Hedge Fund Conversions--When Seeing Shouldn't Be Believing

We’re changing how we present the performance of hedge funds that convert into mutual funds.

Executive Summary

- Investors should be wary of hedge funds that convert into mutual funds.

- There's often less than meets the eye to these funds' track records, a portion of which reflects their performance as unregistered hedge funds.

- These "hedge fund conversions" have tended to be poor performers as mutual funds.

- To dispel potential confusion, we're changing the way we present these funds' track records.

- We will cease displaying the funds' pre-conversion track record, which was amassed when they were unregistered hedge funds.

Background My colleague John Rekenthaler recently wrote about a small, somewhat musty corner of the mutual fund universe: hedge fund conversions. John's message was buyer beware: Mutual funds that convert from hedge funds often boast wonderful track records that, once scratched at a bit, fall apart.

Why? These funds exploit SEC rules that allow them to carry forward the performance record of the hedge fund that was converted. This despite the fact that the hedge fund's track record wasn't amassed in a transparent, verifiable way--limited partnerships are typically unregistered and therefore don't publicly disclose holdings or performance. You can probably guess what happens next: These converted funds are sold to investors on the strength of the hedge fund's predictably great track record. (Fund companies aren't going to bother converting hedge funds that have crummy records, after all.)

This practice might seem harmless but it can be problematic for a number of reasons that John lists in his piece. For instance, it leaves the door wide open for firms to convert hedge funds with records that have been cherry-picked or data-mined, or which came into success under circumstances that raise serious questions about whether that success is repeatable (as with hedge funds that had almost no assets under management prior to conversion and thus didn't have to deal with pesky real-world challenges like transaction costs, liquidity risks, or investment capacity).

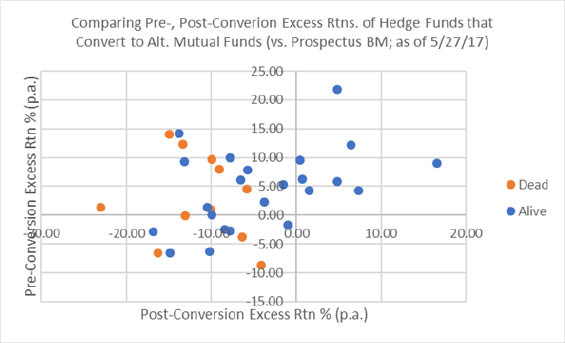

Harsh Reality What we've seen thus far has been dismaying: Many of these converted funds have been dismal performers. To illustrate, I pulled together a list of all U.S. alternative mutual funds that had converted from hedge funds and compiled data on their pre- and post-conversion performance records. Specifically, I calculated the amount by which these funds beat their prospectus benchmark index before and after they converted from hedge funds to mutual funds and plotted those excess returns in the chart below.

Source: Morningstar.

As shown in the chart, these funds tended to annihilate their benchmarks when they were hedge funds (that is, pre-conversion, vertical axis of chart). Indeed, 23 of the 34 hedge funds beat their prospectus benchmark index prior to converting. The average excess return of these winning funds was a startling 7.9% per year.

But things could hardly have been more different once they became open-end mutual funds (that is, post-conversion, horizontal axis of chart): Only eight of the 23 hedge funds that had beaten their prospectus benchmarks pre-conversion also topped them after converting. What's more, the shortfalls were often massive: The 15 funds that lagged their benchmark did so by nearly 10% per year, on average.

It's also worth noting that seven of the 23 hedge funds that had beaten their index pre-conversion performed so abysmally as mutual funds (lagging their benchmarks by around 12% per year, on average) that they were eventually killed off. And while eight of the 23 hedge funds did manage to beat their index both pre- and post-conversion, seven of those eight were benchmarked to cash equivalents or bonds. In essence, these funds succeeded in not losing money--a not-so-heroic feat considering they converted to mutual funds in the relatively placid market climate of recent years.

All told, the differences in pre- and post-conversion performance were stark: The average hedge fund beat its benchmark by around 4% per year before converting and trailed its index by more than 6 percentage points per year once it converted into a mutual fund.

Source: Morningstar.

Policy Change Taken together, these results have led us to conclude that it's potentially misleading to link a hedge fund's pre-conversion record to the mutual fund it has converted into, even if SEC rules allow it.

As such, we're making a policy change: We'll no longer display the pre-conversion returns of open-end mutual funds that were converted from hedge funds. We'll treat these funds the same as any other newly incepted open-end fund--they'll begin life with no performance history and build their track record in the sunshine.

We plan to make this policy change in the third quarter. When it takes effect, the pre-conversion track record of these funds will disappear, leaving only the portion of the track record they've built since converting into a mutual fund.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)