Are Managed-Futures Funds a Thing of the Past?

These are inhospitable markets for systematic trend-followers.

Managed-futures funds are in the midst of their largest drawdown in recent history. During the past three years through the end of April 2017, the 36 unique funds in the managed-futures Morningstar Category with histories at least that long had an average maximum drawdown of 13.4%.

The lion's share of capital in this space is managed by medium to long-term systematic trend-followers who rely on sustained trends in multiple asset classes. The bread and butter of their investment processes is momentum trading, mainly buying on strength and selling into weakness in the futures and forwards markets.

Historically, riding trends in multiple time horizons and trading on momentum has produced returns with low correlations to traditional long-only stock and bond investments. Managed-futures funds have used these models since the 1970s in major asset classes such as equities, bonds, currencies, and commodities.

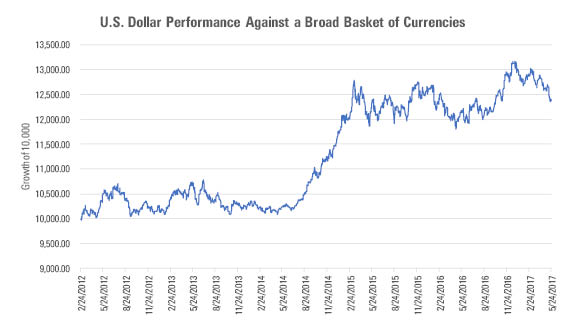

The following two charts encapsulate some of the challenges these funds have faced in recent years within currencies and commodities markets. The first chart shows the performance of a U.S. dollar index against a broad basket of other currencies. For roughly a year between 2014 and 2015, the greenback trended upward in almost a straight line. However, starting in March 2016 and continuing into the present, it entered into a rangebound behavior characterized by frequent reversals every couple of weeks or months.

Source: Morningstar Inc. Data as of May 25, 2017

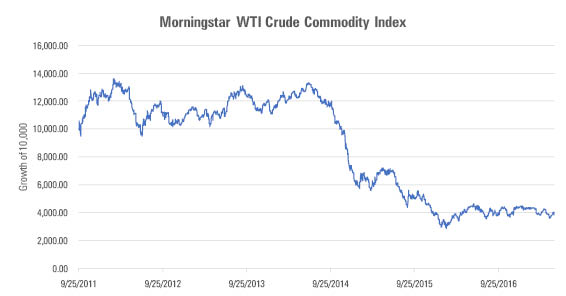

The next chart depicts the performance of crude oil. Starting from the second quarter of 2014 and into the first quarter of 2016, this market had a strong downward trend, but it also entered into a rangebound return environment in 2016, which has continued into the present. Frequent reversals during the past year in both currencies and commodities markets have detracted from the performance of managed-futures funds.

Source: Morningstar Inc. Data as of May 25, 2017

The story is not much different in the fixed-income markets. For example, the 10-year U.S. Treasury yield has been mean-reverting around the 2% level in a relatively tight range during the past five years. There were some bright spots starting in the last quarter of 2016, like long equity trends and currency trends in the British pound (on the short side) and Japanese yen (on the long side), but they were not substantial enough to save the day.

Though most managed-futures funds do use shorter-term models (and other non-trend-following systematic macro trades) to add model diversification and to reduce the adverse impact of choppy markets, in most cases these models do not drive these funds' longer-term results. In addition, the funds’ relatively large cash and cash-equivalent holdings are not earning as high yields as they did prior to 2008.

Only a handful of managed-futures mutual funds existed during the 2008 financial crisis, so it remains to be seen how they will fare under a similar period of market stress. Because these funds are likely to be shorting bonds as rates rise, they may not provide downside protection in a rapidly developing flight-to-quality scenario; this would be exacerbated by any long equity positions (like the ones currently seen in many of these portfolios).

However, in prolonged bear markets or rapidly rising inflation scenarios, longer-term trends are more likely to emerge, creating a more fertile ground for these funds to generate returns. Until then, rangebound markets might continue hurting systematic trend-followers in the short run. These funds are approaching an inflection point where additional losses may trigger further investor redemptions, as has happened several times in the managed-futures industry before the strategy gained popularity in the mutual fund space.

/s3.amazonaws.com/arc-authors/morningstar/5ff7a7e7-10d3-4880-b243-dff72384e635.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5ff7a7e7-10d3-4880-b243-dff72384e635.jpg)