What Fund Manager Bonuses Tell Us

Most investment shops reward managers for short-term results, and few consider risk-adjusted returns.

This article was originally published in the March 2017 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor here.

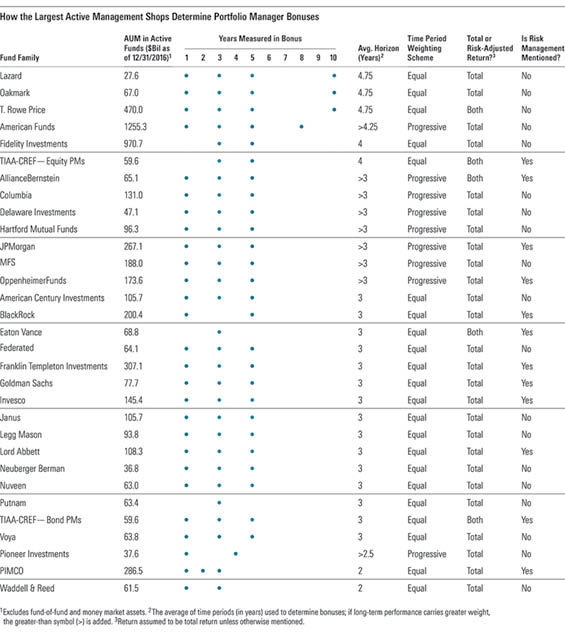

We believe that shareholders of actively managed funds must maintain long-term investment horizons to reap the rewards of active management. Likewise, investment firms should compensate their managers based on long-term performance. Last year, we published a study that compared the performance time periods used by the top 20 active management shops when determining portfolio manager bonuses. We've expanded that research to include the top 30 active investment firms. We've also noted which shops emphasize risk-adjusted returns as opposed to total returns or cite risk management as a component of manager compensation.

The exhibit excludes firms that utilize multiple subadvisors, which contend with numerous compensation plans. It also leaves out firms that don't explicitly link compensation to fund performance and companies that lack detailed information regarding their compensation structures in their Statements of Additional Information.

After extending last year's research to include the 30 largest active management firms, the story with regard to investment time periods considered has remained consistent. Most investment firms base portfolio manager bonuses on performance over one-, three-, and five-year periods. Very few asset managers take a longer-term view. In fact, of the 30 asset managers listed here, only four explicitly consider returns beyond five years.

Focused on the Long Term Lazard, Oakmark, and T. Rowe Price have exceptionally long-term investment horizons. Each firm determines compensation on fund performance relative to appropriate benchmarks or peer groups over one, three, five, and 10 years, with an even weighting on each time frame. Their inclusion of a 10-year evaluation period is unusual in the industry and is in shareholders' best interests, considering the long-term nature of most mutual funds.

American Funds' structure also stands out in its long-term orientation, which has been one of the keys to its investment success. The firm pays bonuses based on one-, three-, five-, and eight-year returns relative to a benchmark and competitors. As shown in the exhibit, the firm uses a progressive weighting scheme, meaning it places increasing weight on each succeeding measurement period, which also represents an industry best practice.

The industry in general has increasingly favored the long term. Many firms that historically compensated managers based on one- and three-year results have begun phasing in five-year returns. Recently, J.P. Morgan said it added a 10-year measure when evaluating managers, though the firm has not yet added that language to its SAI.

Short-Term Results Still Play a Big Role Despite the trend to favor longer-term returns, short-term results continue to influence bonuses at most firms. Of the asset managers included in the exhibit, all but three--Fidelity, Eaton Vance, and Putnam--consider one-year returns when determining bonuses. Fidelity's skippers are rewarded for three- and five-year returns, which is commendable. Eaton Vance and Putnam only look at results over three years; they should begin to consider additional time horizons. TIAA considers just three- and five-year returns for its equity managers, but it also looks at one-year results for its bond managers.

Two firms stand out for having manager compensation structures with unusually short-term focuses. Waddell & Reed pays bonuses on one- and three-year results, equally weighted. Maintaining such a short-term emphasis could encourage unwanted behavior, such as increased risk-taking. That said, 30% of that bonus is deferred for three years and invested in firm funds, which partially alleviates concerns. Meanwhile, PIMCO's compensation plan is based on one-, two-, and three-year performance versus predetermined benchmarks. A compensation structure that stresses longer-term investment performance would better align managements' interests with those of fund shareholders.

Risk-Adjusted Returns Noticeably Absent The investment industry has arguably deemed risk-adjusted returns as the best measure of portfolio manager skill. However, most investment firms focus on total returns when determining manager bonuses. In fact, of the firms included in the exhibit, only AllianceBernstein, Eaton Vance, T. Rowe Price, and TIAA consider risk-adjusted returns when measuring their portfolio managers.

The four firms place varying degrees of emphasis on risk-adjusted results. Eaton Vance focuses primarily on total returns, thought it may also consider risk-adjusted performance, such as the Sharpe ratio. T. Rowe Price and AllianceBernstein appear to give total- and risk-adjusted returns equal consideration. Meanwhile, TIAA represents the only company that weights risk-adjusted returns more heavily than total returns. The firm gauges managers by their information ratios, a risk-adjusted return measure that rewards consistency of results versus a benchmark or peer group. It also considers, to a lesser degree, Morningstar peer group rankings. Generally speaking, we think it's admirable to promote responsible risk management.

Eight other firms cite risk management as a component that impacts manager bonuses: J.P. Morgan, Oppenheimer, BlackRock, Franklin Templeton, Goldman Sachs, Invesco, Lord Abbett, and PIMCO. Several investment managers claim to assess their skippers based on risk-adjusted performance, but they have not included that language in their SAIs. For instance, American Century says its managers' bonuses hinge on their information ratios, but the firm's SAI does not reflect that.

There's no proof that tying compensation to risk controls improves investor outcomes. The average Morningstar Risk ratings and risk-adjusted returns of companies in the exhibit that consider risk management do not differ materially from those that don't. However, many other factors, such as investment team turnover, could distort those numbers. Overall, we think it's sensible to give managers incentive to control their risks.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)