering the fund's allocation from dilution."

(On the flip side, the most heavily redeemed fund for the third year running was Silver-rated

Number nine on the list,

Fears of rising interest rates may have piqued investors' interest in short-term bond funds; Silver-rated

Passive funds such as Silver-rated

Vital Signs among Active Strategies Investors haven't thrown in the towel on actively managed strategies altogether, though. In fact, some actively managed funds have gotten more money than they can handle over the past year.

One that has attracted investors' notice is Bronze-rated

Silver-rated

Among balanced funds, perennial investor favorite Gold-rated

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)