Funds That Buy Like Buffett, 2017

These funds follow the Oracle of Omaha in buying and holding quality businesses.

On Saturday, May 6, thousands of people will gather in Omaha, Nebraska for the annual

, as it was last year.) That means it's time for our annual look at the mutual funds with the biggest stakes in the stocks held in Berkshire Hathaway's investment portfolio, as listed in Buffett's annual letter to shareholders. You can read this year's letter

, or as part of Berkshire's annual report,

.

As usual, this year's letter includes Buffett's explanations and opinions on a variety of topics, in addition to the financial results. Buffett explains why he doesn't "adjust" Berkshire's earnings like so many Wall Street-focused public companies do, and why Berkshire's market value has diverged so dramatically from its book value during the past 20 years, as the company's profits have increasingly come from operating businesses rather than investable securities. He discusses in some detail why he likes those businesses, which include three major insurers (Berkshire Hathaway Reinsurance Group, General Re, and GEICO), a railroad (Burlington Northern Santa Fe), a utility business (Berkshire Hathaway Energy), and dozens of smaller manufacturing, service, and retail businesses. Buffett discusses a wager he made nine years ago with investment manager Ted Seides: Seides bet that he could choose five funds of hedge funds that would collectively outperform an S&P 500 fund in a 10-year period, and Buffett bet that the index fund would beat the hedge funds. (Spoiler alert: with one year left in the bet, the S&P 500 fund is far ahead.)

As always, Buffett's letter also lists the top stocks in Berkshire's investment portfolio. This portfolio had been managed entirely by Buffett, but for the past few years some of it has been run independently by Todd Combs and Ted Wechsler, who each now manage more than $10 billion. (Thus, a more accurate title for this article might be "Funds That Buy Like Buffett, Combs, and Wechsler," but that's not as snappy.) The top two holdings by market value as of Dec. 31, 2016 were longtime Buffett favorites

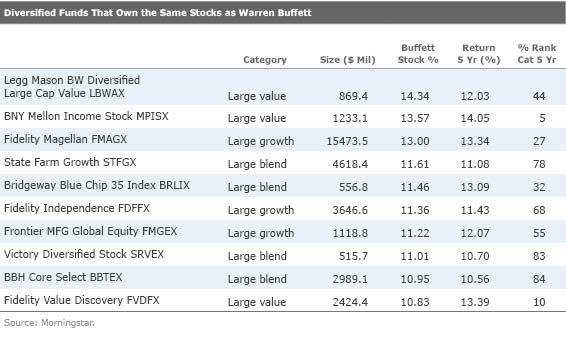

Following the release of the past seven Berkshire Hathaway annual reports, we looked at the funds with the highest percentage of their portfolio in Berkshire's top 10 stock holdings at the end of 2009, 2010, 2011, 2012, 2013, 2014, and 2015. The table below shows funds with the biggest weightings in Berkshire's top 10 holdings at the end of 2016, as listed above. We left out sector funds such as Fidelity Select Wireless FWRLX and Fidelity Select Computers FDCPX, which would otherwise be the top two (owing to their Apple stakes), as well as funds with less than $500 million in assets and those with less than a five-year track record. With those constraints, the following table shows the 10 funds with the most Buffett-like taste in stocks, including each fund's five-year return and percentile rank in its Morningstar Category through April 30, 2017.

There's been a fair amount of turnover on this list compared with years past, and one big reason for that is the first-time presence of Apple among Berkshire's top stock holdings. Nine of these 10 funds hold Apple, and for several it's among the top holdings. Buffett has been famously wary of owning technology stocks in the past, saying he doesn't have sufficient understanding of their businesses, but Apple is arguably more of a consumer company these days, and in any case, it's not clear whether the Apple stake is attributable to Buffett or to Combs and/or Wechsler. As in previous years, the managers of these funds follow Buffett in liking big, profitable companies with strong competitive advantages, but as a group they now have a bit more of a growth tilt.

This trend is illustrated by two newcomers,

Another newcomer to this year's list is Bronze-rated

Bronze-rated

Finally, there's Silver-rated

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)