Younger Workers: Don't Overlook These Tax Benefits

Many of these tax benefits phase out at higher income levels, but it could pay to check eligibility.

April 15 is fast approaching; it's a good time to familiarize yourself with tax deductions and credits. Though many of them phase out at higher income levels, take a look to see if you are eligible for any of them. It's also possible that applying deductions could reduce your modified adjusted gross income to a point where you might qualify for a tax benefit you otherwise wouldn't.

To better understand how these tax benefits work, it's important to note that some are deductions and some are expenses. Tax deductions reduce taxable income, and their value thus depends on the taxpayer's marginal tax rate, which rises with income. Factoring in the tax deduction reduces your taxable income, and ultimately reduces the amount of taxes you end up paying.

Tax credits, meanwhile, reduce your tax liability dollar for dollar and do not depend on tax rates. Many tax credits are nonrefundable, which means that they can reduce your tax liability by the amount of the credit, all the way down to zero. But if your credit is bigger than your tax bill, you will forgo these further credits (you can't get a refund from them), and you can't carry them forward. With refundable tax credits, on the other hand, after your tax liability is reduced to zero you will pocket the surplus credit in the form of a tax refund.

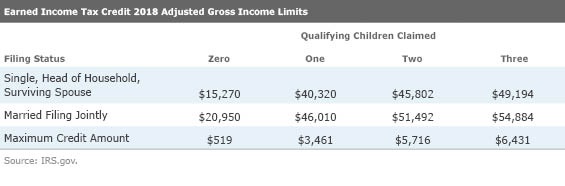

Earned Income Tax Credit Type: Refundable Credit IRS Form: 2016 Schedule EIC The earned income tax credit is a tax benefit available to workers of low to moderate income, with children or without. The more children you have, the higher the adjusted gross income thresholds become. (Note: You can't claim the EITC if you are married filing separately.)

- source: Morningstar Analysts

The IRS has a tool you can use to help you see if you are eligible to claim the EITC and estimate your benefit--available in English or Spanish.

Saver's Credit Type: Nonrefundable Credit IRS Form: 8800 You might be eligible for the saver's credit if you contributed to a tax-sheltered retirement account in 2018, such as an IRA, 401(k), 403(b), or 457(b). Aftertax contributions such as a Roth IRA or aftertax 401(k) also count. Rollover contributions are not eligible for the saver's credit. You can claim the saver's credit if you're over age 18, not a full-time student, and can't be claimed as a dependent on anyone else's tax return.

The amount of the credit is 50%, 20%, or 10% of your retirement plan or IRA contributions up to $2,000 ($4,000 if married filing jointly), depending on your adjusted gross income (reported on your Form 1040 or 1040A).

Child Tax Credit Type: Nonrefundable Credit IRS Form: 8812 Provided you meet the eligibility requirements, you can reduce your tax liability by up to $1,000 per child (under age 17). (This is in addition to the $4,050 exemption you can claim for each dependent.)

Above these income thresholds, the amount of the credit decreases, by $50 per $1,000 (so if you make over a certain amount, you would not be eligible for a credit): $75,000 for single, head of household; $110,000 for married filing jointly; and $55,000 for married filing separately.

Additional Child Tax Credit Type: Refundable Credit IRS Form: 8812 The Additional Child Tax Credit works like this: If your Child Tax Credit is larger than your income tax liability, you may be able to claim the Additional Child Tax Credit.

Say you are eligible to receive $3,000 in child tax credits but only have a $2,000 tax bill. If you file the Additional Child Tax Credit, you may be eligible to receive that $1,000 as a refund (provided you have earned income of at least $3,000).

Child and Dependent Care Expense Credit Type: Nonrefundable Credit IRS Form: 2441 The IRS offers a credit for the costs of care for a qualifying individual while you are working (or seeking employment). The dollar limit on the amount of the expenses you can use to figure the credit is $3,000 for one dependent or $6,000 for two or more qualifying dependents. Infant/toddler day care, preschool, summer day camp, or after-school care for children under age 13 are all qualified expenses. (Tuition and fees associated with kindergarten or elementary school do not qualify.)

Depending on your adjusted gross income, the amount of your credit is between 20% and 35% of your allowable expenses, up to $3,000 for one qualifying child or $6,000 for two or more qualifying children. The percentage you use depends on the amount of your adjusted gross income. The maximum credit you can receive for one qualifying child is $1,050 (down to $600). For two children, the credit ranges from $2,100 (down to $1,200). For more on the child and dependent care expense credit, see this article.

Premium Tax Credit Type: Refundable Credit IRS Form: 8962 If you get your health insurance through the Marketplace and are not eligible for or cannot get affordable coverage through an employer-sponsored health insurance plan, you may be eligible for the premium tax credit. To qualify, you must meet many eligibility requirements. You cannot claim the credit if you are married filing separately, or if you can be claimed as a dependent by another person. Also, your income must be with a certain range.

This is a complex tax credit. The size of your premium tax credit is based on a sliding scale. If you have a lower income you will get a larger credit to help cover the cost of your insurance. When you enroll in Marketplace insurance, you can choose to have the Marketplace compute an estimated credit that is paid to your insurance company to lower what you pay for your monthly premiums (advance payments of the premium tax credit). Or you can choose to get all of the benefit of the credit when you file your tax return for the year.

If you choose to have advance payments of the premium tax credit made on your behalf, you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return. For more information, click here.

Home Mortgage Interest Deduction Type: Deduction IRS Form: 1040 Schedule A Taxpayers can deduct the interest paid on first and second mortgages up to $1 million in mortgage debt (the limit is $500,000 if married and filing separately). Any interest paid on first or second mortgages over this amount is not tax deductible. The deduction is limited to $100,000 (or $50,000 if you're married filing separately) if the money borrowed from a home equity loan or home equity line of credit is used for purposes other than the home.

If you pay private mortgage insurance you can deduct those premiums, provided you make $54,500 or less as a single tax filer or $109,000 or less as a couple filing jointly.

You can also deduct mortgage points in some cases. To read more about home mortgage interest deductions, click here.

Lifetime Learning Credit Type: Nonrefundable Credit IRS Form: 8863 If you are enrolled in school at least part-time, you may be able to claim a lifetime learning credit of up to $2,000 for qualified education expenses paid for all eligible students. Your modified adjusted gross income must be lower than $131,000 if married filling jointly; $65,000 if single, head of household, or qualifying widow(er).

Qualified expenses are tuition and fees required for enrollment or attendance (including amounts required to be paid to the institution for course-related books, supplies, and equipment). Payments made in 2016 for academic periods beginning in 2016 or during the first three months of 2017 are eligible.

This credit is available for a unlimited number of tax years, but it cannot be filed in the same year that the American Opportunity Credit is filed.

American Opportunity Credit Type: Partially Refundable Credit IRS Form: 8863 The American Opportunity Tax Credit is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. The student must be pursuing an undergraduate degree or other recognized education credential. You can get a maximum annual credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to zero, you can receive 40% of any remaining amount of the credit (up to $1,000) as a refund.

Each eligible student can only claim this tax credit four times (for each of the four years of postsecondary education). It cannot be taken in the same year that the Lifetime Learning Credit is taken.

The American Opportunity Tax Credit includes expenses for course-related books, supplies, and equipment, but room and board is not a qualified expense. Payments made in 2016 for academic periods beginning in 2016 or during the first three months of 2017 are eligible.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)