How Fund Companies Stack Up in Our Analyst Ratings

Stepping back to see the forest for the trees.

This article was originally published in the April 2017 issue of Morningstar FundInvestor and represents Morningstar Analyst Ratings as of that date. Download a complimentary copy of FundInvestor here.

Heading our U.S. Morningstar Analyst Ratings committees gives me a useful vantage point for spotting trends at fund companies. Are we getting more bullish or bearish about a fund company? Is there a certain team at a firm that is a growing cause for concern? If we spot something like that, we'll dig in to be sure we understand the big picture and have funds rated accordingly.

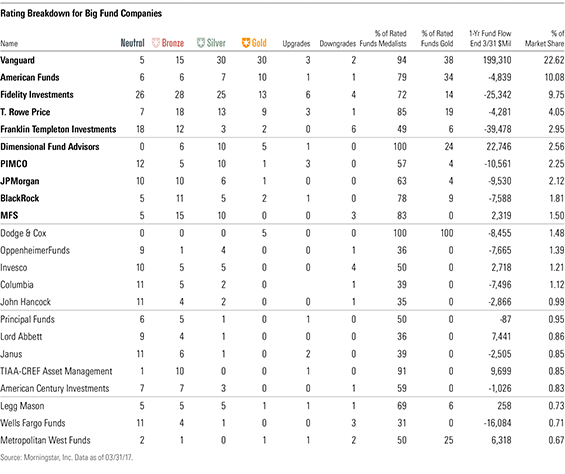

Let's see how that big picture looks. I've built a table that shows the largest fund companies' Morningstar Analyst Ratings breakdown, ratings changes, asset size, and flow data. The changes shown are during the past 12 months. When looking at the changes, keep in mind that we rate more funds from the largest firms, so, as a percentage of rated funds, a few downgrades or upgrades are not necessarily a big percentage of a firm's money under management. This look is limited to open-end funds, though we recently started rating exchange-traded funds, and target-date funds are counted only once.

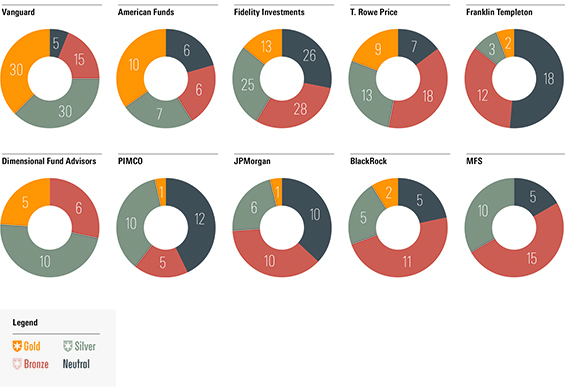

Who Comes Out on Top? Before I get to the trends, let's examine the big picture to see who is most impressive. I pulled the percentage of Morningstar Medalists among rated funds and then highlighted the percentage of Gold-rated funds to get an idea of which firms stand out. If I were picking a fund company, I'd probably start with those figures. The graph shows the distribution of ratings for the largest fund companies. The big table shows ratings, upgrades, downgrades, the percentage of rated fund medalists, the percentage of rated funds that are Gold, fund flow trends, and market share.

Source: Morningstar.

Of all the data, the figure of 94% is the most striking. That is, 94% of the Vanguard funds we rate are medalists. Considering that we rate 80 Vanguard funds, it's truly remarkable. That nicely sums up why Vanguard is taking in an unheard of amount of new money from fund investors. That's a particularly difficult feat to pull off for a firm that is the largest fund company in the world, but indexing has scale that active management does not. Vanguard also has an impressive 38% of rated funds at Gold.

Two smaller firms boast 100% of rated funds as medalists. DFA and Dodge & Cox have been very consistent at delivering value to investors, though with fewer funds and less money than Vanguard. Even more impressive, though, is that Dodge & Cox has a perfect five Gold medalists out of five rated funds. Its focus and dedication to long-term thinking have built some great funds.

Looking at the percentage of medalist funds, a number of other big firms have fared quite well. Ten of the largest 11 firms have a majority of funds rated as medalists. Only Franklin Templeton fell below the line. The figure tails off after that, but TIAA-CREF is kind of an odd duck, with 91% of rated funds as medalists but lacking any Silver- or Gold-rated funds. While TIAA-CREF has fairly low costs and consistent performance, it doesn't really foster the elite investing skills that would take a fund to a Silver or Gold rating.

Near the bottom of medalist percentages are Oppenheimer, Wells Fargo, John Hancock, and Lord Abbett. Each firm has some areas of strength and some weak spots, and each (save Lord Abbett) tends to have less competitive fees.

On the Mend I subtracted downgrades from upgrades to get an idea of which firms appear to be improving or declining. Two firms that are on the upswing are those that suffered key manager departures but have since stabilized. We upgraded three PIMCO funds and downgraded none as the funds' managers gained our confidence.

We upgraded two Janus funds that we had downgraded in 2013 after Chad Meade and Brian Schaub left the firm. Jonathan Coleman has gotten off to a good start at

We raised

The above trends are encouraging, but, as you can see from the charts above, there are many firms that score higher in our process than Janus and PIMCO. Janus earns 11 Neutrals, six Bronzes, one Silver, and no Golds, so it has a very long way to go.

Fidelity and T. Rowe Price Trend Higher

Picking up two net upgrades isn't a big deal for Fidelity and T. Rowe Price when you consider that we rate 92 and 47 of their funds, respectively. T. Rowe Price saw three upgrades. Most noteworthy,

We also raised

Our final upgrade was

The Firms With Little Drama Almost as compelling as their high percentages of medalists and Gold-rated funds is that some elite firms don't have many upgrades or downgrades because they are smooth-running ships. Investing is a very long-term game, and this kind of stability makes it easier for fund investors to succeed. Vanguard, American Funds, and Dodge & Cox have very little in ratings-change activity, and that's great. Stable ratings are less impressive for a firm like Lord Abbett where there are more Neutral ratings than medalists.

Of course, it's also tough to get an upgrade when you have a lot of Gold-rated funds to begin with. We did raise three Vanguard funds to Bronze from Neutral--

At Vanguard Explorer, we were pleased with some changes that cut out the less-impressive managers and added some we like quite a bit. Thus, the moves addressed our concerns about too many managers and the diluted quality of managers. Vanguard dismissed Granahan Investment Management and Kalmar Investment Partners and replaced them with ClearBridge's small- and mid-growth teams, which earn a Bronze and Silver rating from us on their own. We also like the subadvisors from Arrowpoint, Wellington, and Vanguard's quantitative group.

Vanguard Growth & Income has kept a low profile as a fairly tame large-cap fund, but it has consistently outperformed. The fund is run by Vanguard's quantitative equity group, Los Angeles Capital, and D.E. Shaw's quantitative models. The managers have tight sector constraints and diffuse portfolios, so one would expect the fund to perform fairly close to the index.

The Trend Is Not Their Friend

Franklin Templeton had six downgrades and no upgrades the past 12 months, and all of the downgrades came on the fixed-income side. Now that's a strong trend. Although Franklin has some seasoned fixed-income leaders, it has fallen into some traps on the municipal-bond side where five of the six downgrades occurred. We cut its national muni funds to Bronze from Silver and its California and New York funds to Neutral from Bronze. Funds such as

Invesco suffered four downgrades and no upgrades. Two funds run by the same team were lowered in the wake of Mary Jayne Maly's retirement. The firm added Matt Titus as comanager, but his record at

We also lowered

I wouldn't read a big trend into Invesco's lower ratings, but it's not an uncommon sight to see disappointment a few years after a big fund company merger. Invesco merged away many of the weaker funds in its lineup after combining with Morgan Stanley's retail fund group. While that's an understandable thing to do, it can make the firm look a little better than it is because you no longer see as many mistakes.

Finally, Wells Fargo had three downgrades and no upgrades. There is no theme to the changes, but it makes Wells Fargo look mediocre with 11 Neutrals, four Bronzes, one Silver, and no Golds. Clearly, Wells needs to improve quality of management and reduce fees to give investors a reason to stick around in this more competitive landscape.

Conclusion The trends help us to spot relative improvement or declines in some firms' skills. But the medalist charts tell you where the best opportunities lie. Dodge & Cox, Vanguard, and American Funds have the highest percentages of rated funds that are Gold as well as more than three fourths of their rated funds earning medalist status. These firms are well positioned to deliver strong results.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)