Rekenthaler: What’s in My Portfolio

It can be difficult to invest by the rules, when life intrudes.

Half-Witted

Wednesday’s column discussed my portfolio’s asset allocation. I had not written directly about that subject before, but I had argued for the merits of owning more stocks. Thus, my 91% stock position may not have come as a complete surprise. (Nor, it turned out, as a complete anomaly, as several readers disclosed that they follow similar approaches.)

(That column came down rather too strongly against bonds. Such is the nature of essays; the need to move an argument along, forcefully, without getting mired in side paths, can lead to overstatements. What I should have added: The allocation also depends on market conditions. There are times when Treasury bonds tempt because they pay out more than the stock market's earnings yield. However, this is not one of those times, as Treasuries are at 3%, and the earnings yield just under 4%.)

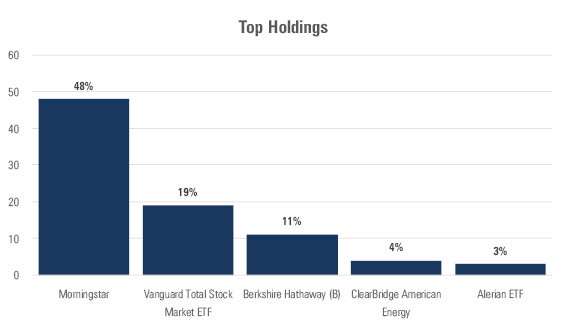

Today’s subject is security selection, specifically my top-five holdings, which account for 85% of assets. Unlike on Wednesday, I will not attempt a full-throated defense of my decisions. Or any defense, really. There’s no question what I should own: several low-cost funds, which in aggregate provide highly diversified exposure to the global stock market. Almost all investors, here or elsewhere, have some home-country bias, so that could be expected and pardoned. Otherwise, the portfolio should be predictable.

Not this one—

The Starting Point

In the middle of the last decade, I possessed four financial assets. In order of importance they were: 1) human capital, meaning the future earnings that I could generate; 2) Morningstar MORN stock options; 3) a 401(k) plan; and 4) home equity. The first two items were highly correlated, so that my financial health was tied to Morningstar’s success. The company was not yet publicly traded. Thus, I had a very high incentive to see Morningstar thrive, and equally good reason to stay aboard.

In other words, my condition was such as to delight a compensation consultant, and depress a financial advisor.

All worked out. The company went public in 2006, I exercised many of my options, and I now had a significantly larger investment portfolio, almost all of which consisted of company stock. That was my starting point, roughly a decade ago.

Cold, hard analysis advised selling all Morningstar stock. My human capital continued to be connected with the company’s fortunes. As I was far short of my retirement age, being in my middle 40s, that meant that a great deal of my investment assets (considering both earned and unearned capital) was correlated with Morningstar’s stock price, even if I owned none of the stock at all. Better to hold something else. Indeed, best to short MORN, so as to reduce my idiosyncratic risk even further.

Of course, that last bit wasn’t going to happen. Even if I had wished to commit employment suicide, Morningstar policy would not have permitted the act. Not that such a policy is anything more than a formality. Shorting one’s company stock is not a realistic choice.

Unplanned

Thus, my initial stake in Morningstar stock was north of 90%, its ideal ending position was zero, and the current weighting is almost exactly in between. I have split the difference.

The above is an example of how literal truths can be strung together to tell a whopper. Each statement is correct: The portfolio’s starting point was almost 100%, its theoretical, and the actual position. But the implication is dead wrong. I have intentionally split no differences. At no time have I calculated how much Morningstar stock I currently possess, established targets, and formulated a plan to diversify. In fact, I have never explicitly attempted to diversify all.

To some extent, that approach can be justified on investment terms. Taxes are transaction costs—and severe ones at that. Diversification’s benefit is murky and difficult to measure. In contrast, taxes extract an immediate and unavoidable penalty. There are financial reasons to accept legacy positions.

However, it would be yet another whopper if I were to pretend that was the primary reason for retaining my Morningstar position. The motivation was personal. I had worked at the company for almost 20 years (now 30); its money had become my money. What’s more, I had met my wife on the job. (She interviewed me when I applied.) I had no wish to divest myself of my Morningstar financial connection, even if doing so was suggested by the numbers.

Three Trades

That said, I have acted on three occasions:

1) June 2009. This trade began during the dark months of late 2008. Due to a series of foolish decisions, I had been forced for tax purposes to sell some of my MORN when the market was near the bottom. A brave and intelligent investor would have immediately put that money back to work, in equities, so that if and when the market recovered from the panic, nothing would have been lost. Being not that brave and not that intelligent, I waffled.

Fortunately, my training and knowledge of market history eventually overcame my fears, so that I reinvested most of those assets in June 2009, and the remainder a few months later. Most of that money went into Vanguard Total Stock Market ETF VTI, which now is my second-largest holding. Had the account been tax-sheltered I would have selected an actively managed fund, if for no other reason as to test my fund-selection abilities, but as those assets were taxable, I opted for a passive investment.

2) Autumn 2011. The first company report I ever read was from Berkshire Hathaway BRK.A., which was also the first stock that I ever admired. When the stock took a beating in 2011, accompanied by gloomy articles that questioned chairman Warren Buffett’s leadership, I became what I had long desired: a Berkshire Hathaway shareholder. (Just the B shares, but that was plenty good enough.) As it happened, that new holding has far outdistanced the Morningstar shares that were sold to finance its purchase, but that was not the calculation at the time. It was instead the opportunity to own what I had for so many years sought, at what seemed to be an attractive entry price.

3) Spring 2016. I discussed this trade at the time that it was made. Oil prices had tumbled, dragging energy stocks down with them. As with Berkshire Hathaway a few years earlier, my contrarian instincts were triggered, and I bought two energy-pipeline funds, which are now my fourth- and fifth-largest holdings. As with Berkshire Hathaway, these were chicken-contrarian purchases. They were bought when relatively unpopular, but in the grand scheme of things they are conservative, lower-beta securities. I seek stocks that are unliked, but which are not unlikeable.

Such is my portfolio’s story. I offer it not as advice, because few investors will face even broadly similar circumstances, and fewer still will have the same beliefs. And the reality is, when it comes to the issues of legacy holdings, company stock, and tax strategies, beliefs matter. Not all the relevant factors can be quantified. Consider this tale as an example of the complexities that can occur when investment matters intersect with life desires.

Final note: I zoomed past a couple of items. It's hard to cover all the bases in a topic this large. One, the Berkshire Hathaway investment had a second purpose, besides fulfilling an investment wish. Because it is so diversified, the company is effectively a very cheap, very tax-efficient mutual fund. That is in fact how I view its role in my portfolio—as an actively managed companion to Vanguard Total Stock Market. Second, yes I have very little in non-U.S. stocks. My very short explanation is that if Jack Bogle is skeptical of the need to invest overseas, then perhaps my oversight is not egregious.

My longer explanation will need to await another occasion. Suffice it to say, yes I realize that the portfolio is U.S.-centric.

Race to the Bottom

Have you made a particularly bad investment mistake? A blooper that you think cannot be matched? If so, let me know, at john.rekenthaler@morningstar.com. Two readers have recently sent me their greatest gaffes. In a future column, I will relate those accounts, along with my 2008 blunder. Join us if you dare.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar’s investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)