Are Sustainable Funds More Expensive?

Socially responsible investing doesn't have to cost more.

Socially responsible investing, also known as sustainable, impact, or ESG (environmental, social, and governance) investing, has been steadily growing in popularity in recent years. A year ago, we launched the Morningstar Sustainability Rating for funds to help investors measure to what extent any mutual fund's portfolio aligns with ESG principles.

One concern that frequently arises among those new to this type of investing is performance, specifically whether investors have to sacrifice returns if they invest sustainably. Many people have assumed that the answer must be yes, but in fact there is no good evidence of any significant performance difference between sustainable and nonsustainable mutual funds, as Morningstar director of sustainability research Jon Hale has noted in a couple of recent studies. Similarly, an article from 2012 surveys the academic literature showing no significant performance penalty for sustainable funds.

Another concern that sometimes surfaces is price. Are sustainable mutual funds more expensive as a group than nonsustainable funds? Do investors have to pay up for ESG screening? This question hasn't been investigated as extensively as the performance one, so we examined it in a couple of different ways using Morningstar data.

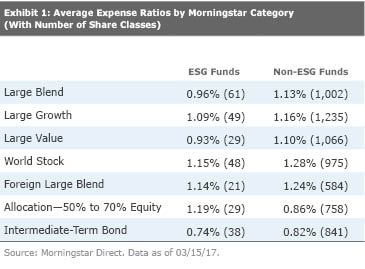

Comparing Average Expense Ratios The most straightforward way to examine this question is to directly compare the average expense ratios of sustainable versus nonsustainable funds. To do so, we divided funds within each Morningstar Category into those tagged as "socially conscious" in our database versus all others, and then looked at the most recent annual report net expense ratio for each fund or share class. We excluded index funds for the purposes of this study to provide a more apples-to-apples comparison, because the vast majority of ESG fund assets (more than 90%) are actively managed.

Exhibit 1 shows the result if we simply calculate a straight average of all the expense ratios in each group. This exhibit includes seven Morningstar Categories with at least 20 different ESG fund share classes. (Other categories have too few ESG funds for useful results.) The two columns show the average expense ratio of the ESG and non-ESG funds in each category, with the number of share classes in each group in parentheses.

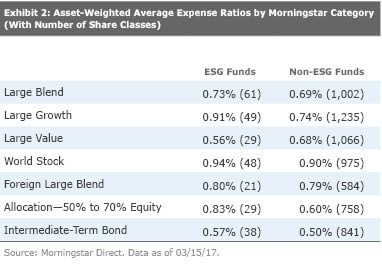

For all the categories except Allocation--50% to 70% Equity, the average expense ratio for ESG funds is lower than the average for non-ESG funds. That looks encouraging, but there are some caveats. These groupings lump together all share classes and treat them equally, ranging from no-load and institutional shares to expensive shares with high 12b-1 fees. The lower average for ESG funds could just mean that they're less likely to have these expensive share classes, because of the way they're distributed. Asset-weighted averages, in which share classes are given a greater weighting in proportion to their size, give a better idea of what investors are actually paying. Exhibit 2 shows the asset-weighted average expense ratios for ESG and non-ESG funds in the same seven categories:

These numbers paint a rather different picture; in all of the categories except large value, the ESG funds are more expensive than the non-ESG funds. (The low average expenses for large-value ESG funds are primarily due to

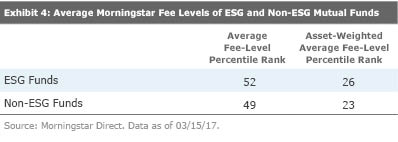

Comparing Morningstar Fee Levels Another way to look at this question, one that avoids many of the problems noted above, is with the Morningstar Fee Level, which measures how cheap or expensive a fund is relative to its peers. The expense ratio of each share class of each fund is ranked within an appropriate peer group (for example, no-load large-cap funds or front-load shares of small-cap funds), resulting in a percentile ranking from 1 (cheapest) to 100 (most expensive). Each share class is then assigned a fee level based on this percentile ranking, ranging from Low (the cheapest 20%) to High (the most expensive 20%). This rating allows us to directly compare funds and share classes of widely varying categories and sales structures. (See this article or this methodology document for more details.)

As of March 2017, there are 213 U.S.-sold nonindex mutual funds tagged as "socially conscious" in Morningstar's database, with a total of 529 different share classes. The Morningstar Fee Levels of these share classes break down as shown in Exhibit 3. As the exhibit shows, 40% of the socially conscious share classes have fee levels of Above Average or High, versus 37% rated Below Average or Low. That's a slight tilt to the more expensive side, but only a slight one.

If we calculate a straight average of all the individual fee percentile rankings, we get an average of 52, just slightly above the average of 49 for funds not tagged as socially conscious. If we calculate an asset-weighted average, the numbers are smaller, because cheaper funds have understandably attracted more assets than expensive ones (even when index funds are excluded), but the pattern is the same. ESG funds have an asset-weighted average fee level percentile of 26, slightly higher than the figure of 23 for non-ESG funds. All this is broadly consistent with the results from the asset-weighted average expense ratios we saw above.

Summing Up What can we conclude from this study? Funds with an ESG mandate tend to be a bit more expensive than other funds, but the differences are not large. There are reasonable explanations for this pattern. Most ESG funds are not very large, so they are not able to benefit from the economies of scale found in funds with huge asset bases; as ESG funds gather more assets, more of them should be able to lower costs for shareholders. Also, funds with an ESG or impact mandate usually have extra costs for shareholder advocacy and similar activities that aim to move companies in a positive direction. Even with these factors working against them, ESG funds are not all that pricier than their non-ESG counterparts. There are plenty of cheap ESG options for investors who seek them out, including a growing number of sustainable index funds and exchange-traded funds.

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)