10 Cheap Stocks Set to Grow Their Dividends

We look at the least expensive companies in the Morningstar US Dividend Growth Index, which looks for cash-rich businesses with sustainable and growing yields.

Dividend growth strategies have gained attention from investors in recent years, and it's not hard to understand why. Strategies that focus on companies with a history of dividend growth--and the ability to sustain it--such as the Morningstar US Dividend Growth Index, are core, total return-focused equity strategies with a defensive bent.

It's important for investors to have reasonable expectations for dividend growth strategies, though. Investors seeking current income might not be satisfied with a yield such as the one supplied by the Dividend Growth Index. In fact, the dividend yield for the index is only slightly higher than that of the market as a whole: 2.48% versus 1.88% for the Morningstar US Market Index.

Rather than homing in on the market's juiciest yields, the Dividend Growth index looks for companies whose cash flows have translated into a rising payout. Companies that are focused on growing dividends tend to be higher quality, cash-rich businesses that hold up well in down markets, participate in up markets, and are capable of excess returns over a full market cycle.

To find such companies, the Morningstar US Dividend Growth Index uses several screens, explains Dan Lefkovitz, content strategist for Morningstar Indexes. First, we cull the U.S. equity market for securities that pay qualified dividends. (This excludes real estate investment trusts.) Index constituents must exhibit a five-year history of increasing their dividend payments. To gauge the sustainability of dividend growth into the future, eligible constituents must display positive consensus earnings forecasts from the analyst community. As a safeguard against dividend cuts and financial distress, stocks with indicated dividend yield in the top 10% of the universe are excluded. Finally, existing constituents are allowed to remain if they have recently bought back shares and have not decreased their dividend payment.

Constituents must also have reasonable payout ratios; companies with payout ratios above 75% are ineligible. This screens out companies with unsustainable dividends, Lefkovitz said.

From an investor's standpoint, dividend growth determines the extent to which equity income will keep pace with the inflation rate. A rising dividend is fundamental to investors' ability to preserve purchasing power through their equity portfolio. Unsurprisingly, companies whose dividend payments increase at a rate that outstrips inflation become more attractive to own, boosting their share price. That said, however, there are some bargains among dividend growers in our coverage universe.

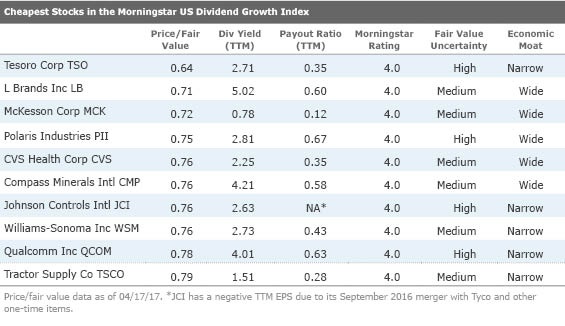

The following table lists the 10 cheapest stocks in the Dividend Growth index relative to our analysts' estimate of their intrinsic value. Below, we dive into our analysts' takes on three of the undervalued names.

Polaris Industries

PII

Polaris, a manufacturer of off-road vehicles like all-terrain vehicles and snowmobiles, earns a wide moat rating thanks to its brands, history of innovation, and lean manufacturing capabilities. Equity analyst Jaime Katz acknowledges that competitive pressures have been growing in the "power-sports" industry; she also notes a slowdown in the global economic environment could hamper the replacement and adoption rates of big-ticket recreational products. But Katz also points out that Polaris historically had a strong reputation for innovation, and new product lines along with acquisitions have supported its strong performance in both strong and difficult environments. She thinks the shares look attractive relative to our $106 fair value estimate.

CVS Health Corp

CVS

Senior equity analyst Vishnu Lekraj notes that CVS Health Corp and its pharmacy benefit manager peers have been under pressure due to misinformation emanating from certain parts of the pharmaceutical and investment communities. However, Lekraj believes CVS is a strong healthcare services firm and will be a critical player within the space over the next several decades. CVS's substantial claim volume gives it the opportunity to take advantage of two key industry drivers: supplier pricing leverage and centralized cost scale. With total adjusted claims at approximately 1.3 billion, it is able to negotiate top-tier drug pricing discounts with suppliers. This gives it the advantage of expanding its client base and preserving its gross margins. Scale is also a source of competitive advantage as each additional claim processed is more profitable than the previous, Lekraj said. He thinks CVS is currently undervalued, trading at a large discount to our $104 fair value estimate.

Tractor Supply Co

TSCO

Tractor Supply is the largest consumer farm specialty retailer in the U.S. with more than $7 billion in annual sales. The firm has differentiated itself through its products and customer demographics, which provide underlying support to the company's brand-intangible assets and a narrow economic moat, says Katz. She believes Tractor Supply's brand and broad product mix have built a loyal customer base and have insulated it from peers that focus on one segment of the market. Katz believes the brand-intangible asset will continue to be relevant and will benefit Tractor Supply for at least another 10 years, as we find it difficult to believe any new entrant would be able to enter the market with scale across the numerous categories the company has operated in retailing. She thinks the shares' current price, at a 20% discount to our $80 fair value estimate, presents investors with a good opportunity.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)