Sustainability and Quality Go Hand in Hand

We find that funds with high sustainability ratings tend to have higher-quality holdings.

The Morningstar Sustainability Rating is a way to evaluate portfolios based on how well the companies they hold are managing their environmental, social, and corporate governance, or ESG, risks and opportunities. Many asset managers are now incorporating firm-level ESG information into their investment process not just to respond to investor demand for sustainable options, but because they see it as an additional dimension relevant to their evaluation of companies. With our Sustainability Rating, fund investors now can add an ESG perspective to their evaluation process.

What kind of funds does this ESG perspective help identify? To answer that question, I compared funds with the highest Morningstar Sustainability Rating (5 globes) against those with the lowest rating (1 globe). What I found was that 5-globe funds tend to be a higher-quality group than 1-globe funds measured in several ways.

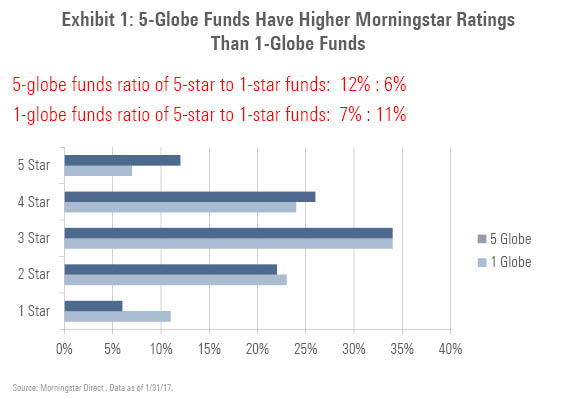

First, 5-globe funds have better Morningstar Ratings. Our star rating is based on a fund’s risk-adjusted return relative to its Morningstar Category including up to 10 years of performance. Exhibit 1 shows the star rating distributions of 5-globe funds and 1-globe funds. Twice as many 5-globe funds have 5 stars (12%) than 1 star (6%). Among 1-globe funds, the reverse is true. Only 7% have 5 stars, while 11% have 1 star. The observation holds when adding 4-star and 2-star funds to the mix. For 5-globe funds, 38% receive 4 or 5 stars, while 28% receive 1 or 2 stars. For 1-globe funds, 31% receive 4 or 5 stars, but 34% receive 1 or 2 stars. In the overall universe, the distribution is normal, such that approximately one third of funds receive 4 or 5 stars, one third receive 3 stars, and one third receive 2 or 1 stars.

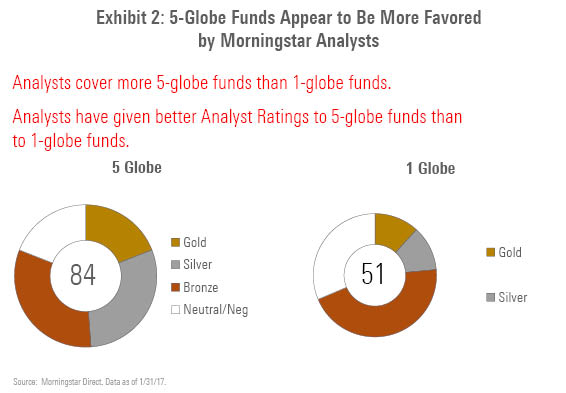

Second, 5-globe funds appear to be more favored by Morningstar analysts than 1-globe funds. This can be observed simply by looking at overall coverage levels, as well as by looking at the Morningstar Analyst Ratings themselves. While numerous factors can come into play in deciding what funds our analyst team covers, the two most significant are quality and popularity. Our analysts want to point investors toward better funds and to cover funds that have significant assets. As shown in Exhibit 2, our U.S. manager research analysts cover 84 actively managed funds that have a Sustainability Rating of 5 globes but only 51 actively managed funds with 1-globe ratings. And the Analyst Ratings they give to the 5-globe funds are better than those they give to the 1-globe funds. More 5-globe funds have Analyst Ratings of Gold and Silver, while 1-globe funds tend to have more Analyst Ratings of Bronze (our lowest positive rating), Neutral, and Negative.

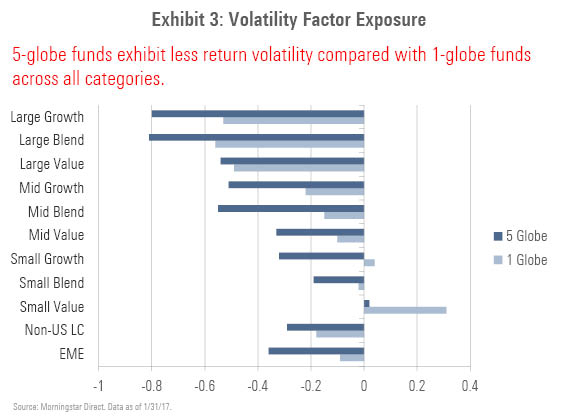

Third, 5-globe funds are less volatile than 1-globe funds. Exhibit 3 shows the volatility risk factor exposures from the Morningstar Global Risk Model for 5-globe funds and 1-globe funds across the U.S. categories and the foreign large-cap and emerging-markets equities categories. Across every category, 5-globe funds have lower exposure to the risk model’s Returns Volatility factor than do 1-globe funds. This shows up in measures of standard deviation and Morningstar Risk as well, as I outlined in an earlier article.

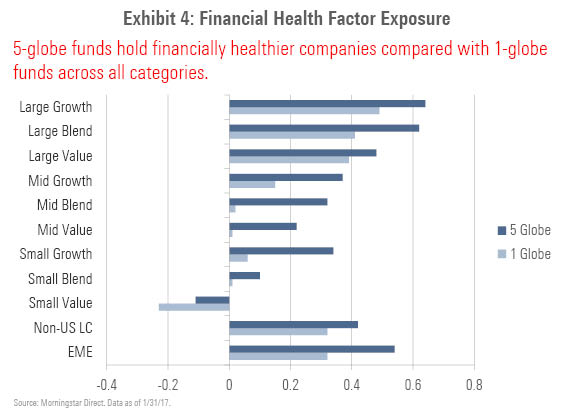

Fourth, 5-globe funds have more exposure to great companies in their portfolios than do 1-globe funds. One way to define a great company is in terms of financial health and Morningstar Economic Moat Rating. Again turning to the Morningstar Global Risk Model, as shown in Exhibit 4, 5-globe funds score higher on the Financial Health risk factor than 1-globe funds across every category, indicating that 5-globe funds have greater exposure to financially healthy companies.

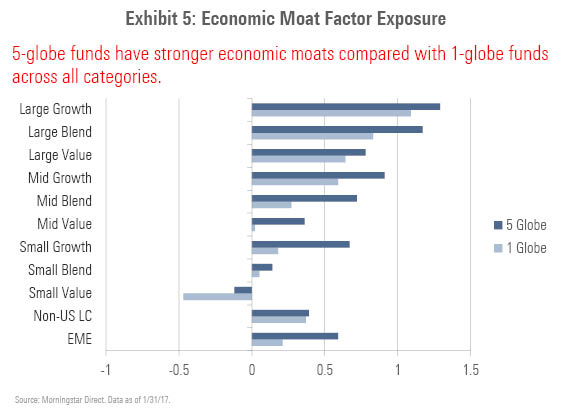

At Morningstar, we define an economic moat as a structural competitive advantage that allows a firm to hold competitors at bay while earning above-average returns on capital over the long term. As shown in Exhibit 5, 5-globe funds have greater exposure to the risk model’s Economic Moat factor than 1-globe funds across every category.

In addition to identifying funds that hold companies with better ESG evaluations, a Morningstar Sustainability Rating of 5 globes tends to point investors to a subset of funds with better Morningstar Ratings (risk-adjusted return relative to category), better Morningstar Analyst Ratings (forward-looking analyst evaluation), lower volatility, and greater exposure to financially healthy companies with economic moats. It suggests that companies that are doing a good job addressing their ESG risks and opportunities tend to be quality companies and that funds that have a lot of those types of companies in their portfolios tend to be quality funds.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)