Fidelity Launches Sustainable Investing Funds

The fund giant becomes the latest to enter the ESG field.

Fidelity has entered the field of sustainable investing, launching two sustainability index funds and signing the UN-supported Principles for Responsible Investment, or PRI.

The funds cover U.S. and international equities. Fidelity U.S. Sustainability Index FENSX will track the MSCI USA ESG Index, and Fidelity International Sustainability Index FNIYX will track the MSCI All Country World ex-USA ESG Index.

These market-cap-weighted indexes include companies that rate highly on environmental, social, and corporate governance, or ESG, criteria relative to their sector peers, based on company evaluations conducted by MSCI's ESG Research group. MSCI takes companies with the highest ESG ratings that represent 50% of the market cap in each sector (and region, in the case of the international index) and build indexes that are otherwise similar to two broad-market indexes (the MSCI USA Index and the MSCI ACWI ex-USA Index). In addition, companies involved in alcohol, gambling, tobacco, nuclear power, and weapons are excluded from the ESG indexes.

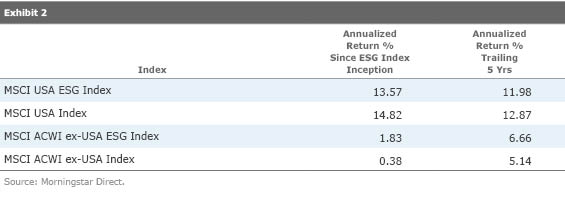

Investors can expect these funds to track closely with their MSCI ESG indexes, but it's also relevant to know how well the ESG indexes have performed over time relative to their conventional counterparts. In the six and a half years since its launch, the MSCI USA ESG Index has underperformed the MSCI USA Index by an annualized 125 basis points, even though its sector weightings are nearly identical to those of the broader index. The gap narrows to 89 basis points annualized if we look only at the trailing five years.

On the international side, the MSCI ACWI ex-USA ESG Index has outperformed the MSCI ACWI ex-USA Index by an annualized 145 basis points since its 2007 launch and by 152 basis points annualized during the trailing five-year period. The ACWI ex-USA indexes include both developed markets outside the United States and emerging markets, and it is in emerging markets where the ESG version has outperformed. Some of that outperformance comes from the ESG index's lower weighting in China (19% of assets versus 27% in the MSCI ACWI ex-USA Index), which has helped during the trailing five years as China has lagged most other emerging markets.

Although ESG analysis in emerging markets has lagged that of developed markets because of a lack of data and less transparency from companies, data have improved in recent years and proved to be useful in assessing risk. Many emerging-markets companies have poorly developed policies and systems in place to manage their ESG risks. On corporate governance, in particular, emerging-markets firms generally have weaker protection of minority shareholder rights, have higher levels of corruption and fewer safeguards against it, and are more frequently involved in ESG-related controversies that can harm the company's reputation and result in fines and lost business. Being able to identify firms that are more effectively addressing ESG risks can provide an edge for emerging-markets investors. The MSCI Emerging Markets ESG Index has been considerably less risky than the MSCI Emerging Markets Index during the past five years. Its five-year standard deviation is 14.36 (through April), while that of the conventional index is 15.35.

The new funds do have worthy competitors. While there are plenty of actively managed U.S. large-cap sustainable funds from which to choose, for passive investors there are seven index or quasi-index funds that have five-year track records. Each fund listed in Exhibit 3 tracks a different ESG index, even the iShares exchange-traded funds, which track different flavors of MSCI ESG indexes, so none have exactly the same holdings and weightings. The DFA and TIAA-CREF funds are passive ESG portfolios screened from conventional indexes. The Fidelity fund comes in 1 basis point cheaper than

There are also plenty of actively managed international sustainable funds, but among the passive options, only three have five-year records, and none have the breadth that the Fidelity fund has, given its reach into emerging markets. During the past five years, however, emerging markets underperformed developed markets, so that's why the returns of the index the Fidelity fund tracks lag those of its two most prominent competitors.

It's worth noting that some of these funds, as shareholders and on behalf of their fundholders, actively engage with companies they hold in their portfolios about ESG issues. They have proxy voting policies that support ESG-oriented shareholder resolutions, and they sponsor or cosponsor resolutions related to ESG issues. This is a way for end investors to have an impact on corporate decisions related to sustainability.

Which brings us back to Fidelity's signing of the PRI. Asset manager signatories, among other things, pledge to "seek appropriate disclosure on ESG issues by the entities in which we invest" and to be "active owners and incorporate ESG issues into our ownership policies and practices." Fidelity hasn't said how it intends to fulfill these pledges, but when an asset manager as big as Fidelity signals to companies that it is serious about sustainability issues, it has an impact. Fidelity needs look no further than its Boston-based peer, State Street Global Advisors, which has been a leader in active ownership around ESG issues.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)