Our Take on the First Quarter

The stock rally continued into 2017 as President Donald Trump took office, and the Fed hiked rates.

Eight years into the bull market, stocks continued their climb in the first quarter of 2017. The broad-based US Market Index was up 5.9% in the quarter, is up almost 18% over the past 12 months and 7.6% on an annualized basis for the past 15 years.

The dominant story in the U.S. at the start of the year was the beginning of the Trump administration. Investors continued to bet that changes to the tax code, rolling back of regulations, and an infrastructure spending program would boost business. The makeup of the rally in the fourth quarter and the first looks different as as more details about policies have emerged. The market has been re-evaluating would-be winners and losers. For example, in the fourth quarter small-cap stocks were the best performers and large-caps the worst, but that flipped in the first quarter partially because big changes to trade rules that would impact larger business appear to have become less likely.

Similarly, healthcare stocks fell in the fourth quarter over concerns that reform would reduce the number of Americans with insurance. These stocks have been some of the best performers in 2017 as the prospects of major changes to the healthcare system fade.

The Fed was in focus, too, as the central bank raised rates in March and seemed poised to continue to normalize monetary policy throughout the year. Just like the December hike, the market shrugged off the impact of higher rates as the move was widely expected and seen as a sign that the economy is strong enough to support the hikes.

The equity rally was not a U.S. only story. International equity funds performed well in the quarter, with diversified emerging-markets funds rising over 12% and Europe stock funds rising 7%.

Morningstar's analysts have provided an in-depth review and outlooks across equity sector, fund categories, and the broader economy. Their takes are below along with quarter-end fund category and index data.

Morningstar's Quarter-End Coverage

Stock Market Outlook Lofty Valuations Call for Careful Stock-Picking Given general valuation levels, careful individual stock selection is more important now.

First-Quarter Underscores Slow Growth Expectations Across the economy, there doesn't appear to be much excitement about growth or fear of a recession, says Morningstar's Bob Johnson.

Few Values Left in the Global Stock Market Morningstar's directors of equity research think investors need to be cautious in the market today and offer some of their best investment ideas.

Sector Outlooks

Basic Materials: The Most Expensive Sector We Cover With shares propped up by unsustainable Chinese demand, basic materials stocks are trading at a whopping 44% premium to our estimate of intrinsic value.

Consumer Cyclical: Still Opportunity in a High-Confidence Environment Many discretionary companies have benefited from positive sentiment following the U.S. presidential election, and some still have attractive margins of safety. Consumer Defensive: Still Thirsty for Growth Although growth remains sluggish, opportunities in consumer defensive stocks are still available for selective investors.

Energy: Coming Shale Growth a Major Threat to Oil Prices Rapid U.S. production growth is looming and puts the nascent oil price recovery at risk.

Financial Services: Weighing the Strategic Tradeoffs of the Fiduciary Rule The global financial sector is in the midst of financial advice moving toward a fiduciary-like standard and fees becoming more transparent.

Healthcare: Stock-Picking Increasingly Important as Valuations Rise We think ACA repeal efforts are unlikely to lead to major legislative changes.

Industrials: Solid Fundamentals, but Few Screaming Buys GM, Johnson Controls, and Stericycle are our favorites.

REITs: Playing Defense in an Uncertain Market Look to retail for opportunity within a fairly valued REIT sector.

Tech: Overvalued Overall, but Opportunities Remain Valuations in general are painting overly rosy scenarios, but we still see pockets of value in areas such as enterprise software and IT services.

Telecom: Firms Strive to Be More Than 'Dumb Pipes' U.S. telecoms are working to diversify away from being pure wireless network providers. Utilities: Is There Enough Growth to Offset Higher Interest Rates? Utilities stocks keep rewarding investors with attractive yields and growth, dispelling the long-held notion that rising interest rates will hurt sector returns.

Credit Market Insights Bond Indexes Perform Well as Spreads Tighten Further Both the investment-grade and high-yield indexes are trading much tighter than their long-term historical averages.

Data Report

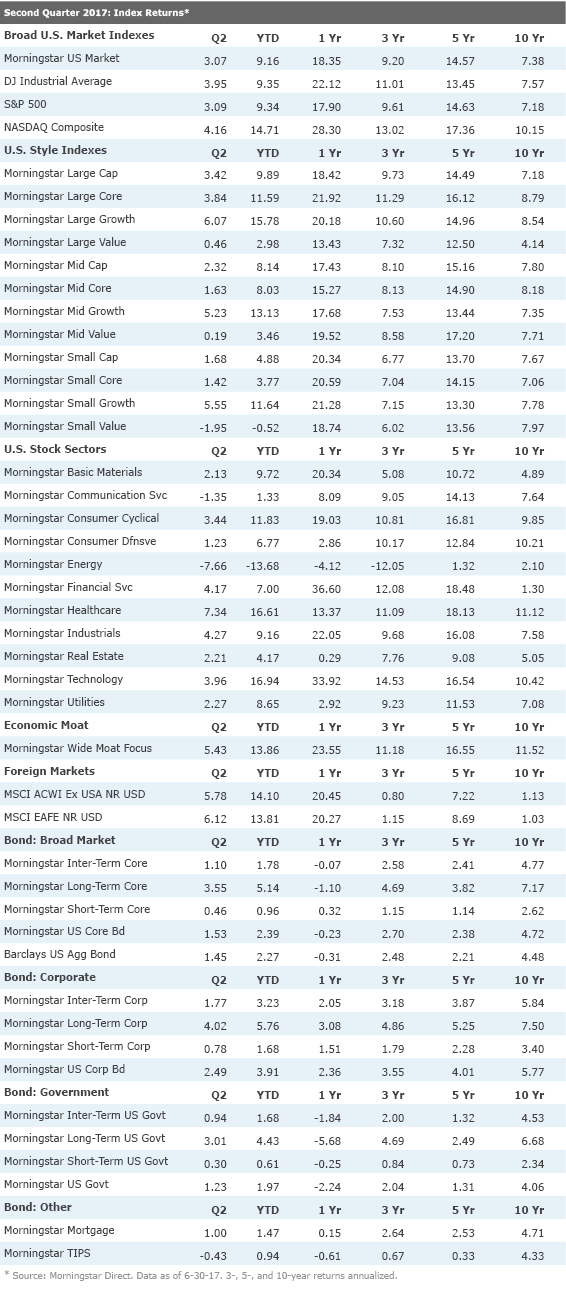

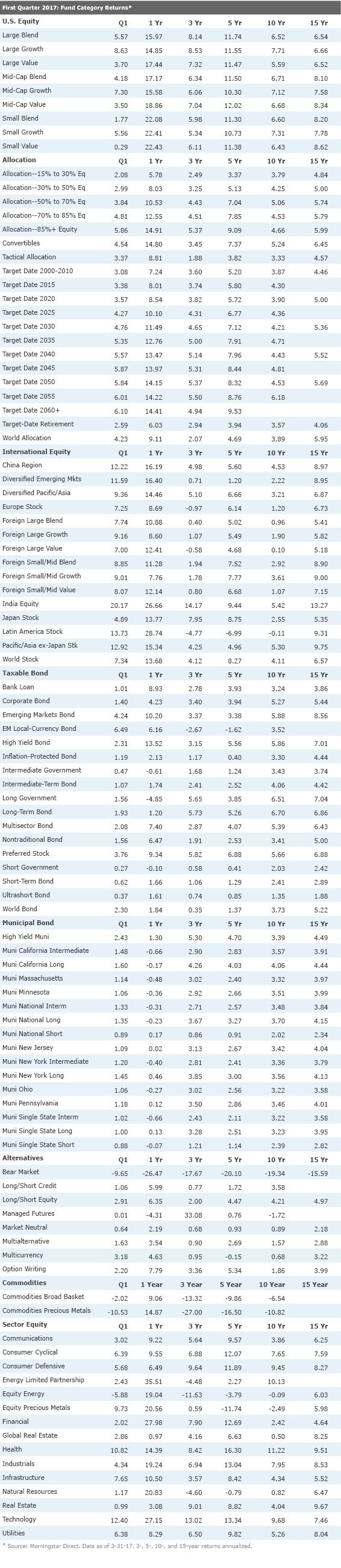

Open-End Fund Category Returns Index Returns Download Data (Excel)

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)