10 Funds That Beat the Market Over 15 Years

While it's true that most funds won't beat market indexes over long stretches after accounting for fees, here's a closer look at a handful of Morningstar Medalists that did.

Last week, my colleague John Rekenthaler, Morningstar's vice president of research, examined an article in The Wall Street Journal exploring a study that found that more than 90% of all actively run U.S. diversified funds lagged their benchmarks over the trailing 15-year period ended December 2016. In fact, while the common story is that active U.S. fund managers struggle to beat the S&P 500, or perhaps the U.S. stock market overall, the Journal's article showed that victory for indexing extends far more widely than that, to categories such as intermediate-government and international-stock funds.

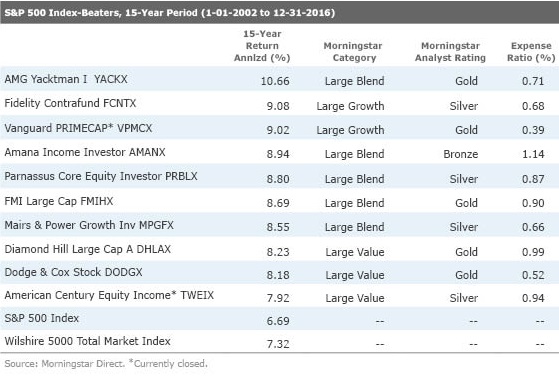

In that vein, we thought it would be fun to take a look at some actively run funds that have beaten the S&P 500 index over the same trailing 15-year period (running from January 2002 through December 2016). To find them, we ran a simple screen in Morningstar Direct to find all funds in the U.S. large-value, large-blend, and large-growth categories. We then ranked by highest 15-year annualized return and excluded any funds that our manager research analysts do not cover as well as those earning a Morningstar Analyst Rating of Neutral or lower.

Some caveats apply. First and most importantly, we aren't making a call as to whether these funds will continue to outperform the S&P 500 index. (In some cases, the S&P 500 may not even be the fund's prospectus benchmark.) That said, the funds listed here all garner medalist ratings, which means we do expect them to outperform their respective categories over a full market cycle.

Second, I included the funds' expense ratios in the table, though it wasn't one of my screening criteria. I found that of the 15-year outperformers, 50% had fees that fell into the lowest quartile of all large-cap U.S. funds, and the other 50% were in the second quartile. This isn't really surprising given my screening criteria focused on funds earning medals, as low costs are one of the five pillars that support our analyst ratings. But keep in mind that the fund's expense ratio is only its current price tag--it hasn't been constant over the 15-year period (though in the case of most of the funds listed below, expenses were likely very competitive compared with the competition over the long haul).

Lastly, this is just a fun exercise. This article shouldn't be interpreted as a recommendation of active funds over index funds generally. As the Journal article explains and as Morningstar's Active/Passive Barometer study bears out, most active funds do, in fact, trail their benchmarks over long stretches after accounting for fees. However, as Ben Johnson and Alex Bryan point out in the Active/Passive Barometer study, and Rekenthaler echoes, the odds of success for active funds are much improved when their cost hurdles are reasonable.

Here is a closer look at a handful of actively managed funds that accomplished what so many others failed. (This list is far from exhaustive, and the funds featured were subjectively chosen from the list of winners by the author.)

Price and valuation are what matter most here. Managers Stephen Yacktman and Jason Subotky pull in their horns when opportunities are scarce, but when bargains appear they act with conviction, says senior analyst Kevin McDevitt. Their process is marked by patience and discipline: Once a stock is in the portfolio, the team is reluctant to sell because high-quality companies tend to compound capital at attractive rates. This leads to low turnover. On the other hand, if the team cannot find cheap stocks to buy, it will let cash build to 20% or more of assets (the fund's current cash level). This leaves the fund well-protected should a bear market come along, although relative results may lag again if the current rally continues. But fundholders can also have faith that when the time comes, the managers will be aggressive buyers.

Will Danoff, who has led the fund since 1990, follows a typical growth strategy--looking for firms with improving earnings--but it's his execution that sets the fund apart. Danoff weaves together his own analytical insights, gleaned from 30 years at Fidelity, with research from 135 global analysts, explains associate director of manager research Katie Reichart. Fidelity's large analyst team helps Danoff keep tabs on the sprawling portfolio and feeds him ideas that can help distinguish the fund from its benchmark. Indeed, despite the fund's large asset base and portfolio of 300-plus names, it has avoided looking too marketlike, Reichart says. Danoff doesn't shy away from taking large positions where he can, and in the past the fund has held as much as 20% in non-U.S. equities.

This fund is closed, but it's a great one to put on your watchlist. Vanguard Primecap has achieved one of the fund industry's best track records with a patient, disciplined contrarian growth strategy. The managers look for companies that have grown rapidly in the past, have good potential to continue that growth in the future, and have become temporarily cheap for some reason, says senior analyst David Kathman. They're often willing to wait for a stock to rebound, as long as nothing about it has fundamentally changed. This approach means it's prone to periods of short-term underperformance when the strategy is out of sync with the market, but over the long term it has worked extremely well.

This fund screens out companies that get a significant part of their revenue (generally more than 5%) from products or activities prohibited under Islamic law, including alcohol, tobacco, pork processing, gambling, and borrowing or lending money. This means essentially all financials are prohibited, as are companies with a debt/market cap ratio greater than 30%. Within these restrictions, lead manager Nick Kaiser and comanager Scott Klimo select stocks that pay a dividend and have decent yields (generally higher than that of the S&P 500), but also have reasonable price/earnings ratios, Kathman says. Kaiser is often willing to hold stocks for many years, resulting in very low annual turnover. He is also willing to let cash build up if he doesn't see any compelling opportunities. The disciplined process has led to a good long-term record, which extends Amana Income's appeal beyond its religious target market.

Managers Todd Ahlsten and Ben Allen use a combination of negative and positive screens to ensure that this fund follows socially conscious or ESG (environmental, social, governance) mandate principles. They avoid firms that get more than 10% of their revenue from alcohol, tobacco, gambling, weapons, nuclear power, or which have financial ties to Sudan. They prefer firms that score well on various governance, workplace, and environmental criteria and which have good customer and community relations. Within those constraints, Kathman says, Ahlsten and Allen maintain a portfolio of roughly 40 stocks, at least 75% of which must be dividend-payers, with an emphasis on those having wide or increasing competitive advantages. The thorough, high-conviction strategy has led to an excellent long-term record.

Pat English, who has managed the fund since its 2001 inception, has built a compelling long-term record executing this low-turnover, concentrated approach. The fund holds around 25-30 stocks, and valuation drives the managers' decisions, explains analyst Gretchen Rupp. They purchase firms that pass their fundamental tests when the price is attractive on a variety of measures, including relative historical metrics such as price/cash flow and price/sales, as well as their assessment of the firm's intrinsic value. Notably, the fund's focus on higher-quality names helps protect investors' capital on the downside; it lost "only" 27% during 2008's downturn. Investors can count on this veteran team to stay focused on the long term in good times and bad, Rupp says.

This fund's guiding principle is to buy and hold financially sound businesses with durable competitive advantages and above-average returns on equity. The approach is market-cap-agnostic, and the portfolio includes giants like

Veteran manager Chuck Bath follows a classic approach to value investing: buying companies when their market prices are lower than his estimate of their intrinsic business value and selling them when they reach that value, says Rupp. The fund's contrarian, flexible approach means the portfolio doesn't adhere to any of the index's sector weightings, and it can display market-cap biases. Cash can also grow when markets become frothy. Bath's unwavering independent approach can lead to mixed results in the short term, but it has rewarded patient investors over long stretches, says Rupp.

Dodge & Cox Stock's distinctive portfolio is built from the bottom up, and sector exposure often veers from market weightings. The experienced management team invests mostly in large-cap stocks that look cheap on a range of valuation measures. The portfolio is concentrated and turnover is low. The fund's Above Average Morningstar Risk scores, which emphasize downside volatility, demonstrate the risks of a fairly concentrated and sometimes contrarian approach. That said, the managers' long-term perspective and disciplined adherence to their strategy are reasons to expect continued outperformance in the long run, particularly given the extra edge of low expenses.

Lead manager Phil Davidson helps this fund (which is closed to new investors) achieve its excellent downside protection with a steady focus on yield. His team buys only dividend-paying stocks, convertible bonds, and preferred stocks. Higher up the capital structure than equity, the latter two security types help notably reduce the fund's volatility. The managers focus is downside protection and capital preservation, which can cause performance to lag when markets rally, Rupp says. But, as she explains, the fund gets ahead by losing less: Its downside resilience drives its strong long-term record.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)