5 Media Stocks Worth Tuning In For

Stocks in the media sector have lagged of late; we found five compelling bargains amid the sell-off.

The market has grown increasingly skeptical of media stocks lately. After March-quarter earnings failed to impress in many cases, the median stock in the diversified media industry has shed 5.2% for the trailing one-month period through May 12. By contrast, the median stock in the Morningstar US Market Index has managed to eke out a 0.9% gain over the same period.

What's ailing these companies? Though many issues are company-specific, there are also general concerns contributing to media stocks' malaise. Subscription revenue is one: The emergence of entertainment options such as Netflix, Amazon Prime Instant Video, Hulu, and short-form online video has led to increased cord-cutting and is challenging the pay-television model. In addition, advertising revenue continues to be an issue among many media players. If advertisers continue to shift money away from television, profitability at many media companies will suffer.

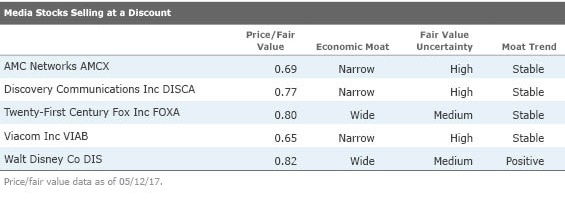

Though skepticism has weighed on the prices of stocks in the sector, some have brighter prospects than others. Our analysts believe there are some compelling media bargains. As of May 12, the median price/fair value of stocks in the diversified media sector was 0.89, compared with 1.03 for our coverage universe in aggregate. To find some undervalued media companies with good prospects, we screened our coverage list for 4- and 5-star stocks that have wide or narrow economic moats, which means our analysts believe the company has a durable competitive advantage that will allow it maintain its profitability over the long term. Then we excluded stocks with fair value uncertainties of very high or extreme, in which we have less confidence in our ability to estimate their cash flows.

Five companies passed our screen.

AMCX

AMC Networks has transformed its flagship AMC channel from a minor cable channel showing classic movies into a premier prestige platform for original scripted content. The transformation provides the smaller AMC with strong growth potential compared with larger rivals, says equity analyst Neil Macker. He notes, however, that this growth remains contingent on AMC's ability to source and cultivate strong original content as well as monetize the programs internationally. The company's narrow moat owes to the significant barriers to entry in the industry: Creating a basic cable network with carriage, high-quality content, and attractive affiliate fees requires not only a large up-front monetary investment but also deep industry relationships.

AMC's first-quarter revenue and adjusted operating income met Macker's expectations. Top-line growth of 2% was driven by affiliate fee growth, he said, which offset weak advertising and foreign exchange headwinds. Macker maintained AMC's narrow moat rating and $77 fair value estimate; he thinks the current price may provide investors with an attractive entry point.

Discovery Communications

DISCA

Discovery Communications produces and owns unique content with proven appeal to audiences across cultures and languages. This transnational appeal provides the company with the ability to repurpose the content across multiple platforms and international borders, says Macker. The company's three flagship networks--Discovery, TLC, and Animal Planet--have wide distribution in the U.S. and worldwide, each channel reaching over 94 million U.S. cable households and more than 300 million international households.

First-quarter results were weak, as both revenue and EBITDA came in below consensus and Macker's projections. Macker maintained Discovery's narrow economic moat rating and $34 fair value estimate, although he noted that he is concerned about Discovery's subscriber losses and its continued absence from Hulu and YouTube over-the-top television packages. Currently trading in 4-star territory, the stock may be an attractive opportunity for investors with a longer-term investment horizon and higher risk tolerance, Macker said.

Twenty-First Century Fox

FOXA

21st Century Fox possesses a vast array of media enterprises worldwide. Macker believes the company enjoys strong competitive advantages based on its worldwide cable networks (such as Fox News, FX, and regional sports networks), along with its film and television studios. Macker assigns 21st Century Fox a wide moat rating: He believes that the value of video content continues to increase even as the distribution markets mutate. Following the split from News Corp, Fox now operates a global entertainment company that is well situated to capitalize on increasing content value.

Fox posted a slightly worse than expected fiscal third quarter, with revenue and EBITDA both slightly below Macker's projections as the film studio continues to disappoint and the cable segment continues to suffer from demonetization in India. While the quarter was disappointing, Macker says he is encouraged by the continued strength of the domestic cable business, which posted affiliate fee growth of 8%. Macker maintained Fox's wide moat rating and $35 fair value estimate.

Viacom

VIAB

Viacom holds a valuable portfolio of cable networks with worldwide carriage, a large production studio, and a deep content library. In our view, two of the narrow-moat company's networks, Nickelodeon and MTV, particularly benefit from strong brands.

Viacom beat low expectations in the fiscal second quarter of 2017, as revenue and adjusted operating income both exceeded consensus and Macker's projections. While the firm is moving forward with its restructuring plan, he believes the recent decision by Hulu to not add Viacom channels to its live TV service highlights the challenges that management faces while realigning the firm around its six primary brands. Macker maintained Viacom's narrow moat rating and its fair value estimate of $53. With the stock trading in 4-star territory, we believe Viacom shares may offer an attractive entry point for investors with the patience to deal with the ups and downs of implementing the long-term strategic plan.

Walt Disney

DIS

Media conglomerate Disney is two distinct yet complementary businesses rolled into one. The media network business includes ESPN and ABC; the Disney-branded businesses include parks, filmed entertainment, and consumer products. The world-class Disney brand is well-known and embraced by parents and children alike. Moreover, ESPN remains the dominant player in sports entertainment. As a result, the cable sports channel can charge high subscriber fees and generate sustainable profits.

Disney's fiscal second quarter was mixed. The top line came in below Macker's expectations, but EBITDA was above his projection. While media networks continue to suffer due to weaker than expected advertising revenue and subscriber losses, the parks business expanded with Shanghai driving growth, Macker said. He maintained Disney's wide moat rating and its $134 fair value estimate.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)